Glendale Ca Sales Tax

Welcome to the City of Glendale, a vibrant and thriving municipality located in the heart of the San Fernando Valley, California. In this comprehensive guide, we will delve into the intricacies of Glendale's sales tax, exploring its structure, rates, and the impact it has on the local economy. As an expert in municipal finances and local governance, I aim to provide you with an in-depth understanding of Glendale's sales tax landscape, ensuring you have all the information you need to navigate this critical aspect of the city's revenue stream.

Understanding Glendale’s Sales Tax Structure

Glendale’s sales tax system is a complex yet crucial component of the city’s financial framework. It serves as a primary source of revenue, funding essential public services and infrastructure projects. The sales tax in Glendale is levied on various goods and services, with rates determined by a combination of state, county, and city regulations.

The sales tax rate in Glendale is composed of several components. At the state level, California imposes a base sales tax rate of 7.25%, which applies uniformly across the state. However, Glendale, like many other cities in California, has the authority to impose additional local sales tax rates to meet specific revenue needs.

In Glendale's case, the city sales tax rate is set at 1.25%, bringing the total sales tax rate in the city to 8.50%. This rate is applicable to most goods and services purchased within Glendale's boundaries, including retail sales, restaurant meals, and certain services. The city's sales tax revenue is directed towards funding critical public services such as police and fire protection, public works projects, and community development initiatives.

Additionally, it's important to note that Glendale is situated within Los Angeles County, which also levies a county sales tax on top of the state and city rates. The current county sales tax rate in Glendale is 0.25%, increasing the total sales tax rate to 8.75% for certain transactions.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| City Sales Tax | 1.25% |

| County Sales Tax | 0.25% |

| Total Sales Tax Rate in Glendale | 8.75% |

Sales Tax Exemptions and Special Cases

While the majority of goods and services in Glendale are subject to the standard sales tax rate, there are certain exemptions and special cases to consider. These exemptions are governed by state and local laws and can significantly impact the overall tax liability for businesses and consumers.

One notable exemption is the sale of certain foods, which are exempt from sales tax in California. This includes unprepared food items, such as raw fruits and vegetables, uncooked meats, and other grocery staples. However, it's important to note that this exemption does not extend to restaurant meals or prepared foods, which are subject to the standard sales tax rate.

Another significant exemption applies to clothing and footwear. In California, clothing and footwear items priced under $100 are exempt from sales tax. This provides a substantial savings for consumers and can be a significant incentive for shoppers, particularly during sales events.

Furthermore, certain prescription medications and medical devices are exempt from sales tax, ensuring that healthcare-related purchases are not burdened by additional tax costs. This exemption is especially crucial for individuals with medical needs and can help reduce the financial burden associated with healthcare expenses.

It's essential to stay informed about these exemptions, as they can significantly impact your tax liability and purchasing decisions. Businesses operating in Glendale should ensure they are well-versed in the applicable sales tax laws to accurately collect and remit taxes, avoiding potential penalties and legal issues.

Impact of Sales Tax on Glendale’s Economy

Glendale’s sales tax plays a pivotal role in shaping the city’s economic landscape and development. The revenue generated from sales tax is a critical component of the city’s overall financial health, enabling it to invest in infrastructure, public services, and community initiatives.

One of the key benefits of a robust sales tax system is its ability to generate a stable revenue stream for the city. Unlike other forms of taxation, sales tax is relatively stable and less susceptible to economic downturns. This stability ensures that Glendale can continue to provide essential services and maintain its infrastructure even during challenging economic periods.

The sales tax revenue also empowers Glendale to invest in critical infrastructure projects, such as road improvements, public transportation, and utility upgrades. These investments not only enhance the quality of life for residents but also attract businesses and investors, fostering economic growth and development.

Furthermore, the sales tax revenue contributes to supporting public services, including education, public safety, and social programs. By funding these essential services, Glendale can ensure that its residents have access to quality education, efficient emergency response, and a robust social safety net.

In addition to these direct benefits, Glendale's sales tax also encourages economic activity within the city. By imposing a sales tax, Glendale incentivizes consumers to shop locally, supporting local businesses and generating additional revenue for the city. This, in turn, fosters a vibrant and thriving business community, creating jobs and stimulating economic growth.

Comparative Analysis: Glendale vs. Other California Cities

To gain a deeper understanding of Glendale’s sales tax landscape, it’s beneficial to compare it with other cities in California. While each city has its unique sales tax structure, certain trends and variations can provide valuable insights.

When compared to its neighboring cities in the San Fernando Valley, such as Burbank and Pasadena, Glendale's total sales tax rate of 8.75% is relatively competitive. Both Burbank and Pasadena have similar total sales tax rates, with Burbank at 8.75% and Pasadena at 9.25%. This indicates that Glendale's sales tax rate is well-aligned with the regional market, making it an attractive destination for both consumers and businesses.

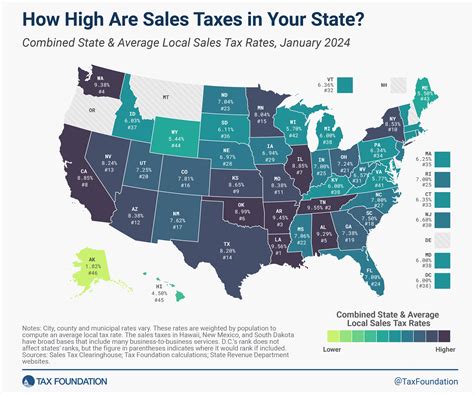

However, when considering cities throughout California, Glendale's sales tax rate is slightly higher than the statewide average. The state's average sales tax rate, including city and county taxes, is approximately 8.50%. This means that Glendale's rate is slightly above the state average, which can impact the competitiveness of its business environment.

Despite this, Glendale's sales tax structure remains an essential tool for generating revenue and supporting the city's economic development. The city's strategic use of sales tax revenue, combined with its vibrant business community and strong public services, makes it an attractive place to live, work, and invest.

Future Outlook and Implications

As we look ahead, the future of Glendale’s sales tax landscape is shaped by a combination of economic trends, legislative changes, and the evolving needs of the city. While sales tax remains a critical revenue source, there are several factors that could impact its structure and effectiveness in the years to come.

One of the key considerations is the potential for economic growth in Glendale. As the city continues to attract new businesses and residents, the demand for public services and infrastructure is likely to increase. This growth could lead to a corresponding increase in sales tax revenue, enabling the city to further invest in its community and enhance its economic vitality.

However, it's important to note that economic growth can also bring challenges. As Glendale becomes more prosperous, there may be calls for tax reform or adjustments to the sales tax structure to ensure fairness and equity. This could involve reevaluating the current rates, exploring alternative tax measures, or implementing targeted incentives to support specific industries or communities.

Additionally, the evolving nature of e-commerce and online sales presents unique challenges for sales tax collection. With more consumers shopping online, it becomes increasingly difficult to capture sales tax revenue from out-of-state or online retailers. Glendale, like many other cities, will need to adapt its tax collection methods and potentially explore new strategies to ensure a fair and equitable tax system for both local and online businesses.

Furthermore, the ongoing discussion around sales tax fairness at the state level could have significant implications for Glendale. Efforts to streamline and simplify the sales tax system, such as the proposed Marketplace Fairness Act, could impact the way sales tax is collected and distributed among cities. While these changes may bring benefits, they could also present challenges in terms of administrative burden and revenue distribution.

In conclusion, Glendale's sales tax system is a dynamic and critical component of the city's financial framework. It provides a stable revenue stream, supports essential public services, and encourages economic growth. As Glendale continues to thrive and evolve, its sales tax structure will play a pivotal role in shaping its future. By staying informed, adapting to changing economic conditions, and embracing innovative tax strategies, Glendale can ensure its sales tax remains a powerful tool for sustainable growth and development.

What is the sales tax rate in Glendale, CA as of 2023?

+The total sales tax rate in Glendale, CA as of 2023 is 8.75%, which includes the state, county, and city sales tax rates.

Are there any sales tax exemptions in Glendale, CA?

+Yes, there are certain exemptions and special cases in Glendale’s sales tax structure. Some notable exemptions include the sale of certain foods, clothing and footwear under $100, and prescription medications.

How does Glendale’s sales tax rate compare to other California cities?

+Glendale’s sales tax rate of 8.75% is relatively competitive when compared to its neighboring cities in the San Fernando Valley. However, it is slightly higher than the statewide average of approximately 8.50%.

What is the impact of sales tax on Glendale’s economy?

+Sales tax revenue plays a crucial role in Glendale’s economy by generating a stable revenue stream, funding infrastructure projects, supporting public services, and encouraging economic activity within the city.

How might sales tax in Glendale evolve in the future?

+The future of Glendale’s sales tax landscape will be shaped by economic growth, potential tax reforms, the evolution of e-commerce, and ongoing discussions around sales tax fairness at the state level. Glendale will need to adapt its tax strategies to stay competitive and equitable.