Fairfax County Property Taxes

Property taxes are an essential aspect of local government finances, providing a significant revenue stream for essential services such as education, infrastructure, and public safety. In Fairfax County, Virginia, the property tax system plays a vital role in funding these critical community needs. This article aims to provide an in-depth analysis of Fairfax County's property tax landscape, offering insights into how the system works, its impact on residents, and the broader implications for the county's financial health and development.

Understanding Fairfax County’s Property Tax System

Fairfax County assesses and collects property taxes annually, with these taxes serving as a primary source of revenue for the county’s general fund. The assessment process is intricate, considering various factors such as property location, type, improvements, and sales data to determine an accurate property value.

The property tax rate in Fairfax County is expressed as a dollar amount per hundred dollars of assessed property value, known as the "tax rate per hundred."

| Tax Rate Type | Tax Rate per Hundred |

|---|---|

| County Tax Rate | $1.099 |

| Town of Herndon Tax Rate | $0.196 |

| School Tax Rate | $0.982 |

| Total Effective Tax Rate | $2.277 |

For the tax year 2023, the effective tax rate for most areas of Fairfax County is $2.277 per hundred dollars of assessed value. This rate consists of the combined tax rates for the county, schools, and any applicable towns or cities within the county.

The assessment process is undertaken by the Fairfax County Department of Tax Administration (DTA), which ensures that all properties are assessed fairly and accurately. The DTA uses a computer-assisted mass appraisal system, considering factors such as location, property size, improvements, and recent sales data to determine the assessed value of each property.

Property owners receive their annual property tax bills, known as "real estate tax bills," by February 15th. These bills detail the assessed value of the property, the applicable tax rates, and the total amount due. Taxpayers have until March 31st to pay their taxes without incurring interest or penalties. Payments can be made online, by mail, or in person at the Fairfax County Treasury Division.

Tax Relief Programs

Fairfax County offers various tax relief programs to assist eligible homeowners. These programs include the Senior/Disabled Real Estate Tax Relief Grant, which provides grants to eligible seniors and disabled homeowners, and the Homestead Exemption, which reduces the assessed value of a primary residence for tax purposes.

Additionally, the county offers the Land Conservation Tax Credit Program, which provides tax credits to landowners who voluntarily place a permanent conservation easement on their property, preserving open space and natural resources.

Impact on Residents and Businesses

Property taxes in Fairfax County directly impact residents and businesses, influencing their financial planning and decisions. For homeowners, property taxes are a significant expense, often constituting a substantial portion of their annual household budget. The tax burden can vary widely depending on the assessed value of the property and the applicable tax rates.

Businesses, particularly those with substantial real estate holdings, also face significant property tax obligations. These taxes can impact a company's profitability and its ability to invest in growth and expansion. However, Fairfax County's robust economy and well-developed infrastructure, supported by property tax revenues, create a favorable business environment, attracting and retaining a diverse range of companies.

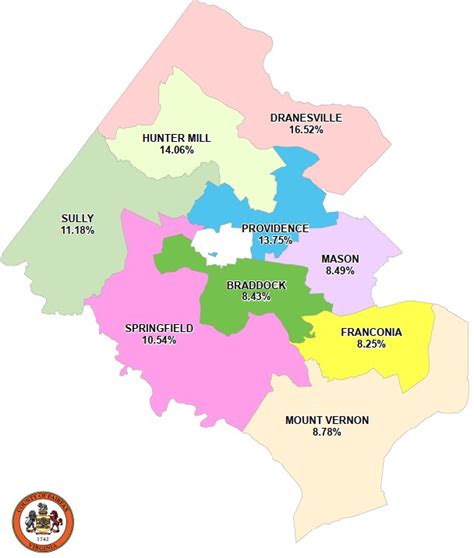

The county's tax rates and assessment practices have been a subject of discussion and occasional controversy. Critics argue that the tax burden is unevenly distributed, with some areas facing higher effective tax rates than others. Additionally, concerns have been raised about the potential impact of rising property values on long-term residents and businesses, particularly those on fixed incomes or with limited financial flexibility.

Tax Appeals and Challenges

Property owners who believe their assessed value is incorrect have the right to appeal. The DTA provides a formal appeals process, allowing taxpayers to present evidence and arguments to support their case. The appeals process is intricate, and property owners often seek professional assistance to navigate it successfully.

Tax appeal outcomes can vary widely, with some appeals resulting in reduced assessments and subsequent tax savings, while others may lead to no change or even increased assessments. The success of an appeal depends on various factors, including the strength of the evidence presented and the prevailing market conditions.

Financial Implications and Future Outlook

Property taxes are a critical component of Fairfax County’s financial stability and long-term planning. The revenue generated from these taxes funds essential services and infrastructure projects, ensuring the county’s continued development and growth.

The county's financial health is closely tied to its property tax base. A strong and stable property tax revenue stream enables the county to maintain its high bond ratings, which, in turn, allow it to borrow at favorable interest rates for major projects and initiatives. However, the county must also balance its tax rates to ensure competitiveness and avoid driving out residents and businesses.

Looking ahead, Fairfax County faces the challenge of managing its tax base in the face of changing demographics and economic trends. The county must adapt its tax policies and assessment practices to ensure fairness and competitiveness while maintaining its financial stability and ability to provide high-quality services to its residents.

Economic Development and Tax Incentives

Fairfax County recognizes the importance of economic development and has implemented various tax incentives to attract and retain businesses. These incentives include tax abatements, tax increment financing (TIF), and enterprise zone programs, which provide tax relief to qualifying businesses, particularly those investing in job creation and community development.

These tax incentives aim to stimulate economic growth, create jobs, and enhance the county's tax base over the long term. However, they also present challenges, as they may reduce immediate tax revenues and require careful evaluation and management to ensure they align with the county's overall financial goals and objectives.

How often are property values assessed in Fairfax County?

+Property values in Fairfax County are assessed annually as of January 1st. This annual assessment ensures that property taxes reflect the current market value of each property.

Are there any tax relief programs for seniors or disabled residents in Fairfax County?

+Yes, Fairfax County offers the Senior/Disabled Real Estate Tax Relief Grant, providing financial assistance to eligible seniors and disabled homeowners. This grant helps reduce the tax burden for these residents.

What is the deadline for paying property taxes in Fairfax County without incurring penalties?

+Property taxes in Fairfax County are due by March 31st without incurring interest or penalties. Taxpayers can pay online, by mail, or in person at the Fairfax County Treasury Division.

How can property owners appeal their assessed value in Fairfax County?

+Property owners can appeal their assessed value through the Fairfax County Department of Tax Administration’s formal appeals process. They can present evidence and arguments to support their case for a lower assessment.

What are the economic development incentives offered by Fairfax County to attract businesses?

+Fairfax County offers various economic development incentives, including tax abatements, tax increment financing (TIF), and enterprise zone programs. These incentives aim to attract businesses, create jobs, and stimulate economic growth.