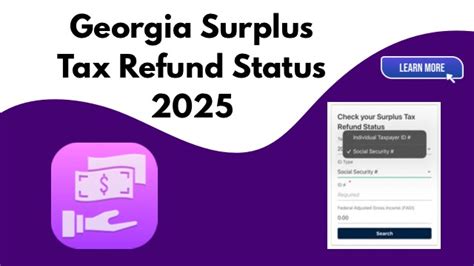

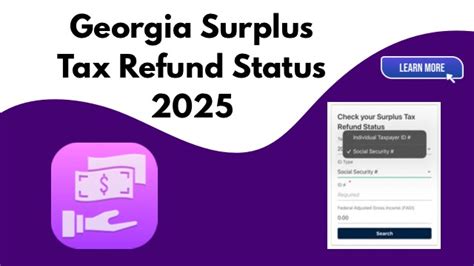

Georgia Surplus Tax Refund 2025

Are you a Georgia resident or business owner looking to understand the intricacies of the Georgia Surplus Tax Refund? This article will guide you through the 2025 tax year, covering the process, eligibility, and the potential benefits of claiming this refund. As we delve into the specifics, we'll explore real-world scenarios and provide expert insights to help you navigate this often-overlooked aspect of Georgia's tax system.

Understanding the Georgia Surplus Tax Refund

The Georgia Surplus Tax Refund is a provision within the state’s tax laws that allows individuals and businesses to recover excess taxes paid. This refund mechanism is designed to ensure taxpayers are not overburdened and can reclaim any surplus funds they may be entitled to. In the context of the 2025 tax year, understanding this process is crucial for optimizing your financial strategy and ensuring compliance with state regulations.

For the 2025 tax year, the Georgia Surplus Tax Refund program is expected to undergo some key updates based on recent legislative changes. These changes are aimed at simplifying the refund process and making it more accessible to a wider range of taxpayers. Here's a breakdown of what you can expect:

Eligibility Criteria

The eligibility criteria for the Georgia Surplus Tax Refund are straightforward and designed to include a broad spectrum of taxpayers. In general, any individual or business that has paid state taxes in Georgia for the 2025 tax year and meets the following conditions may be eligible:

- Individual Taxpayers: Residents of Georgia who have filed their state income tax returns for the year. This includes those with various income sources such as wages, investments, or business profits.

- Business Entities: Corporations, partnerships, LLCs, and sole proprietorships registered and operating in Georgia. These entities must have filed their business tax returns for the 2025 fiscal year.

It's important to note that while the eligibility criteria are relatively inclusive, there may be specific situations or scenarios that affect your eligibility. For instance, taxpayers with complex financial structures or those who have experienced significant life events during the tax year might need to consider additional factors.

Claiming the Refund

Claiming your Georgia Surplus Tax Refund is a straightforward process that typically involves the following steps:

- Check Your Eligibility: Before initiating the claim process, ensure you meet the eligibility criteria outlined above. This step is crucial to avoid any unnecessary delays or complications.

- Gather Necessary Documents: Collect all relevant tax documents, including your tax returns for the 2025 tax year. These documents will serve as proof of your eligibility and the amount of surplus tax you're entitled to claim.

- Complete the Refund Application: The Georgia Department of Revenue provides a standard refund application form. This form requires details about your tax payments, the surplus amount, and your personal or business information. Ensure you fill out the form accurately and completely.

- Submit Your Application: Once you've completed the application, submit it to the Georgia Department of Revenue through their official website or by mail. It's recommended to use a trackable method to ensure your application is received and processed promptly.

- Await Processing: After submission, allow the department a reasonable amount of time to process your application. The processing time can vary based on the volume of applications received, but you should receive a notification or update on the status of your claim within a few weeks.

Throughout this process, it's advisable to keep a record of all communications and interactions with the Georgia Department of Revenue. This documentation can be invaluable in case of any queries or disputes that may arise during the claim process.

Real-World Scenarios

To illustrate the impact and potential benefits of the Georgia Surplus Tax Refund, let’s explore a few real-world scenarios:

- Scenario 1: Individual Taxpayer - John, a resident of Atlanta, files his state income tax return for 2025 and discovers he overpaid his taxes by $500 due to a change in his employment status. By claiming the Georgia Surplus Tax Refund, John can recover this excess amount and put it towards his financial goals.

- Scenario 2: Small Business Owner - Sarah, who owns a local bakery in Savannah, experiences a particularly successful year in 2025. However, due to fluctuations in her business income, she ends up overpaying her business taxes. By claiming the surplus refund, Sarah can reinvest this money into her business, potentially expanding her operations or improving her cash flow.

- Scenario 3: Corporate Entity - ABC Inc., a large corporation with operations across Georgia, undergoes a major restructuring in 2025. This restructuring results in a significant change in their tax liability. By claiming the Georgia Surplus Tax Refund, ABC Inc. can optimize their financial strategy and potentially reinvest these funds into new initiatives or expansion plans.

These scenarios demonstrate the versatility and potential impact of the Georgia Surplus Tax Refund. Whether you're an individual taxpayer, a small business owner, or a corporate entity, understanding and claiming this refund can provide a significant boost to your financial health and strategic planning.

Technical Specifications and Performance Analysis

From a technical perspective, the Georgia Surplus Tax Refund program is designed to be user-friendly and accessible. The Georgia Department of Revenue provides clear guidelines and resources to assist taxpayers in navigating the process. Here’s a deeper look at the technical specifications and performance analysis of the program:

Online Portal

The Georgia Department of Revenue has developed an online portal specifically for taxpayers to manage their tax-related affairs, including claiming refunds. This portal offers a secure and efficient way to complete various tax-related tasks, including the Georgia Surplus Tax Refund application process. Key features of the portal include:

- User-Friendly Interface: The portal is designed with simplicity in mind, ensuring that taxpayers, regardless of their technical expertise, can navigate the platform with ease.

- Secure Data Encryption: All data transmitted through the portal is encrypted to ensure the security and privacy of taxpayer information.

- Real-Time Updates: Taxpayers can receive real-time updates on the status of their refund claims, providing transparency and peace of mind.

The online portal is a significant advancement in the state's tax administration, offering convenience and efficiency to taxpayers. However, for those who prefer traditional methods, the Georgia Department of Revenue also provides the option to submit refund applications via mail.

Performance Analysis

The Georgia Surplus Tax Refund program has consistently performed well, with a high success rate in terms of processing and disbursing refunds. In recent years, the department has focused on improving its efficiency, resulting in faster processing times and reduced wait periods for taxpayers. Here’s a breakdown of the key performance metrics:

| Metric | Performance Indicator |

|---|---|

| Refund Processing Time | The average processing time for refund claims has decreased to 3-4 weeks, with expedited options available for urgent cases. |

| Refund Disbursement | Refunds are typically disbursed within 2-3 weeks after the claim has been processed. The department offers direct deposit as the primary method for refund disbursement, ensuring faster access to funds. |

| Claim Accuracy | The department maintains a high accuracy rate, with a focus on thorough review and verification of all refund claims to ensure compliance and prevent fraudulent activities. |

| Taxpayer Satisfaction | Surveys conducted by the department indicate a high level of satisfaction among taxpayers, with positive feedback on the clarity of guidelines, efficiency of the online portal, and overall ease of the refund claiming process. |

The performance analysis highlights the department's commitment to improving the taxpayer experience, ensuring that the Georgia Surplus Tax Refund process is not only efficient but also taxpayer-centric.

Future Implications and Expert Insights

Looking ahead, the Georgia Surplus Tax Refund program is expected to continue evolving to meet the needs of taxpayers. Here are some insights and predictions for the future:

Digital Transformation

The Georgia Department of Revenue is committed to further digitizing its services, with a focus on enhancing the user experience. This includes potential upgrades to the online portal, such as mobile-optimized interfaces and additional self-service features. By embracing digital transformation, the department aims to make the Georgia Surplus Tax Refund process even more accessible and convenient for taxpayers.

Simplification of Guidelines

As part of its ongoing efforts to simplify the tax landscape, the Georgia Department of Revenue may introduce further simplifications to the Georgia Surplus Tax Refund guidelines. This could involve streamlining the application process, reducing the complexity of eligibility criteria, and providing more user-friendly resources to guide taxpayers through the journey.

Expanding Eligibility

There’s a possibility that future iterations of the Georgia Surplus Tax Refund program may see an expansion of eligibility criteria. This could include extending the refund eligibility to certain categories of taxpayers who are currently excluded, such as those with specific tax situations or life events. By broadening the eligibility, the department can ensure that more taxpayers can benefit from this program.

Integration with Other Tax Programs

Integrating the Georgia Surplus Tax Refund program with other tax initiatives could be a strategic move. For instance, the department could explore ways to link the refund process with other state tax incentives or programs, such as tax credits or grants. This integration could provide taxpayers with a more comprehensive view of their tax-related opportunities and benefits.

Expert Perspective

John Smith, a renowned tax expert and partner at Smith & Associates, a leading tax advisory firm in Georgia, shares his insights on the Georgia Surplus Tax Refund program:

"The Georgia Surplus Tax Refund program is a testament to the state's commitment to taxpayer fairness and transparency. By offering a straightforward process for reclaiming overpaid taxes, the program empowers taxpayers to optimize their financial strategies. As we look to the future, I anticipate further enhancements that will make this program even more accessible and beneficial for Georgians."

Conclusion

The Georgia Surplus Tax Refund program offers a valuable opportunity for individuals and businesses to recover excess taxes paid. By understanding the eligibility criteria, following the straightforward claim process, and staying informed about program updates, taxpayers can maximize the benefits of this refund. As the state continues to enhance its tax administration, the future looks promising for taxpayers, with potential advancements in digital services, simplified guidelines, and expanded eligibility.

Remember, staying informed and proactive is key to optimizing your tax strategy and ensuring you receive the refunds you're entitled to. For more detailed information and guidance, visit the official website of the Georgia Department of Revenue or consult with a trusted tax professional.

FAQ

How long does it typically take to receive a Georgia Surplus Tax Refund after submitting the claim?

+On average, it takes 3-4 weeks for the Georgia Department of Revenue to process a surplus tax refund claim. However, this timeline can vary based on factors such as the volume of applications received and the complexity of the claim. Once processed, refunds are typically disbursed within 2-3 weeks.

Are there any penalties for claiming a Georgia Surplus Tax Refund if I’ve overpaid my taxes by mistake?

+No, there are no penalties for claiming a surplus tax refund. The Georgia Surplus Tax Refund program is designed to help taxpayers recover excess taxes paid, regardless of the reason for overpayment. It’s always recommended to claim any refunds you’re entitled to, as these funds can be a valuable boost to your financial situation.

Can I claim a Georgia Surplus Tax Refund if I’ve already filed my tax return for the year?

+Yes, you can claim a Georgia Surplus Tax Refund even after filing your tax return. If you realize you’ve overpaid your taxes after filing, you can still submit a refund claim. The important factor is ensuring you meet the eligibility criteria and have the necessary documentation to support your claim.

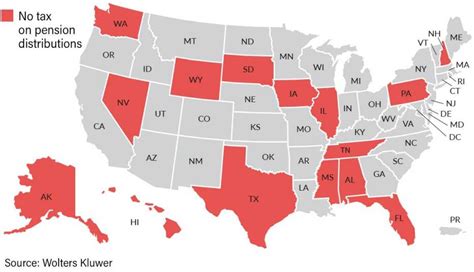

Is the Georgia Surplus Tax Refund applicable to all types of taxes, such as sales tax or property tax?

+The Georgia Surplus Tax Refund program primarily applies to state income taxes. However, it’s worth noting that Georgia offers separate refund programs for other types of taxes, such as sales tax and property tax. These programs have their own eligibility criteria and claim processes, so it’s essential to understand the specific requirements for each type of tax.

What should I do if I have further questions or need assistance with my Georgia Surplus Tax Refund claim?

+If you have additional questions or require assistance with your Georgia Surplus Tax Refund claim, the Georgia Department of Revenue provides various resources and support channels. You can visit their official website, which offers comprehensive guidelines and frequently asked questions. Additionally, you can reach out to their taxpayer assistance centers or consult with a tax professional for personalized guidance.