Sunnyvale Sales Tax

Sunnyvale, nestled in the heart of Silicon Valley, California, is a bustling city renowned for its thriving tech industry and vibrant culture. While the city's reputation often revolves around its technological advancements, it's essential to delve into the practical aspects of daily life, including the matter of sales tax. Understanding the intricacies of sales tax in Sunnyvale is not only beneficial for residents but also for businesses and visitors alike, as it provides insight into the economic landscape and consumer experiences within this dynamic city.

Unraveling the Sunnyvale Sales Tax

Sunnyvale, like many other cities in California, imposes a sales tax that applies to a wide range of goods and services. This tax is a vital component of the city’s revenue stream, contributing significantly to the funding of essential public services and infrastructure development. The sales tax rate in Sunnyvale is subject to various factors, including state, county, and city regulations, making it a complex yet crucial element of the local economy.

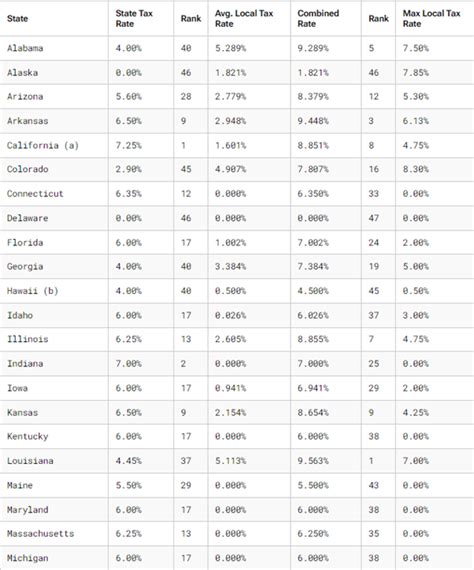

The current sales tax rate in Sunnyvale is 9.25%, which is comprised of a combination of state, county, and city taxes. This rate is relatively higher compared to the national average, reflecting the unique fiscal needs and initiatives of the city and its surrounding regions. The breakdown of this rate provides an insightful look into the distribution of tax revenue, with each percentage point serving a specific purpose in supporting the community.

| Tax Type | Rate |

|---|---|

| California State Sales Tax | 7.25% |

| Santa Clara County Tax | 0.75% |

| Sunnyvale City Tax | 1.25% |

The state sales tax, at 7.25%, is a standard rate applicable across California. This tax contributes to the state's general fund, which is utilized for a variety of public services and infrastructure projects statewide. The county tax, specific to Santa Clara County, supports local initiatives and community programs unique to the county's needs.

The city tax, set at 1.25%, is perhaps the most notable component for Sunnyvale residents and businesses. This tax directly benefits the city's operations, funding critical services such as public safety, education, and local infrastructure maintenance. It's an essential revenue stream that allows Sunnyvale to thrive and maintain its high quality of life.

Impact on Businesses and Consumers

The sales tax rate in Sunnyvale has a significant influence on both businesses and consumers. For businesses, especially those operating within the tech industry, the tax rate can impact pricing strategies and overall profitability. It is a crucial consideration when formulating business plans and financial projections, especially for startups and small businesses that are sensitive to such economic factors.

For consumers, the sales tax is a tangible reminder of the cost of living in Sunnyvale. While the city boasts a vibrant economy and numerous advantages, the higher sales tax rate can affect purchasing decisions and overall spending habits. Understanding the tax rate can empower consumers to make more informed choices, whether it's negotiating deals or exploring tax-free alternatives.

Exemptions and Special Considerations

Despite the comprehensive nature of the sales tax, certain goods and services are exempt or subject to special considerations. These exemptions can provide significant savings for consumers and businesses alike, making it essential to understand the specific rules and regulations surrounding them.

For instance, many states, including California, exempt certain food items from sales tax. In Sunnyvale, this exemption extends to unprepared food products, such as produce, grains, and dairy, encouraging healthier eating habits and supporting local farmers and grocery stores. Additionally, certain medical devices and supplies are often exempt, providing relief to those with specific health needs.

Furthermore, online retailers and remote sellers face unique challenges in complying with sales tax regulations. The laws surrounding online sales tax are complex and ever-evolving, with many states, including California, implementing specific rules for online transactions. Sunnyvale businesses engaging in e-commerce must stay abreast of these regulations to ensure compliance and avoid penalties.

The Future of Sales Tax in Sunnyvale

As Sunnyvale continues to evolve and adapt to changing economic landscapes, the sales tax rate and its distribution are likely to undergo periodic reviews and adjustments. These changes are often driven by shifts in state and local policies, economic conditions, and community needs. Keeping abreast of these changes is crucial for businesses and residents alike, ensuring they remain compliant and can plan effectively for the future.

One potential area of change is the increasing emphasis on online sales and the associated tax obligations. With the growth of e-commerce, many states, including California, are exploring ways to streamline and enforce online sales tax collection. This could impact the way Sunnyvale businesses operate and their tax liabilities, especially for those with a significant online presence.

Additionally, the ongoing conversation surrounding tax fairness and revenue distribution is likely to influence future sales tax policies. As communities advocate for more equitable tax structures, the distribution of tax revenue among state, county, and city entities may undergo changes, potentially impacting the current sales tax rate in Sunnyvale. Staying informed about these discussions and their potential outcomes is vital for all stakeholders.

What is the sales tax rate in Sunnyvale, California?

+The current sales tax rate in Sunnyvale is 9.25%, which includes the California state sales tax (7.25%), Santa Clara County tax (0.75%), and Sunnyvale city tax (1.25%).

Are there any exemptions or special considerations for sales tax in Sunnyvale?

+Yes, certain food items, such as unprepared groceries, and medical devices are exempt from sales tax. Online retailers and remote sellers also face specific regulations and may need to collect and remit sales tax differently.

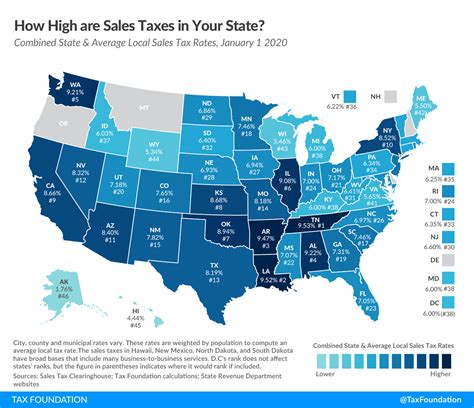

How does the sales tax rate in Sunnyvale compare to other cities in California?

+The sales tax rate in Sunnyvale is relatively higher compared to the state average. While the state sales tax is a standard 7.25%, county and city taxes can vary, resulting in a higher combined rate in Sunnyvale.

What are the potential future changes to the sales tax rate in Sunnyvale?

+Future changes to the sales tax rate may be driven by shifts in state and local policies, economic conditions, and community needs. There is an ongoing discussion about tax fairness and revenue distribution, which could impact the distribution of sales tax revenue among state, county, and city entities.