Berkeley County Tax vs. Charleston County Tax: Which is Better?

When it comes to understanding local taxation policies, residents and business owners in the Charleston metropolitan area frequently encounter the question: Berkeley County Tax vs. Charleston County Tax: Which is Better? As regional economies intertwine, the fiscal decisions made at the county level significantly influence quality of life, public services, and economic growth. To truly grasp the nuances, one must examine not just the numerical rates but also the underlying structure, funding allocations, and long-term implications of each jurisdiction’s taxation approach.

Tax Structures in Berkeley and Charleston Counties: An Overview

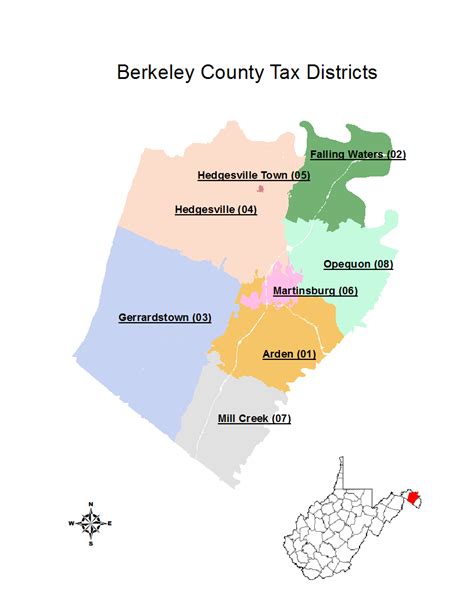

Understanding the foundations of county taxation requires delving into how both Berkeley and Charleston counties structure their property, sales, and other local taxes. These taxes serve as vital funding streams for schools, infrastructure, emergency services, and municipal projects. Although sharing regional proximity, their tax policies exhibit distinctive characteristics shaped by demographic profiles, economic bases, and governance priorities.

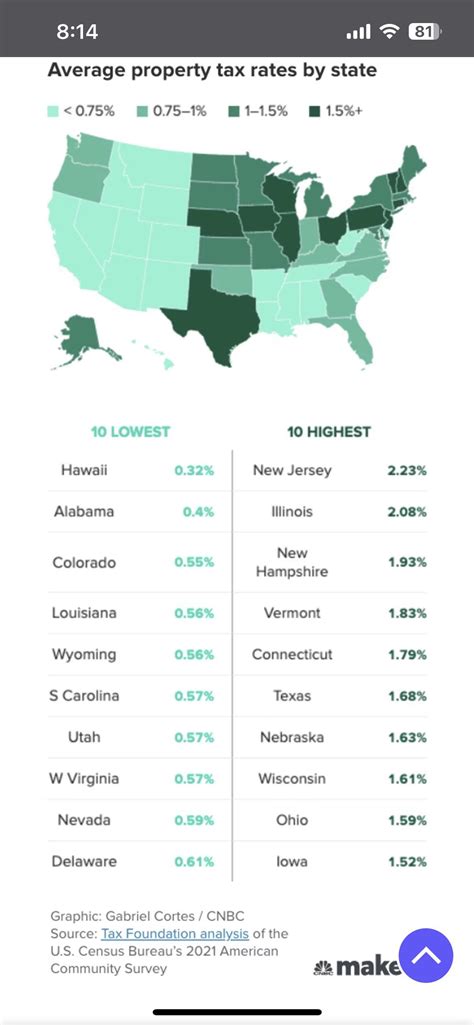

Property Tax Rates and Valuations

Property taxes constitute a primary revenue source, yet their impact varies significantly based on assessed values and millage rates. As of the most recent fiscal reports, Berkeley County’s residential property tax rate averages around 70 to 75 mills, which is competitive compared to neighboring counties. In contrast, Charleston County’s rate hovers near 90 to 95 mills, partly attributable to its densely populated urban core requiring extensive infrastructure upkeep. However, these figures are only part of the story, as assessed property values and exemption policies heavily influence net tax burdens for homeowners.

| Relevant Category | Substantive Data |

|---|---|

| Average Home Property Tax (Annual) | Berkeley County: approximately $1,300; Charleston County: approximately $2,200 |

| Median Property Value | Berkeley County: $250,000; Charleston County: $350,000 |

| Property Tax Rate (Millage) | Berkeley County: 70-75 mills; Charleston County: 90-95 mills |

Sales Tax Dynamics and Impact

Sales taxes form another critical component, especially impacted by regional economic activities. Both counties impose a base sales tax rate of 6%, but regional decisions and additional local taxes lead to slightly varying total rates. For instance, Charleston County’s sales tax can reach 8.5% in certain districts due to additional local surcharges, whereas Berkeley County generally remains around 7-7.5%. These differences influence consumer behavior, retail sectors, and municipal revenue.

| Relevant Category | Substantive Data |

|---|---|

| Combined Sales Tax Rate | Berkeley County: 7-7.5%; Charleston County: 8.5% |

| Revenue from Sales Taxes (2022) | Berkeley: approximately $180 million; Charleston: approximately $320 million |

| Major Stakeholders | Retailers, consumers, local government budgets |

Comparative Analysis of Tax-Driven Public Services

Tax policies shape the quality and scope of public services delivered across counties. Berkeley County emphasizes expanding its educational facilities and infrastructure in rural and suburban areas, reflecting its growing population of families and commuters. Conversely, Charleston County’s prioritization of urban transit, historical preservation, and emergency services aligns with its densely populated districts and economic hubs.

Educational Funding and School Districts

Berkeley County’s tax revenue allocates approximately 55% to public schools, supporting a rapid expansion of schools and technology integration. Charleston County dedicates nearly 60% of its tax income toward maintaining its large-scale school district, which includes Charleston County School District, one of the largest in South Carolina.

| Relevant Category | Substantive Data |

|---|---|

| Per-Student Funding | Berkeley: around $10,500; Charleston: approximately $13,200 |

| School District Enrollment | Berkeley: 30,000; Charleston: over 50,000 |

Economic Profiles and Revenue Variations

The economic fabric of each county fundamentally influences tax revenues and fiscal sustainability. Berkeley County, characterized by expanding suburbs, has a diversified economy rooted in logistics, manufacturing, and technology sectors. It benefits from proximity to Interstate 26 and I-95, facilitating commerce and workforce mobility. Charleston County, with its historic port and burgeoning tourism industry, sees substantial tax income from maritime activities, hospitality, and professional services.

Industrial Contributions and Tax Base

The port of Charleston accounts for nearly 20% of the region’s GDP, generating substantial property and sales tax revenues. Additionally, the hospitality industry contributes significantly, especially given the influx of tourists and conventions. Berkeley County’s industrial parks and logistics hubs attract multimillion-dollar investments, further expanding its taxable base.

| Relevant Category | Substantive Data |

|---|---|

| Port-Related Revenue | Charleston Port: approx. $400 million annually in taxes |

| Tourism Sector Impact | Charleston County: ~$2.5 billion/year from tourism-related taxes |

| Industrial Investment in Berkeley | Over $1 billion in recent logistics infrastructure projects |

Which County Offers Better Tax Benefits?

Deciding which county offers better taxation benefits hinges on individual circumstances and priorities. For homeowners valuing lower property taxes and a suburban environment, Berkeley County’s tax rates and value propositions may appear more attractive. Conversely, those seeking urban amenities, cultural attractions, and a bustling business climate might favor Charleston County’s comprehensive infrastructure and higher—but more targeted—tax investments.

Long-term Fiscal Sustainability

Assessing which governance model sustains fiscal health involves evaluating debt levels, reserve funds, and investment strategies. Berkeley County maintains conservative debt policies, with a debt-to-GDP ratio of 2.5%, supporting rapid growth without over-leverage. Charleston County has a slightly higher ratio, reflecting substantial investments in urban infrastructure but also requiring prudent financial oversight for future stability.

| Relevant Metric | Value |

|---|---|

| Debt-to-GDP Ratio | Berkeley: 2.5%; Charleston: 3.8% |

| Reserve Funds (2023) | Berkeley: $150 million; Charleston: $200 million |

Making an Informed Choice

Ultimately, the decision between Berkeley County tax advantages and Charleston County tax policies is contingent on individual financial situations, community preferences, and long-term goals. Both counties exemplify distinct approaches—Berkeley’s suburban-driven growth with modest taxes, and Charleston’s urban-centric investments with somewhat higher rates—each with its trade-offs. As economic and demographic trends evolve, continuous assessment of these policies remains vital for making strategic residency or investment decisions.

Key Points

- Property Taxes: Berkeley County generally offers lower property tax rates but balanced against median home values, presenting a different fiscal picture than Charleston.

- Sales Tax Impact: Higher local sales taxes in Charleston County fund urban infrastructure, potentially affecting retail and consumer spending patterns.

- Public Service Investment: Both counties invest heavily in education, transportation, and emergency services, aligned with their economic base and growth strategies.

- Economic Diversification: Divergent economic profiles influence fiscal resilience, with each county leveraging port, tourism, or industrial sectors differently.

- Long-Term Stability: Debt levels and reserve funds suggest both counties are managing their fiscal health well, but their strategic priorities vary.

What factors should I consider when comparing Berkeley and Charleston County taxes?

+Key considerations include property tax rates and assessed values, sales tax levels, public service quality, economic stability, and long-term fiscal health. Your personal residency or investment goals will influence which factors matter most.

How do property values affect the overall tax burden in both counties?

+Higher property values can offset higher tax rates by reducing effective taxes for homeowners, while lower values might make even low rates feel burdensome. It’s essential to consider both assessed valuation and millage rates for accurate comparison.

Are Charleston County’s higher sales taxes justified by urban infrastructure needs?

+Yes, increased sales taxes in Charleston fund extensive urban infrastructure, transportation, and public services. These investments aim to sustain economic growth and quality of life, though they may impact retail spending behaviors.