Tax On Unrealized Gains

The concept of taxing unrealized gains is a complex and often debated topic in the world of finance and taxation. Unrealized gains, also known as paper gains, refer to the increase in the value of an asset that an individual holds but has not yet sold or disposed of. This phenomenon is particularly relevant in the context of investments, where the value of stocks, bonds, or other financial instruments may fluctuate over time. Taxing unrealized gains has been a subject of discussion among policymakers, economists, and investors, as it raises questions about the timing and fairness of taxation.

In this comprehensive article, we will delve into the intricacies of taxing unrealized gains, exploring its implications, potential benefits, and challenges. We will examine how different jurisdictions approach this issue, analyze real-world examples, and provide expert insights to offer a holistic understanding of this financial and legal conundrum. By the end of this article, readers will gain a deeper insight into the complexities surrounding unrealized gains and their tax implications.

Understanding Unrealized Gains and Their Significance

Before delving into the taxation aspect, it is crucial to define and comprehend the concept of unrealized gains. When an investor purchases an asset, such as stocks or real estate, and the value of that asset increases over time, the investor experiences an unrealized gain. This gain is considered "unrealized" because the investor has not yet realized or converted this increase in value into cash through the sale or disposal of the asset.

For instance, consider an investor who buys 100 shares of a company's stock at $20 per share. If the stock price rises to $30 per share, the investor has an unrealized gain of $1,000. This gain remains unrealized until the investor decides to sell the shares, at which point the gain becomes realized and subject to capital gains tax. Unrealized gains are a common occurrence in the world of investments and can significantly impact an investor's portfolio value and potential tax liability.

The Significance of Unrealized Gains in Portfolio Management

Unrealized gains play a pivotal role in portfolio management. Investors often monitor and track their unrealized gains to assess the overall performance and health of their investments. These gains can provide valuable insights into the potential future returns and help investors make informed decisions about when to sell or hold their assets. Additionally, unrealized gains can impact an investor's risk tolerance, as they may be more inclined to maintain a position if the gains are substantial, even in the face of market volatility.

Moreover, unrealized gains can influence an investor's strategy. Some investors may opt to realize their gains by selling their assets and locking in profits, especially if they anticipate a potential market downturn. Others may choose to hold onto their assets, believing in the long-term potential for further growth. The decision to realize or maintain unrealized gains is a delicate balance between risk and reward, and it often requires a deep understanding of market dynamics and individual financial goals.

The Debate Surrounding Taxation of Unrealized Gains

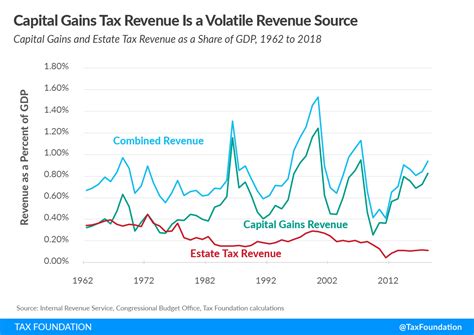

The taxation of unrealized gains has been a contentious issue, with proponents and critics offering contrasting arguments. On one hand, proponents argue that taxing unrealized gains can generate significant revenue for governments, particularly in an era of increasing wealth inequality. They believe that taxing gains as they accrue, rather than waiting for the sale, can ensure a more equitable distribution of tax burdens.

For example, consider a high-net-worth individual who holds a substantial portfolio of stocks and real estate. Over the years, the value of these assets increases significantly, resulting in substantial unrealized gains. Proponents of taxing unrealized gains argue that this individual should pay taxes on these gains annually, even if they have not sold the assets. This approach, they believe, ensures that the individual contributes their fair share to the tax system and helps address wealth concentration.

Challenges and Criticisms of Taxing Unrealized Gains

However, critics of taxing unrealized gains raise valid concerns. One of the primary arguments against this practice is the potential negative impact on investment and economic growth. Critics argue that taxing unrealized gains may discourage investors from holding onto their assets, as they face the burden of taxes even when they have not realized any cash benefit. This could lead to increased market volatility and reduced long-term investment horizons.

Additionally, critics highlight the administrative complexities involved in taxing unrealized gains. Determining the fair market value of assets and calculating gains annually can be a challenging and resource-intensive process. This could place a significant burden on both taxpayers and tax authorities, potentially leading to increased compliance costs and reduced efficiency in the tax system.

Global Perspectives on Taxing Unrealized Gains

The approach to taxing unrealized gains varies across different countries and jurisdictions. Let's explore some real-world examples to understand the diversity in taxation policies.

The United States: A Complex System

In the United States, the taxation of unrealized gains is governed by a complex set of rules and regulations. The U.S. tax system distinguishes between short-term and long-term capital gains, with different tax rates applicable to each. Short-term capital gains, resulting from the sale of assets held for one year or less, are taxed at the investor's ordinary income tax rate. Long-term capital gains, from assets held for more than one year, benefit from lower tax rates.

However, the U.S. tax code does not generally impose taxes on unrealized gains. Instead, it focuses on realized gains, which occur when an asset is sold or disposed of. This approach allows investors to control the timing of their tax liability and potentially minimize their tax burden by strategically selling assets.

| Taxation of Unrealized Gains in the United States |

|---|

| Short-term capital gains: Taxed at ordinary income tax rates |

| Long-term capital gains: Benefited from lower tax rates |

| Unrealized gains: Not generally taxed |

European Union: A Diverse Landscape

The European Union (EU) presents a diverse landscape when it comes to taxing unrealized gains. Each EU member state has its own tax system and policies, leading to a range of approaches. Some countries, like Germany and France, follow a similar model to the United States, focusing on realized gains and allowing investors to control their tax liability.

However, there are notable exceptions. For instance, Denmark and Sweden have implemented systems that tax certain types of unrealized gains. In Denmark, unrealized gains on certain financial instruments, such as stocks and bonds, are subject to an annual wealth tax. This tax is calculated based on the fair market value of the assets, regardless of whether they have been sold.

| Taxation of Unrealized Gains in the European Union |

|---|

| Germany and France: Focus on realized gains |

| Denmark: Annual wealth tax on certain unrealized gains |

| Sweden: Specific systems for taxing unrealized gains |

Asia-Pacific Region: Varied Approaches

The Asia-Pacific region also showcases a wide range of approaches to taxing unrealized gains. Countries like Japan and Australia follow a system similar to the United States, focusing on realized gains and offering tax advantages for long-term investments. On the other hand, Singapore has implemented a unique approach by exempting certain types of investments from capital gains tax altogether, including gains from the sale of shares listed on the Singapore Exchange.

| Taxation of Unrealized Gains in the Asia-Pacific Region |

|---|

| Japan and Australia: Focus on realized gains, tax advantages for long-term investments |

| Singapore: Exempts certain investments from capital gains tax |

Expert Insights and Recommendations

Taxing unrealized gains is a complex issue that requires careful consideration of various factors, including economic impact, administrative feasibility, and fairness. Here are some expert insights and recommendations based on the current landscape.

Striking a Balance Between Equity and Investment Incentives

Experts suggest that finding a balance between equity and investment incentives is crucial. While taxing unrealized gains can contribute to a more equitable tax system, it is essential to consider the potential impact on investment behavior. Striking the right balance can encourage long-term investment horizons while ensuring that high-net-worth individuals contribute their fair share to the tax system.

Simplifying Tax Systems for Efficient Administration

Simplifying tax systems and reducing administrative complexities can be beneficial for both taxpayers and tax authorities. Developing clear and consistent guidelines for valuing assets and calculating unrealized gains can enhance compliance and reduce the burden on taxpayers. Additionally, exploring digital solutions and automated processes can streamline the taxation of unrealized gains, making it more efficient and less resource-intensive.

The Future of Taxing Unrealized Gains

As the global economy evolves and wealth inequality remains a pressing concern, the future of taxing unrealized gains is likely to be a topic of ongoing debate and policy reform. Here are some potential implications and considerations for the future.

Emerging Technologies and Tax Administration

The advancement of technology, particularly in the realm of blockchain and digital assets, presents both challenges and opportunities for taxing unrealized gains. As more investments move into the digital realm, tax authorities will need to adapt their systems and regulations to effectively capture and tax these gains. Blockchain technology, for instance, can provide a transparent and secure record of asset ownership and transactions, potentially streamlining the process of calculating and taxing unrealized gains.

International Cooperation and Harmonization

With the increasing globalization of investments and the mobility of assets, international cooperation and harmonization of tax policies become crucial. Collaboration between countries can lead to more consistent and fair taxation of unrealized gains, preventing tax evasion and ensuring that investors contribute to the tax systems of the jurisdictions in which they operate. This harmonization can also reduce administrative burdens and promote transparency in the global financial system.

Policy Reforms and Public Perception

Policy reforms surrounding the taxation of unrealized gains will likely be influenced by public perception and political will. As public discourse around wealth inequality and the role of taxation evolves, policymakers may be inclined to explore new approaches to taxing unrealized gains. Public education and engagement can play a pivotal role in shaping the future of this tax policy, ensuring that any reforms are well-received and understood by taxpayers.

Frequently Asked Questions

How do unrealized gains impact an investor’s tax liability in the United States?

+In the United States, unrealized gains do not generally impact an investor’s tax liability until the assets are sold or disposed of. The U.S. tax system focuses on realized gains, which are subject to capital gains tax rates. However, certain investments, such as mutual funds, may distribute realized gains to investors annually, leading to a tax liability even without selling the assets.

What are the potential benefits of taxing unrealized gains?

+Taxing unrealized gains can offer several potential benefits, including increased revenue for governments, a more equitable distribution of tax burdens, and a potential reduction in wealth concentration. It can also encourage long-term investment horizons and promote a more stable financial system.

Are there any drawbacks to taxing unrealized gains?

+Yes, taxing unrealized gains may have drawbacks. It could discourage investment and lead to increased market volatility as investors may be more inclined to sell assets to avoid taxes. Additionally, the administrative complexities and compliance costs associated with taxing unrealized gains can be significant.

How can taxpayers minimize their tax liability on unrealized gains?

+Taxpayers can minimize their tax liability on unrealized gains by understanding the tax implications of their investments and strategically planning their asset sales. Holding onto assets for more than one year can qualify for lower long-term capital gains tax rates in many jurisdictions. Additionally, taxpayers can explore tax-efficient investment vehicles and strategies.