Tax Rate San Francisco Ca

Welcome to the comprehensive guide on the tax rates in San Francisco, California. This article aims to provide an in-depth analysis of the various taxes applicable in this vibrant city, offering valuable insights for residents, businesses, and anyone interested in understanding the financial landscape of San Francisco. With its thriving economy and diverse population, San Francisco's tax structure plays a crucial role in shaping the city's financial ecosystem.

Understanding the Tax Landscape in San Francisco

San Francisco, known for its cultural richness and technological innovation, is also a hub of economic activity. As such, the city imposes a range of taxes to support its development and infrastructure. From personal income taxes to business-specific levies, the tax landscape in San Francisco is diverse and intricate.

Personal Income Tax Rates

For individuals residing in San Francisco, personal income tax is a significant consideration. The city’s income tax rates are determined by the California Franchise Tax Board (FTB) and are based on a progressive scale. Here’s a breakdown of the current personal income tax rates applicable in San Francisco:

- For taxable income up to 9,375, the tax rate is 1%.</li> <li>Income between 9,376 and 23,437 is taxed at 2%.</li> <li>Income ranging from 23,438 to 36,656 is subject to a 4% tax rate.</li> <li>For earnings between 36,657 and 59,999, the tax rate increases to 6%.</li> <li>Income over 60,000 is taxed at 9.3%.

It’s important to note that these rates are in addition to the federal income tax rates and may be subject to adjustments based on various factors, including deductions and credits.

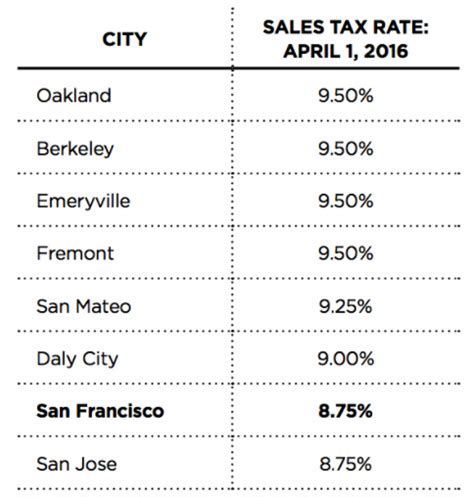

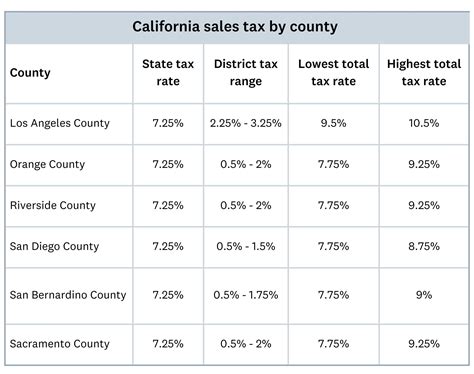

Sales and Use Taxes

Sales and use taxes are another significant aspect of San Francisco’s tax landscape. These taxes are imposed on the sale of goods and services and are collected by businesses from their customers. The current sales and use tax rate in San Francisco is 8.5%, which includes both the state and local tax components.

The breakdown of the sales tax rate is as follows:

| Tax Type | Rate |

|---|---|

| State Sales Tax | 7.25% |

| City and County Tax | 1.25% |

Businesses operating in San Francisco are responsible for collecting and remitting these taxes to the appropriate tax authorities.

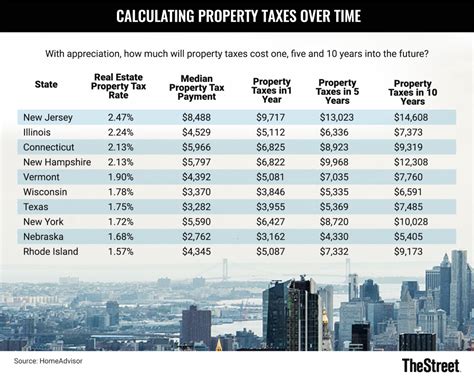

Property Taxes

Property taxes in San Francisco are levied on real estate and certain personal property assets. The tax rate is determined by the assessed value of the property and is used to fund local government services and infrastructure projects. Here’s an overview of the property tax rates in San Francisco:

- The base property tax rate is set at 1.1734% of the assessed value.

- Additionally, there are various special taxes and assessments that may apply, depending on the location and nature of the property.

- These special taxes can include measures like Proposition 13, which limits property tax increases to 2% annually.

Business Taxes and Fees

San Francisco imposes a range of taxes and fees on businesses operating within its boundaries. These taxes contribute to the city’s revenue and help support local initiatives and services. Here are some key business taxes and fees to be aware of:

- Gross Receipts Tax: This tax is levied on businesses based on their gross receipts within San Francisco. The rate varies depending on the industry and can range from 0.5% to 1.5%.

- Business Registration Fee: All businesses operating in San Francisco are required to register and pay an annual fee. The fee amount depends on the type of business and its gross receipts.

- Hotel Tax: For hotels and short-term accommodations, a transient occupancy tax is applied, which is currently set at 18% of the rent or charges for the occupancy.

- Entertainment Tax: Certain entertainment and amusement businesses are subject to a tax, with rates varying based on the specific activity and location.

Other Relevant Taxes

In addition to the taxes mentioned above, San Francisco residents and businesses may also be subject to other taxes, such as:

- Vehicle License Fee: This fee is imposed on vehicles registered in San Francisco and is based on the vehicle’s value.

- Transfer Tax: A tax is applied to the transfer of real property within San Francisco, typically paid by the seller.

- Marijuana Tax: With the legalization of recreational marijuana, San Francisco imposes taxes on the cultivation, distribution, and sale of cannabis products.

Compliance and Reporting Requirements

Navigating the tax landscape in San Francisco requires compliance with various reporting and payment obligations. Here are some key considerations:

- Personal income tax returns must be filed annually, typically by April 15th, with the California Franchise Tax Board.

- Businesses are required to register with the appropriate tax authorities and obtain necessary permits and licenses.

- Sales and use tax returns must be filed regularly, and businesses must remit the collected taxes to the state.

- Property tax payments are due annually, and homeowners or property owners should receive tax bills from the county.

- Businesses should carefully monitor and comply with the specific tax requirements for their industry and business type.

The Impact of Taxes on the San Francisco Economy

Taxes play a pivotal role in shaping the economic landscape of San Francisco. The revenue generated from these taxes funds essential services, infrastructure development, and social programs that benefit the city’s residents and businesses. Here’s a closer look at the impact of taxes on the San Francisco economy:

Infrastructure Development

Tax revenues are a significant source of funding for infrastructure projects in San Francisco. These projects include transportation improvements, such as road repairs and public transit upgrades, as well as the development of parks, recreational facilities, and public spaces. By investing in infrastructure, San Francisco aims to enhance the quality of life for its residents and attract businesses and tourists.

Social Programs and Services

Taxes support a wide range of social programs and services that address the needs of San Francisco’s diverse population. These programs include healthcare initiatives, education funding, affordable housing programs, and support for vulnerable communities. The city’s commitment to social welfare is a key aspect of its identity and is made possible through the collection of taxes.

Economic Growth and Business Development

While taxes are an obligation, they also contribute to the city’s economic growth and business development. The taxes paid by businesses and individuals fund initiatives that promote economic vitality, such as business incentive programs, startup support, and job creation efforts. By investing in these areas, San Francisco fosters a business-friendly environment, attracting new enterprises and fostering innovation.

Balancing Act: Tax Policy and Economic Sustainability

San Francisco’s tax policies must strike a delicate balance between generating sufficient revenue for essential services and maintaining a competitive business environment. The city’s leadership and tax authorities continuously evaluate tax rates and structures to ensure they are fair, sustainable, and aligned with the city’s economic goals.

This balance is particularly crucial in a city like San Francisco, known for its high cost of living and vibrant business ecosystem. By carefully managing tax policies, the city aims to attract and retain businesses while also providing the necessary funding for its social and infrastructure development initiatives.

Conclusion: A Complex, Yet Vital, Tax Landscape

San Francisco’s tax landscape is intricate and multifaceted, reflecting the city’s dynamic economy and diverse population. From personal income taxes to business-specific levies, each tax component plays a crucial role in shaping the city’s financial health and its ability to provide essential services.

As San Francisco continues to thrive and evolve, its tax structure will remain a critical aspect of its economic sustainability and social welfare. By understanding and navigating this complex tax landscape, residents and businesses can contribute to the city’s growth and success while also ensuring compliance with the relevant tax obligations.

How often do personal income tax rates change in San Francisco?

+Personal income tax rates in San Francisco are typically adjusted annually, often in line with changes at the state level. These adjustments may be influenced by economic factors, budget requirements, and legislative decisions.

Are there any tax incentives or credits available for businesses in San Francisco?

+Yes, San Francisco offers various tax incentives and credits to support business growth and development. These can include tax breaks for specific industries, job creation incentives, and programs aimed at supporting small businesses and startups.

How can I stay updated on tax changes and compliance requirements in San Francisco?

+To stay informed, it’s recommended to regularly check the official websites of the California Franchise Tax Board and the San Francisco Office of the Treasurer and Tax Collector. These sources provide the latest updates on tax rates, deadlines, and compliance guidelines.

What happens if I fail to comply with San Francisco’s tax obligations?

+Non-compliance with San Francisco’s tax obligations can result in penalties, interest charges, and potential legal consequences. It’s crucial to understand and meet your tax obligations to avoid these issues and maintain a good standing with the tax authorities.

Are there any tax relief programs available for low-income individuals in San Francisco?

+Yes, San Francisco offers tax relief programs and assistance for low-income individuals and families. These programs aim to reduce the tax burden for those facing financial challenges and can include property tax relief, earned income tax credits, and other support initiatives.