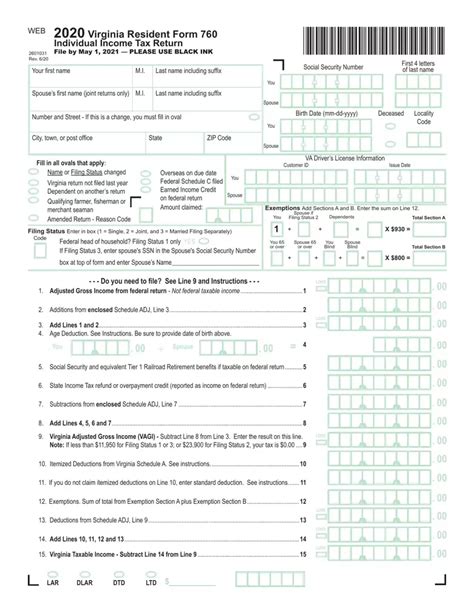

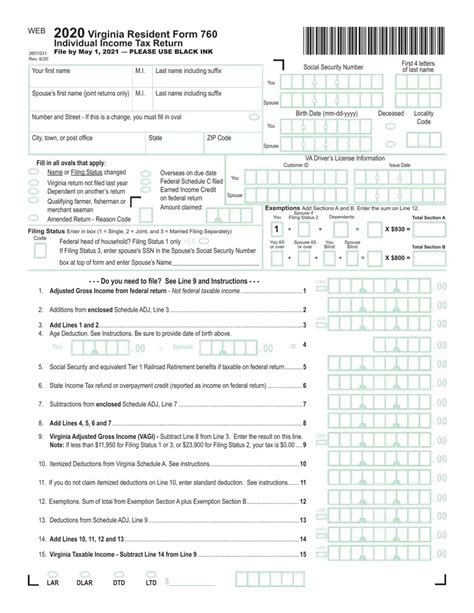

Navigating the Journey of Filing Your Virginia Tax Return

Filing a tax return in Virginia is a meticulous journey that demands both precision and a strategic understanding of state-specific regulations. As a hallmark example of the intersection between federal tax principles and state-level compliance, Virginia's tax system has evolved substantially over recent decades, reflecting broader trends toward digital integration, legislative clarity, and taxpayer empowerment. Navigating this process isn’t merely about submitting forms—it’s about understanding the nuances that ensure your filings are accurate, timely, and optimized for your financial well-being.

Understanding Virginia’s Tax Filing Framework: An In-Depth Exploration

Virginia imposes a structured yet dynamic income tax system, rooted in a progressive rate schedule that ranges from 2% to 5.75%. For individual filers, the state’s revenue primarily supports education, transportation, and public safety initiatives, making compliance a vital aspect of civic participation. The overall process encompasses several interrelated steps: gathering relevant documentation, understanding filing deadlines, selecting appropriate forms, and leveraging available credits and deductions to optimize tax outcomes. This section deciphers each component, breaking down complex legal stipulations into actionable insights rooted in the latest tax codes and fiscal policies.

Essential Taxpayer Data: What You Need to Start

The foundation of accurate Virginia tax filing begins with meticulous data collection. This includes W-2 forms from employers, 1099s from banks or investment firms, records of any additional income sources, and documentation of deductible expenses such as mortgage interest, charitable contributions, and medical costs. Given Virginia’s adoption of digital filing platforms—most notably the Virginia Tax online portal—taxpayers now have streamlined access to pre-filled forms and real-time guidance. Ensuring data accuracy not only minimizes audit risk but also enhances your ability to leverage bonus credits like the Virginia Earned Income Tax Credit, which offsets tax liabilities for qualifying residents.

| Relevant Category | Substantive Data |

|---|---|

| Filing Deadline | Due on May 1st for calendar-year filers, with possible extensions until October 15th if requested |

| Standard Deduction | $4,500 for single filers; $9,000 for married filing jointly (2023 figures) |

| Tax Rate Range | 2% to 5.75%, based on income brackets |

| Additional Credits | Virginia Renter’s Credit, Child and Dependent Care Credit, Education Credit, among others |

Step-by-Step Guidance Through Virginia’s Tax Filing Process

Breaking down the process into granular steps reveals the pathway toward compliance—each stage integral to final settlement. The process begins with preliminary preparation and culminates in submitting the return either electronically or via paper forms. Analyzing each phase reveals opportunities for error reduction and maximized benefits.

Step 1: Collect and Analyze Your Income Data

Begin with consolidating your income records: W-2 forms from all employers, 1099 forms for freelance, investment, or contract income, and any state-specific sources such as rental income or business earnings. Proven best practices include cross-referencing entries against bank statements and prior-year returns, as discrepancies in income data are common pitfalls that can trigger audits.

Step 2: Determine Your Filing Status and Deductions

Filing status—single, married filing jointly, married filing separately, head of household, or qualifying widow(er)—directly influences your tax bracket. Determining eligibility for specific deductions and credits hinges on this classification. For instance, the Virginia standard deduction varies based on filing status and income level, and itemizing deductions is advantageous only if it surpasses the standard deduction threshold.

Step 3: Utilize State-Specific Tax Software or Hire a Professional

In recent years, the Virginia Department of Taxation has bolstered its online portal—Virginia Tax—which offers robust tools, pre-filled forms, and direct submission options. Automated platforms such as TurboTax or H&R Block further streamline federal and state filings, incorporating checks for errors and potential audits. For complex situations, enlisting a CPA with expertise in Virginia tax law ensures tailored strategies, such as handling multi-state income or business deductions.

Step 4: Complete and Review Your Form

Entering data into the correct Virginia tax form—most often Form VA-1040—requires precision. When using electronic filing software, validation occurs dynamically, reducing errors. Manual filers must double-check calculations, verify coding of deductions, and ensure all supplemental schedules are attached. Remember that overlooked credits or misclassified income can lead to underpayment penalties or missed refunds.

Step 5: File and Pay Your Taxes

Electronic filing with scheduled payments is typically the fastest, safest, and most economical method. The Virginia Tax portal supports direct bank transfers and credit card payments, with fees clearly outlined. If opting for paper submission, mailing forms to the designated address is acceptable but can delay processing. Timeliness is critical to avoid late penalties—so set reminders for the May 1st deadline or extended date if applicable.

Additional Considerations: Handling Audits and Amendments

Tax audits remain a low but real risk—particularly for high-income earners or those with complex deductions. Maintaining meticulous records, including receipts, bank statements, and prior correspondence, facilitates quick resolution. Should errors be identified post-filing, submitting an amended return using Form VA-500X ensures compliance and prevents penalties. Staying proactive and transparent sustains your credibility with the Virginia Department of Taxation.

Key Points

- Accurate data collection is the cornerstone of successful filing, minimizing errors and audits.

- Understanding Virginia-specific deductions enhances tax savings, including credits like the Earned Income Tax Credit and the Renter’s Credit.

- Adopting digital tools accelerates compliance, reduces mistakes, and offers real-time support.

- Timely submission mitigates penalties, with extensions available but not recommended as default.

- Record-keeping is critical; documentation must be retained for at least three years in case of audits or amendments.

Legal and Policy Developments Impacting Virginia Tax Filings

State tax legislation is a dynamic arena, with recent reforms affecting deductions, credits, and filing procedures. Notably, Virginia’s recent alignment with federal changes—such as adjustments to standard deductions and tax brackets—has simplified compliance but introduced new calculations and forms. Legislative efforts have also targeted transparency enhancements, digital innovations, and relief programs for vulnerable populations.

Historical Context and Evolutionary Trends

Virginia’s tax system initially mirrored federal structures but has progressively incorporated distinctive features—like the Virginia Renter’s Credit and the adoption of online filing portals—reflecting shifts toward modernization and taxpayer-centric policies. Understanding this historical trajectory can empower filers to anticipate future changes, such as potential new credits or rate adjustments driven by economic reforms.

Methodological Approaches in Virginia Tax Policy

The state employs a combination of legislative amendments, administrative rules, and outreach programs to calibrate its tax system. Regular data collection and analysis of taxpayer behaviors inform policies, which aim to balance revenue needs with equitable access. For example, the phased implementation of online filing systems demonstrates a commitment to reducing compliance barriers and streamlining processes.

FAQs about Navigating Virginia Tax Returns

When is the deadline to file my Virginia tax return?

+The standard deadline is May 1st for calendar-year filers. Extensions can be requested, extending the deadline to October 15th, but taxes owed are still due by May 1st to avoid penalties.

Can I file my Virginia return electronically?

+Yes, Virginia offers an online portal—Virginia Tax—enabled for e-filing, which ensures faster processing, confirmation, and direct deposit of refunds.

What are common deductions and credits available in Virginia?

+Common deductions include the standard deduction, mortgage interest, and charitable contributions. Credits such as the Earned Income Tax Credit (EITC) and Renter’s Credit can significantly reduce your liability if you meet eligibility criteria.

What should I do if I need to amend my Virginia return?

+If you discover errors after filing, submit Form VA-500X to correct inaccuracies, provide supporting documentation, and clarify changes. Timely amendments help avoid penalties and interest.

What are penalties for late filing or payment?

+Late filing can incur penalties of 6% per month on unpaid taxes, up to 30%. Late payment leads to interest charges. Prompt submission and payment mitigate this risk.