County Tax Records

Welcome to an in-depth exploration of the fascinating world of County Tax Records! These records, often overlooked by the general public, hold a wealth of information and play a crucial role in our society. From understanding the financial landscape of a region to ensuring fair and efficient governance, County Tax Records are an essential component of our administrative systems. In this comprehensive article, we will delve into the intricacies of these records, uncovering their significance, functionality, and impact on our daily lives.

The Essence of County Tax Records

County Tax Records are official documents maintained by local government authorities, specifically by the county assessor’s office or its equivalent. These records detail the assessed value of properties within a particular county, along with the corresponding tax liabilities. They serve as a cornerstone for local revenue generation, providing the necessary funds for vital public services and infrastructure development.

These records are not just a bureaucratic necessity; they are a reflection of the economic health and growth of a region. By analyzing County Tax Records, one can gain insights into property values, market trends, and the overall financial stability of a community. Moreover, they ensure transparency and accountability in the tax system, allowing citizens to understand how their tax contributions are utilized.

A Glimpse into the Data

Let’s take a closer look at the specifics of County Tax Records. These records typically include the following information:

- Property Details: This includes the property's address, legal description, ownership information, and physical characteristics such as size, number of rooms, and any special features.

- Assessment Value: The assessed value is determined by the county assessor and is based on various factors, including market value, income potential, and replacement cost. It serves as the basis for calculating property taxes.

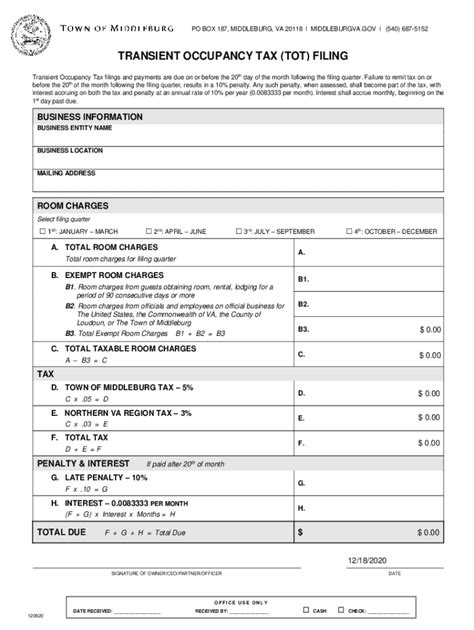

- Tax Liability: The tax liability is the amount of tax owed by the property owner, calculated using the assessed value and the applicable tax rate. This information is vital for property owners to budget and plan their finances accordingly.

- Assessment History: County Tax Records often provide a historical perspective, allowing one to track the changes in a property's assessed value over time. This can be particularly insightful for understanding market trends and property appreciation.

| County | Property Address | Assessment Value ($) | Tax Rate (%) | Tax Liability ($) |

|---|---|---|---|---|

| Orange County | 123 Main St, Anaheim | 450,000 | 1.25 | 5,625 |

| Los Angeles County | 456 Elm Ave, Los Angeles | 700,000 | 1.10 | 7,700 |

| San Diego County | 789 Pine St, San Diego | 320,000 | 1.30 | 4,160 |

The Impact on Communities

County Tax Records have a profound impact on the communities they serve. Here’s a closer look at some of these impacts:

Fair Taxation and Equity

County assessors ensure that properties are valued fairly and consistently. This equitable assessment process ensures that no property owner is overburdened with excessive taxes. By maintaining accurate records, assessors can identify and address any discrepancies, ensuring a fair tax system for all residents.

Public Service Funding

The revenue generated from property taxes is a significant source of funding for essential public services. These include education, healthcare, public safety, and infrastructure development. County Tax Records play a crucial role in determining the allocation of these funds, ensuring that vital services are adequately supported.

Economic Development

County Tax Records are a valuable tool for economic development. They provide investors and businesses with reliable data on property values and market trends. This information can attract new businesses and investments, leading to job creation and economic growth within the county.

Community Planning

County Tax Records are also utilized for community planning and development. By analyzing property values and ownership patterns, local governments can identify areas in need of revitalization or areas suitable for specific types of development. This data-driven approach ensures efficient and effective land use planning.

The Future of County Tax Records

As technology advances, so does the potential for County Tax Records to evolve. Here are some insights into the future of this critical administrative system:

Digital Transformation

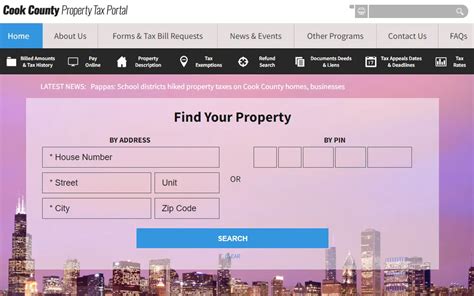

Many counties are already embracing digital solutions for managing and accessing County Tax Records. Online platforms and databases make it easier for property owners, researchers, and government officials to access and analyze these records. This digital transformation enhances transparency and efficiency, allowing for quicker assessments and improved data management.

Data Analytics and Insights

With advanced data analytics, County Tax Records can provide even deeper insights. By utilizing machine learning and predictive modeling, assessors can forecast property values, identify potential tax evasion, and optimize tax collection processes. These analytics can also assist in identifying areas of concern or opportunity for community development.

Community Engagement

The future of County Tax Records also lies in community engagement. By involving residents in the assessment process and providing them with accessible tools to understand their tax obligations, counties can foster a sense of trust and transparency. This engagement can lead to better tax compliance and a stronger connection between residents and their local government.

Sustainable Practices

In an era of environmental consciousness, County Tax Records can play a role in promoting sustainable practices. By incorporating green building assessments and encouraging energy-efficient property developments, counties can incentivize environmentally friendly practices and contribute to a greener future.

How often are County Tax Records updated?

+The frequency of updates varies by county, but most counties conduct regular reassessments every few years. These reassessments ensure that property values remain current and accurate.

Can I access County Tax Records online?

+Many counties now offer online access to their tax records. You can typically find these records on the county assessor's website or through a dedicated online portal.

What if I disagree with my property's assessed value?

+If you believe your property's assessed value is inaccurate, you have the right to appeal. The process varies by county, but it typically involves submitting evidence and attending a hearing to present your case.

How are County Tax Records used for community planning?

+County Tax Records provide valuable data on property ownership, values, and trends. This information helps local governments make informed decisions about land use, development, and infrastructure planning.

What role do County Tax Records play in economic development?

+County Tax Records attract investors and businesses by providing reliable data on property values and market trends. This information assists in identifying potential investment opportunities and fostering economic growth.

In conclusion, County Tax Records are not just administrative documents; they are the lifeblood of local governance and community development. By understanding their significance and potential, we can appreciate the role they play in shaping our communities and ensuring a fair and prosperous future. So, the next time you think about taxes, remember the intricate world of County Tax Records and the vital role they serve.