Business Occupation Tax

The Business Occupation Tax, often referred to as BOT, is a crucial aspect of the economic landscape for businesses operating within certain jurisdictions. This tax is levied on various entities, from sole proprietorships to large corporations, and its implications can significantly impact the financial strategies and overall profitability of businesses. In this comprehensive guide, we will delve into the intricacies of the Business Occupation Tax, exploring its definitions, applications, variations, and the critical role it plays in the business world.

Understanding the Business Occupation Tax

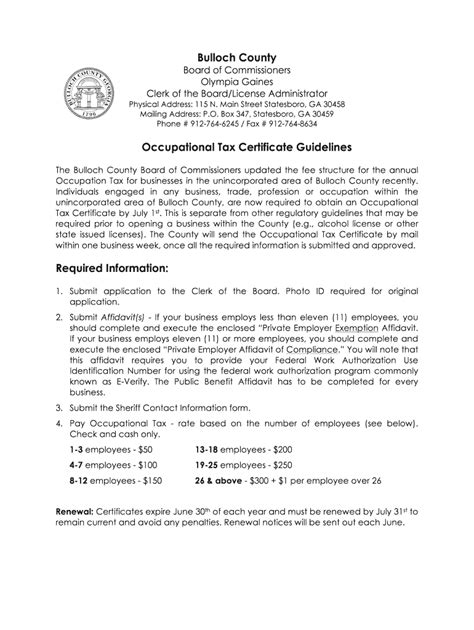

The Business Occupation Tax is a type of license fee or tax imposed on businesses for the privilege of conducting operations within a specific jurisdiction, typically at the state, county, or municipal level. It is distinct from income or sales taxes, as it is not directly tied to a business’s revenue or the goods and services it provides. Instead, the BOT is often calculated based on factors such as the type of business, its location, and sometimes, the number of employees or square footage occupied.

The primary purpose of the Business Occupation Tax is to generate revenue for local governments to fund essential services like infrastructure development, public safety, and community initiatives. In return for this tax, businesses are granted the legal right to operate within the jurisdiction, often accompanied by certain protections and access to local resources.

Types of Business Occupation Taxes

Business Occupation Taxes come in various forms, and the specific type a business is subject to can depend on numerous factors. Here are some common variations:

1. Flat Rate BOT

In some jurisdictions, a flat-rate BOT is applied, where all businesses of a certain type pay a fixed amount regardless of their size or revenue. This simplifies the tax calculation process but can be disadvantageous for smaller businesses, as the tax burden may be relatively higher for them.

| Business Type | Flat Rate BOT ($) |

|---|---|

| Retail Stores | 500 |

| Professional Services | 750 |

| Manufacturing | 1000 |

2. Graduated Scale BOT

A graduated scale BOT is more progressive, with the tax rate increasing as the business’s size or revenue grows. This approach aims to distribute the tax burden more equitably, ensuring that larger, more profitable businesses contribute a higher share. The rates can be based on factors like annual revenue, number of employees, or a combination of metrics.

| Revenue Range | BOT Rate (%) |

|---|---|

| 0 - $500,000 | 1 |

| $500,001 - $1,000,000 | 1.5 |

| $1,000,001 and above | 2 |

3. Location-Based BOT

Certain jurisdictions may impose a location-based BOT, where the tax is tied to the specific area where the business operates. This can lead to variations in tax rates between different regions or even within the same city, often reflecting the local government’s desire to encourage economic development in certain areas.

| City Neighborhood | BOT Rate ($/sqft) |

|---|---|

| Downtown Core | 0.50 |

| Suburban Areas | 0.35 |

| Industrial Zones | 0.25 |

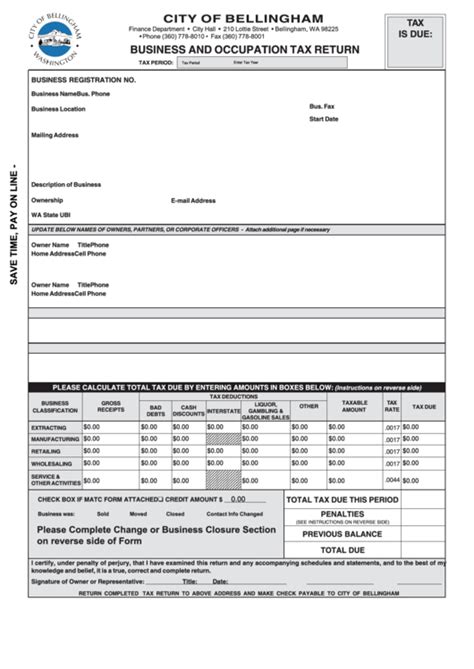

Compliance and Filing Procedures

Compliance with Business Occupation Taxes is essential to avoid penalties and maintain a business’s good standing. The filing procedures can vary, but generally, businesses are required to:

- Register with the appropriate government agency or department.

- Determine the applicable tax rate and calculate the tax liability.

- Submit the tax payment by the due date, which is often annually or semi-annually.

- Retain records of tax payments for audit purposes.

Common Challenges in Compliance

One of the primary challenges businesses face is keeping up with changing tax rates, as these can be adjusted periodically by local governments. Additionally, misunderstanding the tax regulations or failing to account for specific industry or location-based exemptions can lead to overpayment or non-compliance issues.

Impact on Business Operations

The Business Occupation Tax can have a significant influence on a company’s financial planning and overall business strategy. Here’s how it can impact operations:

1. Budgeting and Financial Planning

Businesses must allocate a portion of their budget specifically for BOT. This tax can affect a company’s profitability, especially for smaller enterprises with tighter margins. Accurate budgeting for BOT is essential to avoid cash flow issues.

2. Strategic Location Choices

When considering expansion or relocation, the BOT can be a decisive factor. Businesses may opt for locations with more favorable tax rates or those offering tax incentives for specific industries. This strategic decision can impact the company’s overall cost structure and long-term profitability.

3. Tax Planning and Minimization

Businesses often engage in tax planning to minimize their BOT liability. This can involve restructuring operations, exploring tax incentives, or taking advantage of available deductions and credits. Effective tax planning can lead to significant savings and improve a company’s financial health.

Case Study: The Impact of BOT on a Small Business

Consider the example of Cafe Del Sol, a small coffee shop chain operating in several cities. When the chain expanded into a new city, it faced a higher BOT due to the location-based tax structure. This led to a 15% increase in their overhead costs, which impacted their pricing strategy and overall profitability. To mitigate this, Cafe Del Sol explored tax incentives for small businesses and restructured its operations to qualify for certain deductions, ultimately reducing its BOT liability by 10%.

Future Implications and Considerations

As the business landscape evolves, the role of the Business Occupation Tax is likely to adapt as well. Here are some key considerations for the future:

1. Technological Advancements

With the rise of digital technologies, the process of BOT compliance and payment is becoming increasingly streamlined. Online portals and digital payment systems can make tax filing more efficient and reduce administrative burdens for businesses.

2. Tax Reform and Policy Changes

Changes in local and state governments can lead to shifts in tax policies, including the structure and rates of the BOT. Businesses must stay informed about these changes to adapt their financial strategies accordingly.

3. Impact on Small Businesses

For small and medium-sized enterprises, the BOT can be a significant expense. Governments may need to consider tax relief measures or incentives to support these businesses, ensuring they remain competitive and can contribute to local economies.

4. International Comparisons

When considering expansion into new markets, businesses should compare the BOT structures and rates in different countries. This analysis can inform strategic decisions and help businesses understand the financial landscape in their target markets.

Conclusion

The Business Occupation Tax is a critical component of the business ecosystem, impacting everything from a company’s financial health to its strategic decisions. Understanding the nuances of this tax, its variations, and its implications is essential for businesses to navigate the economic landscape effectively. By staying informed and engaging in strategic tax planning, businesses can optimize their financial strategies and thrive in their respective jurisdictions.

How often must businesses pay the Business Occupation Tax?

+The frequency of BOT payments can vary, but most jurisdictions require annual or semi-annual payments. Some areas may even have quarterly or monthly BOT requirements.

Are there any exemptions or deductions available for the BOT?

+Yes, many jurisdictions offer exemptions or deductions based on factors like industry, location, or business size. These can significantly reduce a business’s BOT liability.

What are the penalties for non-compliance with the Business Occupation Tax?

+Penalties for non-compliance can include fines, interest charges, and even revocation of the business’s license to operate. It’s crucial to ensure timely and accurate BOT payments to avoid these consequences.