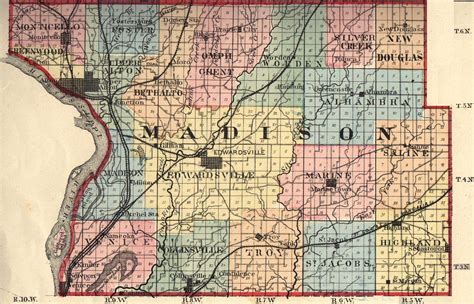

Madison County Il Taxes

Madison County, located in the southern region of Illinois, plays a significant role in the state's economic landscape. One of the critical aspects that impact the county's residents and businesses is its tax system. This article delves into the intricacies of Madison County's tax structure, shedding light on its various components, rates, and implications.

Understanding Madison County’s Tax Landscape

Madison County’s tax system is multifaceted, encompassing a range of taxes that contribute to the county’s revenue and funding for essential services. The county’s tax structure is governed by state laws and regulations, with additional local ordinances and policies shaping the specific tax rates and assessments.

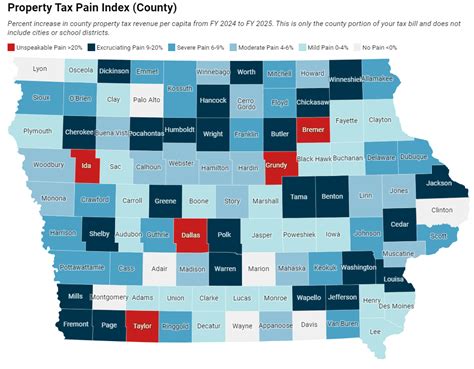

One of the primary taxes in Madison County is the property tax, which forms a substantial portion of the county's revenue. Property taxes are levied on real estate properties, including residential homes, commercial buildings, and land. The assessed value of the property, determined by the county's assessor's office, is a key factor in calculating the tax liability.

In Madison County, the property tax rate is expressed as a percentage of the assessed value. For instance, a property with an assessed value of $200,000 and a tax rate of 3.5% would have an annual property tax bill of $7,000. This rate is subject to change annually, influenced by factors such as the county's budget requirements, local infrastructure projects, and the overall economic climate.

In addition to property taxes, Madison County also imposes sales and use taxes. These taxes are applied to the retail sale of goods and certain services within the county. The sales tax rate is typically expressed as a percentage added to the purchase price. For example, if the sales tax rate is 7%, a $100 item would have an additional $7 tax, making the total cost $107.

Sales and use taxes contribute to the county's revenue and are often used to fund specific initiatives or services. Madison County may also have additional special tax districts, where certain areas or industries are subject to unique tax rates to support targeted projects or improvements.

Tax Rates and Comparisons

Madison County’s tax rates can vary significantly within the county, influenced by factors such as the municipality, school district, and special tax districts. For instance, the property tax rate in the city of Edwardsville might differ from that in the town of Highland, even though they are both located within Madison County.

When compared to other counties in Illinois, Madison County's tax rates can be relatively competitive. For instance, the average property tax rate in Madison County is approximately 3.2%, which is lower than the state average of 3.4%. However, it's essential to consider that tax rates can change annually, and specific locations within the county may have higher or lower rates.

| Tax Type | Madison County Rate | Illinois Average Rate |

|---|---|---|

| Property Tax | 3.2% | 3.4% |

| Sales and Use Tax | Varies by Municipality | Varies by County |

Tax Assessment and Collection Process

The process of tax assessment and collection in Madison County involves several key steps and stakeholders.

Assessment Process

The assessment process begins with the Madison County Assessor’s Office, which is responsible for evaluating the value of properties within the county. This assessment determines the taxable value of each property, which forms the basis for calculating property taxes.

The assessor's office employs various methods to assess property values, including market analysis, property inspections, and consideration of factors such as location, size, and improvements. Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair.

Tax Billing and Collection

Once the assessed values are determined, the Madison County Treasurer’s Office takes over the tax billing and collection process. The treasurer’s office sends out tax bills to property owners, detailing the assessed value, applicable tax rates, and the total tax liability.

Property owners are typically given a grace period to pay their taxes without incurring penalties. Failure to pay taxes on time can result in additional fees, interest, and potential legal consequences, including tax liens or property seizures.

The treasurer's office also plays a crucial role in disbursing the collected tax revenue to various entities, including the county government, school districts, municipalities, and special tax districts. This process ensures that the funds are allocated appropriately to support the various services and initiatives within Madison County.

Tax Relief and Incentives

Madison County recognizes the importance of providing tax relief and incentives to certain segments of its population and businesses. These initiatives aim to promote economic growth, support vulnerable communities, and encourage investment.

Property Tax Exemptions

Madison County offers various property tax exemptions to eligible individuals and organizations. These exemptions can reduce the taxable value of a property, resulting in lower tax liabilities. Some common exemptions include:

- Homestead Exemption: Provides a reduction in property taxes for primary residence homeowners.

- Senior Citizen Exemption: Offers tax relief to elderly homeowners based on income and age criteria.

- Veteran's Exemption: Grants tax benefits to honorably discharged veterans or their surviving spouses.

- Agricultural Exemption: Allows reduced tax assessments for properties used for agricultural purposes.

These exemptions aim to make property ownership more affordable and provide support to specific demographic groups within the county.

Business Incentives

Madison County also offers incentives to attract and retain businesses. These incentives can take the form of tax breaks, grants, or reduced tax rates for eligible businesses. The county’s economic development initiatives often focus on encouraging job creation, innovation, and investment in specific industries.

For instance, the county may offer tax abatements or tax increment financing (TIF) for businesses locating or expanding in designated areas. These incentives can provide substantial savings for businesses, making Madison County an attractive location for economic growth and development.

Impact on the Community

Madison County’s tax system plays a vital role in shaping the community’s economic landscape and overall quality of life. The revenue generated through taxes funds essential services and infrastructure projects that benefit residents and businesses alike.

Funding Essential Services

Tax revenue is a primary source of funding for various public services in Madison County. These services include:

- Education: Funding for public schools, including teacher salaries, infrastructure maintenance, and educational resources.

- Public Safety: Support for law enforcement, fire departments, and emergency services.

- Healthcare: Contributions to public health initiatives and hospitals.

- Infrastructure: Maintenance and development of roads, bridges, and public transportation systems.

- Recreation: Funding for parks, recreational facilities, and cultural programs.

By investing in these areas, Madison County ensures the well-being and prosperity of its residents, creating a vibrant and attractive community.

Economic Development

The tax system also plays a crucial role in driving economic development within Madison County. Tax incentives and a competitive tax environment can attract businesses and investors, leading to job creation and economic growth.

A thriving business community contributes to increased tax revenue, which, in turn, can be reinvested into further development initiatives. This positive cycle can enhance the county's economic resilience and attract more residents and businesses, fostering a robust and dynamic local economy.

Conclusion: Navigating Madison County’s Tax Landscape

Understanding Madison County’s tax system is essential for residents, businesses, and investors alike. From property taxes to sales taxes, each component plays a crucial role in funding the county’s essential services and driving economic development.

Staying informed about tax rates, assessment processes, and available incentives is vital for effective financial planning and community engagement. By actively participating in the county's tax landscape, individuals and businesses can contribute to the continued growth and prosperity of Madison County.

How often do tax rates change in Madison County?

+Tax rates in Madison County can change annually. The county’s budget requirements, economic conditions, and local initiatives often influence these changes. It is essential to stay updated with the latest tax rates to ensure accurate financial planning.

Can I appeal my property tax assessment in Madison County?

+Yes, Madison County provides a process for property owners to appeal their assessed values. If you believe your property’s assessed value is inaccurate, you can file an appeal with the county’s assessor’s office. It is advisable to consult with a tax professional or attorney for guidance on the appeal process.

Are there any tax relief programs for low-income residents in Madison County?

+Madison County offers several tax relief programs for low-income residents. These programs often provide exemptions or reductions in property taxes based on income and age criteria. It is recommended to contact the county’s assessor’s office or local community organizations for more information on eligibility and application processes.

How do I stay updated on Madison County’s tax news and changes?

+You can stay informed about Madison County’s tax updates by regularly checking the county’s official website, following local news outlets, and subscribing to tax-related newsletters or alerts. Additionally, attending public meetings and engaging with local government representatives can provide valuable insights into tax-related matters.