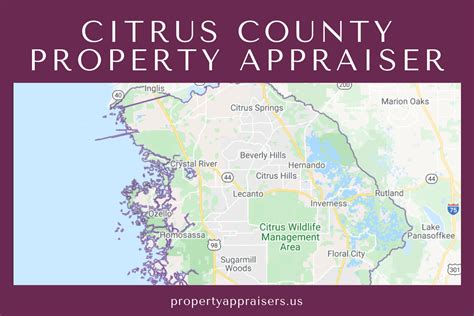

Citrus County Property Tax

Welcome to our comprehensive guide on Citrus County property taxes, a topic of great importance for homeowners and prospective buyers alike. In this expert-led exploration, we'll delve into the intricacies of property tax assessments, rates, and the factors that influence them in Citrus County, Florida. Our aim is to provide you with an in-depth understanding of this essential aspect of homeownership, ensuring you're equipped with the knowledge to navigate the property tax landscape with confidence.

Unraveling Citrus County Property Taxes

Property taxes are a vital source of revenue for local governments, and in Citrus County, they play a significant role in funding essential services and infrastructure. These taxes are determined by the assessed value of your property, which is a carefully calculated estimate of its market value. This value is not static; it can change annually, impacting the amount of tax you owe. Let’s explore the key aspects of Citrus County property taxes.

Assessment Process: A Detailed Look

The Citrus County Property Appraiser’s Office is responsible for assessing the value of all properties within the county. This assessment is a meticulous process that involves examining various factors, including recent sales of similar properties, construction costs, and the property’s overall condition. The appraiser’s goal is to determine a fair and accurate value, ensuring a transparent and equitable tax system.

Here's a breakdown of the assessment process:

- Physical Inspection: Property appraisers may conduct physical inspections of your property to assess its condition and any recent improvements.

- Sales Analysis: Recent sales data of comparable properties in the area is studied to establish a benchmark for your property's value.

- Cost Approach: This method considers the cost of rebuilding your property, minus depreciation, to determine its value.

- Income Approach: Applicable primarily to commercial properties, this approach evaluates the property's income-generating potential.

| Assessment Category | Description |

|---|---|

| Market Value | The estimated price your property would sell for in an open market. |

| Assessed Value | The value determined by the Property Appraiser, which is typically a percentage of the market value. |

| Taxable Value | The value used to calculate your property taxes, taking into account any exemptions or discounts. |

Property Tax Rates: Understanding the Breakdown

The property tax rate in Citrus County is determined by a combination of factors, including the county's millage rate and any additional rates set by local municipalities or special districts. The millage rate is a crucial component, representing the number of mills (one-thousandth of a dollar) levied on each dollar of assessed property value.

Here's a simplified breakdown of how your property taxes are calculated:

- Assessed Value: Let's say your property's assessed value is $200,000.

- Millage Rate: The Citrus County millage rate for 2023 is 9.55 mills.

- Tax Calculation: Your property taxes would be calculated as follows:

Assessed Value ($200,000) x Millage Rate (9.55) = $1,910

This calculation provides a basic estimate of your property taxes, but it's important to note that additional rates and exemptions can further impact the final amount.

Factors Influencing Property Tax Rates

Property tax rates in Citrus County are influenced by a variety of factors, each playing a unique role in determining the final tax burden. Understanding these factors can provide valuable insights into the dynamics of property taxes in the region.

- Budget Requirements: Local governments and special districts rely on property taxes to fund essential services, such as schools, emergency services, and infrastructure maintenance. As these needs evolve, so too can the tax rates.

- Voter-Approved Referendums: In some cases, property tax rates can be increased through voter-approved referendums, which may be proposed to fund specific projects or services.

- Economic Factors: The local economy and real estate market fluctuations can impact property values, which in turn affect tax assessments.

- Special Assessments: Certain improvements or developments within a community may be subject to special assessments, which are additional taxes levied to cover the costs of these projects.

Staying informed about these factors can help homeowners anticipate changes in property tax rates and plan their financial strategies accordingly.

Exemptions and Discounts: Maximizing Your Savings

Citrus County offers a range of exemptions and discounts that can significantly reduce your property tax burden. These incentives are designed to support specific groups of homeowners and promote homeownership within the community. Here’s an overview of some of the most common exemptions and discounts available:

- Homestead Exemption: This exemption is available to Florida residents who own and occupy their primary residence as of January 1st of the tax year. It provides a $25,000 exemption from the assessed value, which can lead to substantial savings.

- Senior Exemption: Citrus County offers an additional exemption for homeowners who are 65 years or older and meet certain income requirements. This exemption provides a further reduction in assessed value, offering relief to senior homeowners.

- Veterans' Exemption: Active-duty military personnel and veterans can qualify for an exemption on their primary residence. The amount of the exemption varies based on the veteran's disability status and length of service.

- Low-Income Discount: Homeowners with limited incomes may be eligible for a discount on their property taxes. This discount is calculated based on income and can provide significant savings for those who qualify.

It's important to note that exemption and discount qualifications can vary, so it's advisable to consult with the Citrus County Property Appraiser's Office or a tax professional to ensure you're taking advantage of all applicable benefits.

Property Tax Payment Options: Flexibility and Convenience

Citrus County offers homeowners a range of payment options to accommodate different financial situations and preferences. Understanding these options can help you choose the most suitable method for paying your property taxes.

- Online Payments: The Citrus County Tax Collector's Office provides an online payment portal, offering a convenient and secure way to pay your taxes. This option is ideal for those who prefer the simplicity and speed of digital transactions.

- Mail-In Payments: If you prefer a more traditional approach, you can mail your tax payment to the Tax Collector's Office. This method requires careful attention to ensure your payment is received on time and properly credited.

- In-Person Payments: For those who prefer face-to-face interactions, the Tax Collector's Office has physical locations where you can make your payments. This option allows for immediate confirmation and provides an opportunity to address any queries directly.

- Payment Plans: Citrus County understands that paying property taxes in a lump sum can be challenging for some homeowners. To provide flexibility, the Tax Collector's Office offers payment plans, allowing you to spread your tax payments over a specified period.

Exploring these payment options and choosing the one that aligns with your financial situation can make managing your property taxes a more streamlined and stress-free process.

Appealing Your Property Assessment: A Step-by-Step Guide

If you believe your property’s assessed value is inaccurate or unfair, you have the right to appeal the assessment. The appeal process in Citrus County is designed to provide homeowners with a fair and transparent mechanism to challenge their property’s assessed value. Here’s a comprehensive guide to navigating this process:

- Understand the Assessment: Start by thoroughly reviewing your property's assessment notice. This document outlines the assessed value, the basis for the assessment, and any applicable exemptions or discounts. If you have questions or concerns, reach out to the Citrus County Property Appraiser's Office for clarification.

- Gather Evidence: Collect evidence that supports your belief that the assessed value is incorrect. This may include recent sales data of similar properties in the area, appraisals, or other relevant documentation. It's crucial to gather as much evidence as possible to strengthen your case.

- File an Appeal: The first step in the appeal process is to file a petition with the Citrus County Value Adjustment Board (VAB). The VAB is an independent body responsible for hearing and deciding on property tax appeals. Ensure you meet the filing deadline, which is typically within a specified timeframe after receiving your assessment notice.

- Prepare for the Hearing: Once your appeal is filed, you'll receive a hearing date from the VAB. Use this time to prepare your case. This may involve organizing your evidence, preparing a written statement, and considering any potential counterarguments. It's advisable to consult with a tax professional or attorney to ensure you're fully prepared.

- Attend the Hearing: On the hearing date, present your case to the VAB. Be prepared to provide detailed explanations and support your arguments with evidence. The VAB will consider your appeal and make a decision based on the evidence presented.

- Receive the Decision: After the hearing, the VAB will issue a written decision, typically within a specified timeframe. If your appeal is successful, your property's assessed value will be adjusted, resulting in a lower property tax burden. If your appeal is denied, you have the right to appeal further, but it's essential to carefully consider the next steps and consult with professionals.

Future Implications and Trends in Citrus County Property Taxes

Understanding the current state of Citrus County property taxes is just the beginning. Staying informed about potential future trends and implications can help homeowners and prospective buyers make informed decisions and plan for the long term. Here’s an analysis of some key factors that may influence property taxes in the years to come:

- Economic Growth and Development: Citrus County's economy is experiencing a period of growth, with an increasing focus on tourism, agriculture, and healthcare. As the county continues to develop and attract new businesses and residents, property values are likely to rise, potentially leading to higher property tax assessments.

- Infrastructure Investments: The county's investment in infrastructure, such as road improvements, water and sewer system upgrades, and public transportation enhancements, can impact property values positively. However, these improvements may also lead to increased tax rates to fund these projects.

- Population Dynamics: The county's population is expected to grow steadily, with an aging demographic and an influx of retirees. This demographic shift can influence property values and tax assessments, as older residents may be more likely to take advantage of senior exemptions and discounts.

- Political and Policy Changes: Changes in local government leadership and policy priorities can have a significant impact on property taxes. For instance, new initiatives or referendums could lead to tax rate increases or the introduction of new exemptions to support specific communities or causes.

- Market Fluctuations: The real estate market is inherently dynamic, and fluctuations in property values can have a direct impact on tax assessments. Monitoring market trends and staying informed about local real estate dynamics can help homeowners anticipate potential changes in their property tax burden.

By staying attuned to these factors and keeping abreast of local developments, homeowners and prospective buyers can make strategic decisions regarding property ownership and investment in Citrus County.

Frequently Asked Questions

When are property taxes due in Citrus County?

+Property taxes in Citrus County are due in two installments. The first installment is due on November 1st, while the second installment is due on March 31st. However, if you prefer, you can pay your entire tax bill in one payment by March 31st.

How can I estimate my property taxes before receiving my assessment notice?

+You can use the Citrus County Tax Calculator to estimate your property taxes. This tool allows you to input your property’s assessed value and millage rate to get a rough estimate. However, keep in mind that this estimate may not account for any exemptions or discounts you may qualify for.

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes can result in penalties and interest charges. Additionally, if your taxes remain unpaid, the county may place a tax lien on your property, which could lead to further legal action and potential foreclosure.

Can I receive a discount if I pay my property taxes early?

+Citrus County does not offer discounts for early payment of property taxes. However, paying your taxes early can provide peace of mind and ensure you avoid any late payment penalties or interest charges.

How often are property assessments conducted in Citrus County?

+Property assessments in Citrus County are conducted annually. The Property Appraiser’s Office assesses all properties within the county to determine their current market value, which forms the basis for property tax calculations.