Tax Act Discount Code

Tax season can be a daunting time for many individuals and businesses, often involving complex calculations, forms, and potential fees. However, with the right tools and strategies, navigating the tax landscape can become more manageable and even cost-effective. One such strategy is utilizing tax act discount codes, which can provide significant savings on tax preparation software and services. In this comprehensive guide, we delve into the world of Tax Act discount codes, exploring their benefits, how to find and use them effectively, and offering valuable insights to help you maximize your tax savings.

Understanding Tax Act Discount Codes

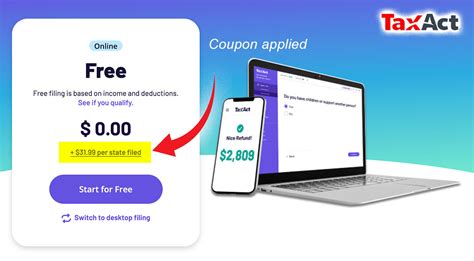

Tax Act discount codes are unique promotional codes offered by TaxAct, a leading provider of tax preparation software and services. These codes are designed to offer discounts on their range of products, making tax filing more affordable and accessible to a wider audience. TaxAct aims to empower individuals and businesses to take control of their taxes, offering user-friendly software and expert guidance at a reduced cost.

Benefits of Tax Act Discount Codes

Using Tax Act discount codes provides several key advantages:

- Cost Savings: Discount codes can significantly reduce the cost of tax preparation software, often by 20-50% or more, depending on the specific offer.

- Accessibility: With discounted rates, TaxAct becomes more accessible to those with limited budgets, ensuring that everyone has the opportunity to file their taxes accurately and on time.

- User-Friendly Experience: TaxAct’s software is renowned for its simplicity and ease of use. With discounted access, users can navigate the tax filing process with confidence and efficiency.

- Expert Support: TaxAct offers expert support and guidance, ensuring that users receive accurate information and assistance throughout the tax filing journey.

Types of Tax Act Discount Codes

Tax Act discount codes come in various forms, each catering to different user needs and preferences:

- Software Discounts: These codes offer reduced prices on TaxAct’s tax preparation software, providing significant savings on the cost of filing.

- Bundle Deals: Bundle deals combine tax preparation software with additional services, such as audit defense or identity theft protection, at a discounted rate.

- Premium Features: Some codes unlock premium features within TaxAct’s software, enhancing the user experience and providing advanced tools for complex tax scenarios.

- Referral Bonuses: Referral codes allow users to share discounts with friends and family, encouraging word-of-mouth promotion and potentially earning rewards for successful referrals.

Finding and Using Tax Act Discount Codes

To make the most of Tax Act discount codes, it’s essential to know where to find them and how to apply them effectively. Here’s a step-by-step guide:

Researching Discount Codes

Tax Act discount codes are often available through various online channels. Here are some reliable sources to explore:

- Official TaxAct Website: TaxAct occasionally offers promotional codes directly on their website, often as part of seasonal campaigns or limited-time offers. Check the homepage or dedicated promotions pages for the latest discounts.

- Partner Websites: TaxAct partners with various websites and platforms to offer exclusive discounts. These partners may include personal finance blogs, coupon sites, or tax-focused resources. Search for “Tax Act discount codes” or “TaxAct promo codes” on Google to discover these partnerships.

- Social Media: TaxAct’s official social media channels, such as Twitter and Facebook, often announce promotional campaigns and provide discount codes to their followers. Keep an eye on their pages during tax season for exclusive offers.

- Email Sign-Ups: Subscribing to TaxAct’s email newsletter can grant access to exclusive discounts and promotions. Sign up for their emails to receive the latest offers directly in your inbox.

Applying Discount Codes

Once you’ve found a valid Tax Act discount code, applying it is straightforward. Follow these steps:

- Visit the TaxAct website and select the tax preparation software or service you wish to purchase.

- Proceed to the checkout page and look for a dedicated field labeled “Discount Code” or “Promo Code.”

- Enter the discount code you’ve obtained and click “Apply” or “Submit.”

- The discount will be instantly applied to your order, reducing the total amount due.

- Complete the checkout process and enjoy your discounted tax preparation experience.

Maximizing Your Tax Savings

Tax Act discount codes are a great way to save on tax preparation, but there are additional strategies to further optimize your tax savings. Consider the following tips:

Filing Early

Filing your taxes early not only reduces stress but can also unlock additional savings. Many tax preparation services, including TaxAct, offer early bird discounts or promotional rates for those who file before a certain deadline.

Comparing Software Options

TaxAct offers various software options tailored to different user needs. Compare the features and pricing of their Basic, Deluxe, and Premier versions to choose the most suitable option for your tax situation. This ensures you’re not paying for unnecessary features while still accessing the tools you need.

Bundling Services

Consider bundling additional services with your tax preparation software. TaxAct offers bundles that include audit defense, identity theft protection, and more. By bundling, you can save on the cost of these services individually and gain peace of mind during tax season.

Taking Advantage of Referrals

TaxAct’s referral program allows you to earn discounts by referring friends and family. Share your unique referral code, and when they sign up for TaxAct services, you’ll receive a discount on your next purchase. It’s a win-win situation, as both you and your referral benefit from reduced costs.

Conclusion: Empowering Your Tax Journey

Tax Act discount codes are a powerful tool for individuals and businesses looking to streamline their tax preparation process while saving money. By understanding the benefits and knowing where to find these codes, you can make tax season more manageable and cost-effective. Remember to explore the various discount options, research early, and consider bundling services to maximize your savings.

With TaxAct's user-friendly software and expert support, coupled with the savings from discount codes, you can confidently navigate the tax landscape and ensure a smooth filing experience. Embrace the power of tax act discount codes and take control of your financial future.

FAQ

Can I use multiple discount codes at once?

+Unfortunately, TaxAct does not allow the use of multiple discount codes simultaneously. However, you can often stack a discount code with other promotions, such as early bird deals or referral bonuses, to maximize your savings.

Are Tax Act discount codes applicable to all TaxAct products?

+Discount codes are typically applicable to specific TaxAct products or services. Always read the terms and conditions of the code to ensure it aligns with the product or service you intend to purchase. Some codes may be restricted to certain software versions or have other limitations.

How long do Tax Act discount codes last?

+The validity period of Tax Act discount codes can vary. Some codes may be valid for a limited time, such as a specific tax season, while others may have no expiration date. It’s essential to check the terms and conditions or the expiration date listed with the code to ensure you use it within the valid timeframe.

Can I use a Tax Act discount code for multiple purchases?

+Most Tax Act discount codes are single-use and cannot be reused for multiple purchases. However, TaxAct may offer recurring promotions or seasonal campaigns where you can benefit from multiple discounts throughout the year. Keep an eye on their website and promotional channels for ongoing offers.