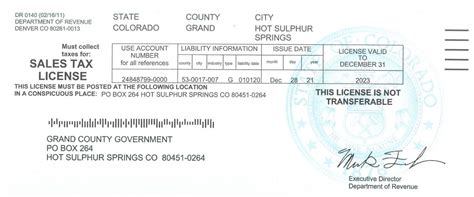

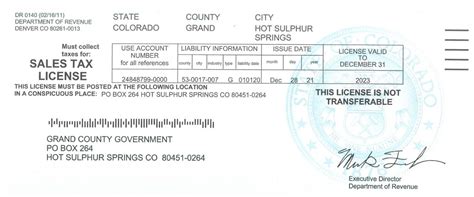

Colorado Sales Tax License

Colorado, the Centennial State, is known for its stunning natural beauty, diverse landscapes, and vibrant economy. For businesses operating within this state, understanding and complying with sales tax regulations is essential. Obtaining a Colorado Sales Tax License is a crucial step for any business looking to establish a presence in the state and ensure compliance with its tax laws.

The Colorado Sales Tax License, officially known as the Retailer's License, is issued by the Colorado Department of Revenue, specifically the Sales Tax Division. This license is a legal authorization for businesses to collect and remit sales tax on taxable goods and services sold within the state. It is a fundamental aspect of the state's tax system and plays a significant role in funding public services and infrastructure.

Understanding Colorado Sales Tax

Colorado imposes a sales and use tax on the sale of tangible personal property and certain services. The tax is collected by businesses at the point of sale and is then remitted to the state. The sales tax rate in Colorado is composed of a state-level tax and various local taxes, resulting in a combined rate that varies across the state.

As of my last update in January 2023, the state-level sales tax rate stands at 2.9%. However, when local taxes are included, the total sales tax rate can range from approximately 5.15% to 10.4%, depending on the location of the sale. This variation is due to the additional taxes levied by counties, cities, and special districts.

It's important to note that Colorado's sales tax laws can be complex, with certain exemptions, discounts, and special provisions for specific industries. These nuances can significantly impact a business's tax liability and compliance obligations.

Sales Tax Registration and Exemptions

Businesses with a physical presence in Colorado, such as a store, office, or warehouse, are generally required to register for a Retailer’s License. Additionally, businesses without a physical presence but engaging in taxable sales within the state, like remote sellers, may also be obligated to register and collect sales tax.

Certain entities, such as nonprofit organizations and government agencies, may be exempt from sales tax obligations. Additionally, specific goods and services, like prescription drugs and some agricultural products, are exempt from sales tax. However, it's crucial for businesses to carefully review the state's regulations to ensure they understand their obligations and potential exemptions.

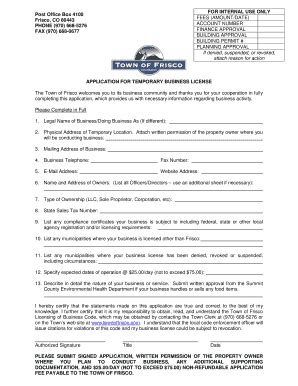

Applying for a Colorado Sales Tax License

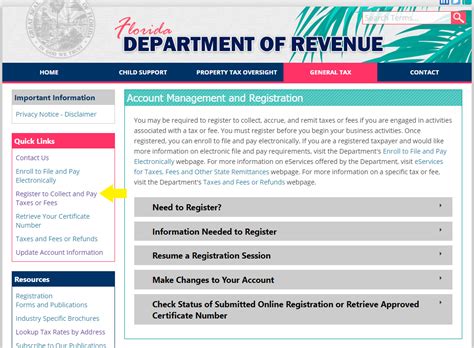

The process of obtaining a Colorado Sales Tax License is straightforward and can be completed online through the Colorado Department of Revenue’s website. The application process involves several steps, including providing business information, selecting the appropriate tax type, and choosing the desired registration method.

During the application, businesses will need to provide details such as the legal name and address of the business, the business's federal employer identification number (FEIN) or social security number (SSN), and the primary contact person's information. Additionally, businesses will need to specify whether they are registering as a sole proprietor, partnership, corporation, or another business structure.

Once the application is submitted, the Colorado Department of Revenue will review the information and issue the Retailer's License, typically within a few weeks. The license will include the business's unique taxpayer identification number (TIN), which is used for all future tax filings and correspondence with the state.

Registration Methods and Timelines

Colorado offers several registration methods, each with its own timeline. The standard registration method, suitable for most businesses, has a processing time of approximately 14 business days. However, businesses can opt for expedited registration, which costs an additional fee but reduces the processing time to 7 business days.

For businesses that require immediate authorization to begin collecting sales tax, the state offers a provisional registration option. This method allows businesses to begin collecting sales tax immediately while their application is being processed. Provisional registration is valid for 60 days and costs an additional fee.

| Registration Method | Processing Time |

|---|---|

| Standard Registration | 14 business days |

| Expedited Registration | 7 business days |

| Provisional Registration | Immediate (valid for 60 days) |

Sales Tax Compliance and Reporting

Once a business obtains its Colorado Sales Tax License, it is responsible for collecting and remitting sales tax on taxable transactions. The sales tax collected is then reported and paid to the state on a regular basis.

The frequency of sales tax reporting and payment depends on the business's estimated tax liability. Generally, businesses with higher tax liabilities are required to file more frequently. The filing frequencies can range from monthly, quarterly, or annually.

Colorado provides an online filing system, called Revenue Online, which allows businesses to register, file returns, and make payments electronically. This system offers a convenient and efficient way for businesses to manage their tax obligations.

Sales Tax Returns and Payment

When filing a sales tax return, businesses must report the total taxable sales and the amount of sales tax collected during the reporting period. The due date for filing and paying sales tax is typically the 20th day of the month following the end of the reporting period.

For example, if a business is filing a monthly return for January, the return and payment would be due on February 20th. Late filings and payments may incur penalties and interest charges.

It's important for businesses to maintain accurate records of their sales transactions and tax collections to ensure compliance with Colorado's sales tax regulations. Failure to comply with these regulations can result in significant penalties and legal consequences.

Sales Tax Resources and Support

The Colorado Department of Revenue provides a wealth of resources to assist businesses in understanding and complying with sales tax laws. These resources include detailed guides, webinars, workshops, and online tools to help businesses navigate the tax landscape.

Additionally, the department offers a taxpayer assistance program, which provides personalized support and guidance to businesses. Taxpayers can schedule appointments with tax specialists to discuss their specific situations and receive tailored advice.

For businesses looking for more comprehensive support, the state also offers a voluntary disclosure program. This program allows businesses to come forward and disclose any previously unreported or underreported tax obligations. By participating in this program, businesses can resolve their tax issues and avoid potential penalties.

Future Implications and Considerations

As the economic landscape continues to evolve, particularly in the wake of global events, businesses must remain vigilant in their tax compliance efforts. Colorado’s sales tax laws, like those in many other states, are subject to change and adaptation in response to economic conditions and legislative decisions.

Businesses should stay informed about any updates or changes to the sales tax regulations, especially those that may impact their industry or specific operations. This includes monitoring any new tax rates, exemptions, or reporting requirements that may be introduced.

Furthermore, as e-commerce continues to grow, businesses engaged in online sales should be aware of the potential for sales tax obligations in multiple states. The concept of economic nexus, which triggers a business's obligation to collect and remit sales tax in a state, has expanded due to recent legislation. This means that even businesses without a physical presence in a state may still have sales tax obligations there.

It's essential for businesses to stay updated on these evolving regulations to ensure they are meeting their tax obligations accurately and in a timely manner. Failure to do so can result in significant financial penalties and legal repercussions.

In conclusion, obtaining a Colorado Sales Tax License is a critical step for businesses operating within the state. It ensures compliance with the state's tax laws and contributes to the funding of essential public services. By understanding the application process, sales tax compliance, and available resources, businesses can navigate the tax landscape with confidence and minimize their tax-related risks.

What are the penalties for non-compliance with Colorado sales tax laws?

+Non-compliance with Colorado sales tax laws can result in penalties and interest charges. The state may impose penalties for late filings, underreporting of tax liabilities, or failure to collect and remit sales tax. These penalties can range from a percentage of the underpaid tax to a flat fee, depending on the nature and severity of the violation. It’s crucial for businesses to ensure compliance to avoid these penalties.

Are there any sales tax holidays in Colorado?

+Yes, Colorado occasionally holds sales tax holidays to encourage shopping and support certain industries. During these periods, specific items, such as school supplies or energy-efficient appliances, may be exempt from sales tax. These holidays are typically announced in advance and provide an opportunity for businesses and consumers to save on taxes.

How often do sales tax rates change in Colorado?

+Sales tax rates in Colorado can change periodically, often as a result of legislative decisions or voter-approved initiatives. The state-level sales tax rate has remained relatively stable, but local tax rates may fluctuate more frequently. It’s essential for businesses to stay informed about any changes to ensure they are collecting and remitting the correct tax rates.