Inheritance Tax In Pa

Inheritance tax is a significant consideration for individuals and families in Pennsylvania, as it can impact the transfer of assets and the financial well-being of beneficiaries. Understanding the intricacies of inheritance tax in PA is crucial for effective estate planning and ensuring a smooth transition of wealth. This comprehensive guide will delve into the various aspects of inheritance tax in Pennsylvania, providing an in-depth analysis of the laws, rates, exemptions, and strategies to navigate this complex topic.

Inheritance Tax: A Brief Overview

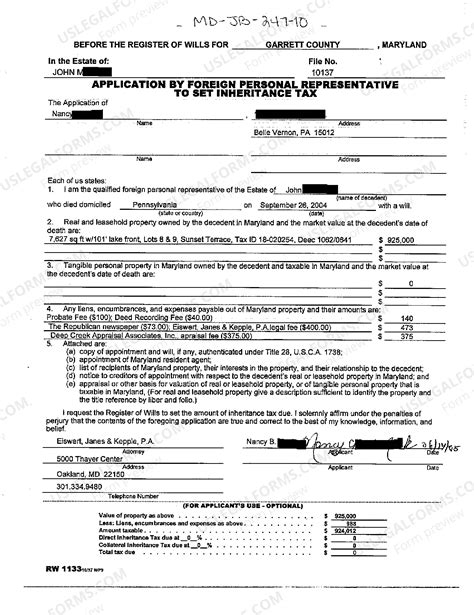

Inheritance tax, often referred to as a “death tax,” is a state-level levy imposed on the transfer of a deceased individual’s assets to their beneficiaries. It is distinct from estate tax, which is a federal tax levied on the value of a person’s estate before it is distributed to heirs. In Pennsylvania, inheritance tax is a crucial component of the state’s revenue stream, contributing to the funding of essential public services.

The Pennsylvania Inheritance Tax Act of 1919 established the framework for the state's inheritance tax system, and subsequent amendments and updates have refined the laws over the years. The tax is administered by the Pennsylvania Department of Revenue and is collected from beneficiaries who receive assets from the estate of a deceased individual.

Inheritance Tax Rates and Exemptions in PA

The inheritance tax rates in Pennsylvania are determined by the relationship between the deceased and the beneficiary. The state has implemented a progressive tax structure, with rates varying based on the degree of kinship. Here’s an overview of the current inheritance tax rates in Pennsylvania:

| Relationship to Deceased | Inheritance Tax Rate |

|---|---|

| Spouse or charity | 0% |

| Parent, grandparent, child, or legally adopted child | 4.5% |

| Siblings, half-siblings, step-siblings, nieces, nephews, aunts, uncles, great-grandparents, great-grandchildren, and in-laws | 12% |

| All other individuals and non-charitable organizations | 15% |

It's important to note that Pennsylvania does offer certain exemptions from inheritance tax. Spouses are entirely exempt, and charitable organizations are also exempt from paying inheritance tax on received assets. Additionally, there is a $3,500 exemption for all beneficiaries, regardless of their relationship to the deceased.

Exemptions for Agricultural and Business Real Estate

Pennsylvania has implemented specific exemptions for agricultural and business real estate. If the inherited property is used for agricultural purposes or is part of a business, the inheritance tax rate is reduced to 0% for qualifying assets. This exemption is designed to support the continuity of family farms and businesses and encourage economic stability in these sectors.

Filing and Payment Requirements

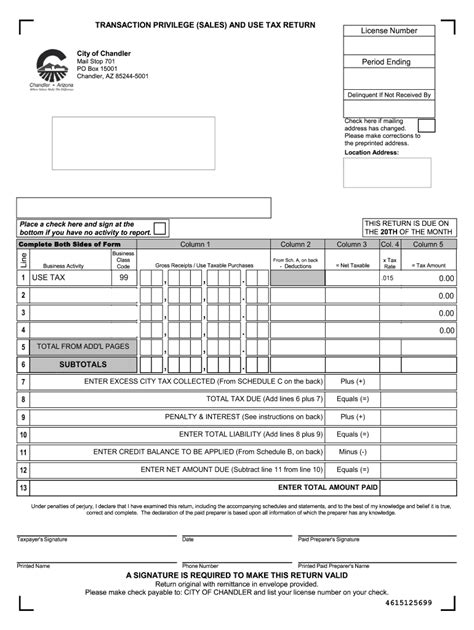

Executors or personal representatives of the estate are responsible for filing the Pennsylvania Inheritance Tax Return (Form Rev-1500) and paying the inheritance tax on behalf of the beneficiaries. The filing deadline is nine months from the date of death, with an automatic six-month extension available upon request. However, interest will accrue on any unpaid tax amounts beyond the initial nine-month period.

The tax is calculated based on the fair market value of the assets received by each beneficiary, as of the date of death. It's crucial to accurately assess the value of the assets to ensure compliance with the tax laws.

Payment Options

- Electronic Payment: The Pennsylvania Department of Revenue offers an online payment system for convenience. Taxpayers can make payments using a credit card, debit card, or electronic check.

- Mail-In Payment: Taxpayers can also mail a check or money order along with the completed Form Rev-1500 to the address provided on the form.

Strategies for Minimizing Inheritance Tax

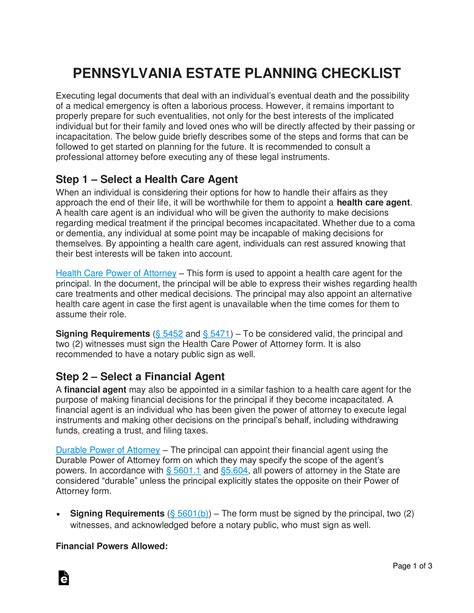

While inheritance tax is a mandatory obligation in Pennsylvania, there are strategies that individuals can employ to minimize the tax burden. These strategies often involve careful estate planning and leveraging legal tools to optimize the transfer of assets.

Utilizing the Marital Deduction

One of the most effective ways to reduce inheritance tax is by utilizing the marital deduction. In Pennsylvania, assets transferred from a deceased spouse to a surviving spouse are exempt from inheritance tax. This strategy ensures that the surviving spouse can inherit the full value of the estate without incurring any tax liability.

Gifting During Lifetime

Gifting assets during one’s lifetime is another strategy to reduce the value of the estate subject to inheritance tax. Pennsylvania allows individuals to make gifts of up to $500 per individual recipient annually without incurring gift tax. By strategically gifting assets, individuals can gradually reduce the value of their estate and potentially lower the overall inheritance tax liability.

Creating Trusts

Establishing trusts can provide flexibility and control over the distribution of assets. Trusts can be designed to minimize inheritance tax by specifying the beneficiaries and the terms under which they receive the assets. For example, a trust can be set up to distribute assets to beneficiaries over a period of years, potentially reducing the tax burden by spreading out the inheritance.

The Impact of Inheritance Tax on Estate Planning

Inheritance tax plays a significant role in shaping estate planning strategies for individuals and families in Pennsylvania. The tax implications can influence decisions regarding asset distribution, beneficiary selection, and the timing of wealth transfers. Effective estate planning involves a careful consideration of inheritance tax laws to ensure that the intended beneficiaries receive the maximum benefit from the estate.

Beneficiary Designation

The choice of beneficiaries is a critical aspect of estate planning. Understanding the inheritance tax rates for different relationships can guide individuals in selecting beneficiaries who will receive assets with the lowest tax burden. For example, transferring assets to children or grandchildren may result in a lower tax rate compared to distant relatives or non-relatives.

Timing of Wealth Transfers

The timing of wealth transfers can also impact the inheritance tax liability. By strategically timing the transfer of assets, individuals can take advantage of changing tax rates, exemptions, or even potential changes in the law. For instance, transferring assets before reaching a certain age threshold or before a significant life event can influence the tax rate applied to the inheritance.

Future Implications and Potential Changes

Inheritance tax laws are subject to change, and Pennsylvania’s inheritance tax system is no exception. While the current laws provide a stable framework for estate planning, there are ongoing discussions and proposals for reforms. Understanding the potential future implications of inheritance tax is crucial for long-term financial planning.

Proposed Reforms

There have been proposals to reform Pennsylvania’s inheritance tax system, including suggestions to simplify the tax structure, reduce rates, or even eliminate the tax altogether. These proposals often aim to make the tax system more equitable and aligned with modern estate planning practices. However, the implementation of such reforms remains uncertain, and it is essential to stay informed about any legislative developments.

The Impact of Federal Tax Changes

Changes at the federal level, such as modifications to estate tax laws or the introduction of new tax policies, can also influence Pennsylvania’s inheritance tax system. Federal tax reforms may impact the state’s revenue streams and, consequently, the structure and rates of inheritance tax. Staying updated on federal tax changes is crucial for effective long-term planning.

Conclusion: Navigating Inheritance Tax in PA

Inheritance tax in Pennsylvania is a complex topic that requires careful consideration and strategic planning. By understanding the rates, exemptions, and available strategies, individuals can optimize the transfer of their assets and minimize the tax burden on their beneficiaries. Effective estate planning, including the utilization of marital deductions, lifetime gifting, and trust creation, can significantly impact the financial well-being of loved ones.

As Pennsylvania's inheritance tax laws continue to evolve, staying informed about potential changes and their implications is essential. Regularly reviewing and updating estate plans to align with the latest tax regulations ensures that individuals can make informed decisions about their wealth and provide for their beneficiaries effectively.

What is the difference between inheritance tax and estate tax in Pennsylvania?

+Inheritance tax is a state-level tax levied on assets received by beneficiaries, while estate tax is a federal tax imposed on the value of an estate before it is distributed to heirs. Inheritance tax rates in PA vary based on the relationship to the deceased, whereas estate tax has a unified credit amount that applies to the entire estate.

Are there any ways to avoid inheritance tax in Pennsylvania completely?

+While it is challenging to completely avoid inheritance tax, there are strategies to minimize the tax burden. These include utilizing the marital deduction, making lifetime gifts, and establishing trusts. Additionally, certain assets, such as those used for agricultural or business purposes, may qualify for reduced tax rates or exemptions.

Can I reduce the inheritance tax by splitting assets among multiple beneficiaries?

+Splitting assets among multiple beneficiaries can potentially reduce the overall inheritance tax liability. By distributing assets to beneficiaries with lower tax rates, such as children or grandchildren, the average tax rate applied to the estate may decrease. However, it is essential to consider the impact on overall estate planning goals.

Are there any penalties for late payment of inheritance tax in PA?

+Yes, late payment of inheritance tax in Pennsylvania can result in penalties and interest charges. The state imposes a 6% interest rate on any unpaid tax amounts beyond the initial nine-month filing period. Additionally, failure to file the inheritance tax return on time may result in further penalties.