Ad Valorem Tax For Georgia Vehicles

Ad Valorem Tax in Georgia: Understanding Vehicle Taxation

Georgia, known for its diverse landscape and vibrant cities, imposes an Ad Valorem tax on vehicles as a means of generating revenue for the state. This tax is an essential component of Georgia's transportation funding, contributing to road maintenance, infrastructure development, and various public services. Understanding the intricacies of Ad Valorem tax for vehicles is crucial for both residents and vehicle owners in the state.

In this comprehensive guide, we delve into the specifics of Ad Valorem tax in Georgia, covering its history, calculation methods, exemptions, and its impact on the state's economy and transportation network. By the end of this article, you will have a clear understanding of your tax obligations as a vehicle owner in Georgia and the role this tax plays in the state's development.

A Historical Perspective on Ad Valorem Tax

Ad Valorem tax, Latin for "according to value," is a type of tax levied on the value of a property or asset. In the context of vehicles, this tax is assessed based on the assessed value of the automobile, ensuring that owners contribute proportionally to the state's finances based on the worth of their vehicles.

The implementation of Ad Valorem tax in Georgia dates back to the early 20th century, when the state sought a more equitable and stable source of revenue for its burgeoning transportation network. This tax system replaced the previous licensing fee structure, which was based on vehicle weight and engine size, with a more comprehensive valuation-based system.

The move to Ad Valorem tax was not without its challenges. It required the establishment of a robust system for vehicle valuation and tax assessment, ensuring that the tax burden was distributed fairly among vehicle owners. Over time, the system has evolved, incorporating modern valuation techniques and tax calculation methods to keep pace with the changing automotive landscape.

Understanding the Tax Calculation Process

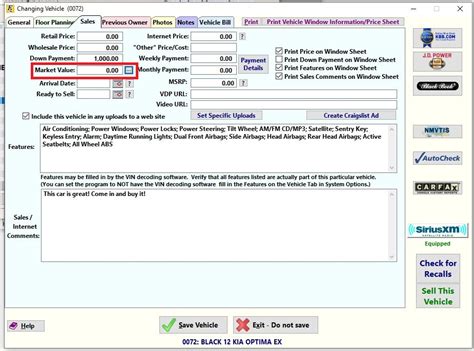

The calculation of Ad Valorem tax for vehicles in Georgia is a multi-step process, involving several factors that contribute to the final tax amount. These factors include the assessed value of the vehicle, the county where the vehicle is registered, and the applicable tax rate.

Assessed Value of the Vehicle

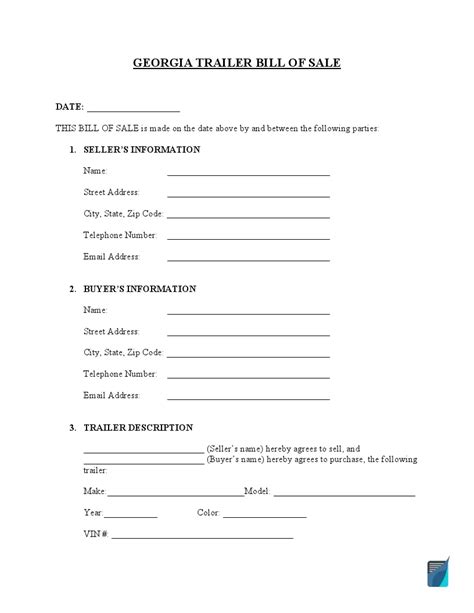

The assessed value of a vehicle is determined by the Georgia Department of Revenue using a formula that takes into account several factors, including the vehicle's make, model, age, and mileage. This valuation process ensures that vehicles are taxed fairly based on their current market value.

For instance, a 2022 Tesla Model 3 with a base price of $46,990 would have a different assessed value than a 2010 Toyota Corolla with a similar mileage. The Tesla, being a newer and more expensive vehicle, would likely have a higher assessed value and, consequently, a higher Ad Valorem tax.

County-Specific Tax Rates

Georgia's Ad Valorem tax system recognizes the varying economic conditions and needs of different counties. As such, each county sets its own tax rate, which can range from 1% to 2% of the vehicle's assessed value. This means that the Ad Valorem tax you pay can vary depending on the county you reside in.

For example, let's consider two counties, Cobb and Fulton. Cobb County might have a tax rate of 1.5%, while Fulton County has a rate of 1.8%. If you own a vehicle with an assessed value of $20,000, you would pay $300 in Ad Valorem tax in Cobb County ($20,000 x 1.5%) and $360 in Fulton County ($20,000 x 1.8%).

Example Calculation

Let's illustrate the tax calculation process with a practical example. Suppose you own a 2018 Ford F-150 pickup truck, and the Georgia Department of Revenue has assessed its value at $25,000. You reside in Gwinnett County, which has a tax rate of 1.7% for Ad Valorem tax.

| Assessed Value of Vehicle | $25,000 |

|---|---|

| County Tax Rate | 1.7% |

| Ad Valorem Tax Amount | $425 |

Therefore, your Ad Valorem tax liability for this vehicle would be $425 ($25,000 x 1.7%).

Exemptions and Special Cases

While Ad Valorem tax is a universal requirement for vehicle owners in Georgia, certain exemptions and special cases exist to provide relief to specific groups of taxpayers.

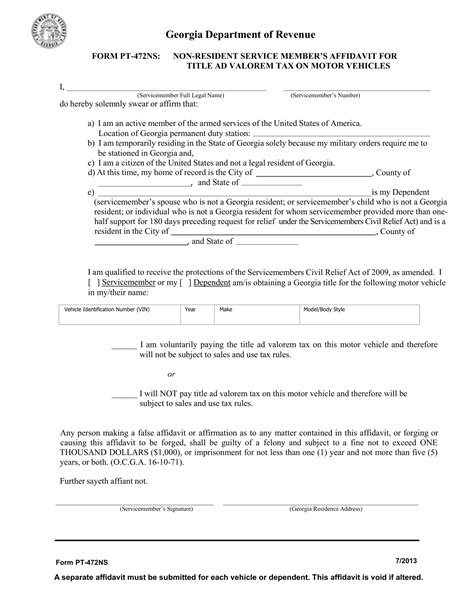

Military Personnel

Active-duty military personnel stationed in Georgia are eligible for a 100% exemption on Ad Valorem tax for their vehicles. This exemption is a way for the state to show appreciation for the service and sacrifice of its military members.

To claim this exemption, military personnel must provide proof of their active-duty status and register their vehicles with the appropriate county tax commissioner's office.

Senior Citizens and Disabled Individuals

Georgia offers a special tax relief program for senior citizens and disabled individuals who own vehicles. This program provides a reduction in the Ad Valorem tax liability, making it more affordable for these groups to maintain their vehicles.

To qualify for this relief, senior citizens must be at least 62 years old, and disabled individuals must have a valid disability parking permit issued by the Georgia Department of Driver Services. The reduction in tax liability varies based on the individual's income and the assessed value of their vehicle.

Electric and Hybrid Vehicles

To encourage the adoption of environmentally friendly vehicles, Georgia offers a tax credit for the purchase of electric and hybrid vehicles. This credit can be applied against the Ad Valorem tax liability, reducing the overall tax burden for owners of these vehicles.

For instance, if you purchase a new electric vehicle with a base price of $50,000, you could be eligible for a tax credit of up to $5,000, significantly reducing your Ad Valorem tax liability for the first year of ownership.

The Impact of Ad Valorem Tax on Georgia's Economy

Ad Valorem tax on vehicles is a significant source of revenue for Georgia, contributing to the state's overall economic health and development. The tax funds are allocated towards various initiatives that benefit the state's residents and businesses.

Road Maintenance and Infrastructure

A substantial portion of the revenue generated from Ad Valorem tax is dedicated to maintaining and improving Georgia's road network. This includes repairs, resurfacing, and the construction of new roads and highways, ensuring that the state's transportation infrastructure remains efficient and safe.

For example, the Georgia Department of Transportation might use Ad Valorem tax funds to reconstruct a stretch of highway that has become outdated or damaged over time, improving safety and reducing travel times for commuters.

Public Transportation and Transit Projects

Ad Valorem tax also plays a crucial role in funding public transportation initiatives. These funds contribute to the expansion and improvement of bus and rail systems, making public transit more accessible and efficient for Georgia's residents.

One notable project funded by Ad Valorem tax revenue is the expansion of the MARTA (Metropolitan Atlanta Rapid Transit Authority) system, which has seen the addition of new rail lines and bus routes, enhancing mobility across the Atlanta metropolitan area.

Economic Development and Job Creation

The revenue generated from Ad Valorem tax is not limited to transportation projects. A portion of these funds is allocated towards economic development initiatives, which aim to attract new businesses and create job opportunities for Georgians.

For instance, the Georgia Department of Economic Development might use Ad Valorem tax revenue to provide incentives to companies considering relocating to the state, offering tax breaks and infrastructure improvements to encourage economic growth.

Conclusion

Ad Valorem tax on vehicles in Georgia is a complex but essential component of the state's revenue system. It ensures that vehicle owners contribute proportionally to the state's finances based on the value of their vehicles, while also providing exemptions and relief for specific groups of taxpayers.

The tax plays a pivotal role in funding critical infrastructure projects, public transportation initiatives, and economic development efforts, ultimately benefiting all residents of Georgia. By understanding the intricacies of Ad Valorem tax, vehicle owners can appreciate the impact their tax contributions have on the state's development and growth.

When is Ad Valorem tax due in Georgia?

+Ad Valorem tax in Georgia is due annually, typically between January 1st and March 31st. However, the exact due date may vary slightly depending on the county where your vehicle is registered. It’s essential to check with your local tax commissioner’s office for the specific due date applicable to your county.

How can I estimate my Ad Valorem tax liability before receiving my bill?

+You can estimate your Ad Valorem tax liability by multiplying the assessed value of your vehicle by the applicable tax rate for your county. For example, if your vehicle has an assessed value of 30,000 and your county's tax rate is 1.6%, your estimated tax liability would be 480 ($30,000 x 1.6%).

Are there any penalties for late payment of Ad Valorem tax?

+Yes, late payment of Ad Valorem tax can result in penalties and interest charges. The specific penalties and interest rates may vary depending on your county and the duration of the late payment. It’s crucial to pay your Ad Valorem tax on time to avoid additional fees and potential legal consequences.

Can I appeal the assessed value of my vehicle if I believe it is inaccurate?

+Yes, if you believe the assessed value of your vehicle is incorrect, you have the right to appeal. The appeal process typically involves providing evidence, such as comparable vehicle sales data, to support your claim. The Georgia Department of Revenue will review your appeal and make a determination. If your appeal is successful, your assessed value and tax liability may be adjusted accordingly.

Are there any resources available to help me understand the Ad Valorem tax system in Georgia?

+Absolutely! The Georgia Department of Revenue provides a wealth of resources to help taxpayers understand the Ad Valorem tax system, including detailed guides, FAQs, and contact information for local tax offices. You can also consult with tax professionals or legal experts for personalized advice regarding your specific situation.