Is The Us Tax System Voluntary

The U.S. tax system is a complex and multifaceted structure that governs the financial obligations of individuals and businesses within the nation. Understanding the nature of this system, particularly the concept of voluntariness, is crucial for both taxpayers and those interested in the economic and legal frameworks of the country.

The Foundation of the U.S. Tax System

The U.S. tax system is rooted in a set of laws and regulations that define the responsibilities of taxpayers and the collection methods of the Internal Revenue Service (IRS). These laws, including the Internal Revenue Code (IRC), outline the types of income that are taxable, the rates at which they are taxed, and the methods by which taxpayers can report and pay their taxes.

The system operates on a self-assessment basis, meaning that individuals and businesses are required to calculate their own tax liabilities based on their income and other relevant factors. This process involves completing tax returns, which are then submitted to the IRS. The IRS, in turn, reviews these returns to ensure compliance and may audit taxpayers if discrepancies or errors are suspected.

Key Components of the U.S. Tax System

- Income Tax: The primary source of federal government revenue is the income tax, which is levied on individuals’ earnings, including wages, salaries, bonuses, and investment income. The tax rate varies based on income levels and filing status, with higher incomes subject to higher tax rates.

- Payroll Taxes: These taxes, including Social Security and Medicare taxes, are withheld from employees’ wages by their employers. These funds are then paid to the government, providing crucial support for social welfare programs.

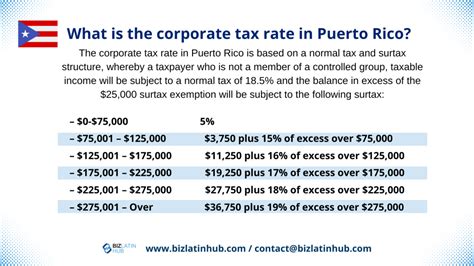

- Corporate Taxes: Businesses, whether corporations or partnerships, are subject to federal and often state and local taxes on their profits. The rates and regulations vary depending on the business structure and jurisdiction.

- Excise Taxes: These are taxes on specific goods and services, such as gasoline, alcohol, and tobacco products. Excise taxes are often used to regulate consumption or generate revenue for specific purposes, such as infrastructure development.

- Property Taxes: Property taxes are levied by local governments on real estate and personal property. These taxes are a significant source of revenue for local services, including schools, police, and fire departments.

The Concept of Voluntariness in the U.S. Tax System

The term “voluntary” in the context of the U.S. tax system can be misleading. While it is true that taxpayers have the responsibility to calculate and report their own tax liabilities, the system is not entirely voluntary in the sense that taxpayers have a choice whether to pay taxes or not.

The U.S. tax system is founded on the principle of "taxpayer compliance," which means that individuals and businesses are expected to follow the tax laws and pay the taxes they owe. Failure to comply can result in significant penalties, including fines, interest, and even criminal charges in cases of tax evasion.

Enforcement Mechanisms

The IRS has a range of enforcement mechanisms to ensure taxpayer compliance. These include:

- Tax Audits: The IRS may select certain taxpayers for audits to review their tax returns and ensure accuracy. Audits can be random or based on specific criteria, such as high income or complex transactions.

- Penalty Assessments: Taxpayers who underpay or fail to pay their taxes may be subject to penalties, which can include late payment penalties, accuracy-related penalties, and failure-to-file penalties.

- Collection Actions: If a taxpayer fails to pay a tax debt, the IRS may take collection actions, such as placing a levy on the taxpayer’s assets (e.g., bank accounts, wages) or filing a tax lien, which is a legal claim against the taxpayer’s property.

- Criminal Investigations: In cases of suspected tax fraud or evasion, the IRS Criminal Investigation division may launch an investigation, which can lead to criminal charges and imprisonment.

Voluntariness and Taxpayer Rights

While the U.S. tax system may not be entirely voluntary, taxpayers do have certain rights and protections. These include the right to privacy, the right to an appeal process, and the right to professional representation during tax matters. The IRS is also required to follow certain procedures and provide due process to taxpayers.

Additionally, the tax system offers a range of deductions, credits, and incentives to encourage certain behaviors or support specific industries. These can make the tax burden more manageable for taxpayers and promote economic growth and social welfare.

The Impact of Voluntariness on Taxpayer Behavior

The concept of voluntariness, or the lack thereof, in the U.S. tax system can significantly influence taxpayer behavior. For many individuals and businesses, the tax system is seen as a necessary burden, and compliance is viewed as a civic duty. However, the complexity of the tax code and the potential for non-compliance penalties can also lead to confusion, anxiety, and even intentional non-compliance.

To mitigate these issues, the IRS provides extensive guidance and resources, including tax forms, instructions, and publications. Taxpayers can also seek assistance from tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), who are authorized to represent taxpayers before the IRS.

The Role of Tax Professionals

Tax professionals play a crucial role in the U.S. tax system. They assist taxpayers in understanding the complex tax laws, preparing accurate tax returns, and ensuring compliance. They also provide strategic tax planning services to help individuals and businesses minimize their tax liabilities within the bounds of the law.

Tax professionals are governed by strict ethical standards and must adhere to professional codes of conduct. They are required to maintain their knowledge of the ever-changing tax laws and regulations to provide the best advice and representation to their clients.

The Future of the U.S. Tax System

The U.S. tax system is subject to ongoing debates and potential reforms. These discussions often center around issues such as tax fairness, simplicity, and the role of taxation in promoting economic growth and social equity.

Proposals for reform include simplifying the tax code, broadening the tax base, and shifting towards a more progressive tax system. Some advocates also suggest moving towards a consumption-based tax system, such as a value-added tax (VAT), which is common in many other countries.

The future of the U.S. tax system will likely be shaped by these debates, as well as economic and political factors. As the nation's economic landscape continues to evolve, so too will the tax system, striving to balance the needs of taxpayers, businesses, and the government.

| Tax Type | Description |

|---|---|

| Income Tax | Tax levied on individuals' earnings, with rates varying based on income and filing status. |

| Payroll Taxes | Withheld from employees' wages, supporting social welfare programs like Social Security and Medicare. |

| Corporate Taxes | Levied on business profits, with rates and regulations varying by business structure and jurisdiction. |

| Excise Taxes | Taxes on specific goods and services, often used to regulate consumption or fund specific projects. |

| Property Taxes | Levied by local governments on real estate and personal property, funding local services. |

What is the primary source of federal government revenue in the U.S.?

+The primary source of federal government revenue in the U.S. is the income tax, which is levied on individuals’ earnings.

How do payroll taxes support social welfare programs?

+Payroll taxes, such as Social Security and Medicare taxes, are withheld from employees’ wages and used to fund these vital social programs.

What are some of the enforcement mechanisms used by the IRS to ensure taxpayer compliance?

+The IRS uses various enforcement mechanisms, including tax audits, penalty assessments, collection actions, and criminal investigations.