Erie County Real Property Tax

Welcome to an in-depth exploration of Erie County's Real Property Tax system, a critical aspect of property ownership and local government finances. This comprehensive guide aims to shed light on the intricacies of this tax, offering an understanding that goes beyond basic knowledge. By delving into the specifics, we aim to empower property owners and stakeholders with the information they need to navigate this essential fiscal obligation effectively.

Understanding Erie County’s Real Property Tax

The real property tax, often referred to as the “property tax” or “real estate tax,” is a crucial component of Erie County’s revenue stream, playing a pivotal role in funding various local services and infrastructure projects. This tax is levied on all real estate properties within the county, encompassing both residential and commercial entities.

The assessment process for Erie County's real property tax is rigorous and detailed. It involves the evaluation of each property's market value, considering factors such as location, size, condition, and recent sales data of similar properties in the area. This process ensures that the tax burden is distributed fairly among property owners, taking into account the actual worth of their assets.

One unique aspect of Erie County's real property tax is the two-tiered assessment system. This system distinguishes between assessable value and equalized value. The assessable value represents the property's assessed value for tax purposes, while the equalized value is a standardized measure, allowing for fair comparisons across the county.

Key Features of Erie County’s Property Tax System

Erie County’s real property tax system boasts several notable features that set it apart from other jurisdictions. These include:

- Annual Tax Assessment Notices: Property owners receive an annual assessment notice detailing their property’s assessed value and the corresponding tax rate. This transparency ensures that owners are aware of their tax obligations and can plan their finances accordingly.

- Online Tax Payment Options: Erie County offers a user-friendly online platform for property tax payments, providing convenience and flexibility for taxpayers. This digital system streamlines the payment process and reduces administrative burdens.

- Appeal Process: In cases where property owners believe their assessment is inaccurate, Erie County provides a clear and accessible appeals process. This ensures fairness and allows for adjustments to be made based on individual circumstances.

Additionally, Erie County's real property tax system actively promotes property tax exemptions and abatements for certain eligible individuals and organizations. These incentives aim to encourage economic development, support local businesses, and provide relief to vulnerable populations, such as senior citizens and veterans.

The Impact of Real Property Tax on Erie County

The real property tax plays a vital role in shaping Erie County’s fiscal landscape and overall development. A significant portion of the county’s annual budget is derived from these tax revenues, funding essential services like public education, law enforcement, emergency services, and infrastructure maintenance.

By providing stable and predictable revenue, the real property tax enables Erie County to plan and execute long-term projects, ensuring the continued growth and improvement of the community. This tax revenue also supports local initiatives, such as community development programs, environmental conservation efforts, and cultural events, enriching the quality of life for residents.

Case Study: Erie County’s Property Tax in Action

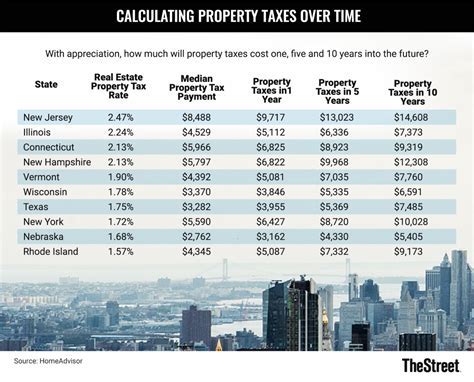

Let’s consider a real-world example to illustrate the impact of Erie County’s real property tax. Suppose a residential property in Erie County with an assessed value of 200,000 and a tax rate of 2.5%. The owner would be responsible for an annual property tax of 5,000, which contributes to the county’s overall tax revenue and helps fund the aforementioned services and initiatives.

| Property Type | Assessed Value | Tax Rate | Annual Property Tax |

|---|---|---|---|

| Residential | $200,000 | 2.5% | $5,000 |

| Commercial | $500,000 | 2.7% | $13,500 |

| Agricultural | $150,000 | 2.3% | $3,450 |

This case study highlights the direct correlation between property value and tax liability, emphasizing the importance of accurate assessments in ensuring a fair tax system.

Looking Ahead: Future Prospects and Challenges

As Erie County continues to grow and evolve, the real property tax system will face both opportunities and challenges. One of the key prospects lies in the potential for technological advancements to further streamline the assessment and payment processes, enhancing efficiency and reducing administrative costs.

However, challenges also exist, particularly in the form of fluctuating property values and economic conditions. Erie County must remain agile in its tax policies, adapting to market changes and ensuring that the tax burden remains equitable and sustainable.

Furthermore, the county should continue to explore innovative strategies to encourage economic growth and development while maintaining a fair and transparent tax system. This could involve incentives for renewable energy initiatives, support for small businesses, and investments in infrastructure that attract new residents and businesses.

Conclusion: A Comprehensive Tax System for Erie County

Erie County’s real property tax system is a complex yet crucial mechanism that supports the county’s growth and development. By understanding the intricacies of this system, property owners can actively participate in their community’s fiscal health and contribute to its prosperity.

As we move forward, Erie County's commitment to a fair and efficient tax system will continue to shape its future, ensuring a vibrant and sustainable community for generations to come.

How is the real property tax calculated in Erie County?

+The real property tax in Erie County is calculated based on the assessed value of the property and the applicable tax rate. The assessed value is determined through a rigorous evaluation process, considering various factors such as location, size, and recent sales data. The tax rate is set annually and may vary depending on the property’s classification (residential, commercial, etc.).

Are there any tax exemptions or abatements available in Erie County?

+Yes, Erie County offers various tax exemptions and abatements to eligible individuals and organizations. These include exemptions for senior citizens, veterans, and individuals with disabilities, as well as abatements for certain economic development initiatives and infrastructure projects. It’s important to check with the Erie County Tax Assessor’s Office for specific details and eligibility criteria.

How can I appeal my property’s assessed value in Erie County?

+If you believe your property’s assessed value is inaccurate, you have the right to appeal. Erie County provides a clear appeals process, which typically involves submitting documentation to support your claim. It’s advisable to consult with a tax professional or seek guidance from the Erie County Tax Assessor’s Office to understand the specific steps and requirements for an appeal.