Pbc Tax Collector

The Property Appraiser's office and the Tax Collector's office are two integral parts of the local government system, often working closely together to ensure efficient and accurate property taxation processes. In this comprehensive article, we delve into the workings of the Tax Collector's office, specifically focusing on the role of the Pbc Tax Collector and how they contribute to the financial ecosystem of their region.

Understanding the Role of the Pbc Tax Collector

The Pbc Tax Collector, an elected official, plays a pivotal role in the administration of taxes within their jurisdiction. Their primary responsibility is to collect taxes efficiently and fairly, ensuring that the revenue generated is directed towards essential public services and infrastructure development.

The Tax Collector's office in Palm Beach County, Florida, known as the Pbc Tax Collector, is a prime example of how these officials can impact their communities. This office is responsible for a range of financial services, from vehicle registration and titling to collecting taxes on real and personal property.

Key Responsibilities of the Pbc Tax Collector

The responsibilities of the Pbc Tax Collector are multifaceted and encompass a wide range of financial and administrative duties. Here’s a breakdown of their key roles:

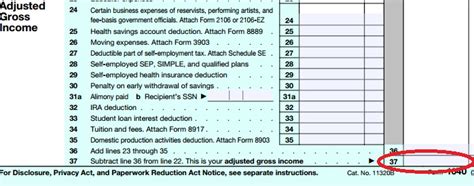

- Property Tax Collection: One of the primary functions is to assess and collect property taxes. This involves evaluating the value of properties, issuing tax notices, and ensuring timely payments from property owners.

- Vehicle Registration and Titling: The Tax Collector's office is often responsible for registering and titling vehicles. This includes issuing license plates, processing title transfers, and collecting registration fees.

- Business Tax Collection: For businesses operating within their jurisdiction, the Pbc Tax Collector collects business taxes, ensuring that businesses contribute their fair share to the local economy.

- Delinquent Tax Enforcement: In cases of non-payment or late payments, the Tax Collector's office has the authority to enforce payment through legal means, such as liens and tax warrants.

- Public Outreach and Education: An essential part of their role is to educate the public about tax obligations, due dates, and payment methods. This includes providing resources and assistance to taxpayers.

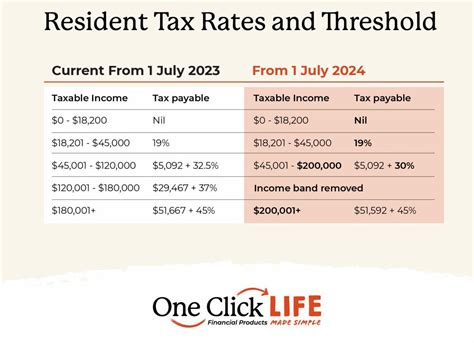

The Impact of Effective Tax Collection

Efficient tax collection by the Pbc Tax Collector has a significant impact on the local community and economy. Timely and accurate tax collection ensures that public services, such as schools, emergency services, and infrastructure projects, are adequately funded. It also fosters a sense of trust and transparency between taxpayers and the local government.

| Tax Type | Revenue Collected (in $ millions) |

|---|---|

| Property Taxes | 560 |

| Vehicle Registration Fees | 32 |

| Business Taxes | 28 |

| Other Fees and Fines | 12 |

As the table above illustrates, the Pbc Tax Collector plays a crucial role in generating revenue for the local government. Effective tax collection not only ensures the financial stability of the region but also empowers the government to invest in community development and public services.

Innovations and Technology in Tax Collection

In today’s digital age, the Pbc Tax Collector, like many other tax authorities, has embraced technological advancements to streamline tax collection processes. Here’s how technology is transforming their operations:

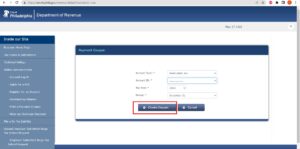

Online Tax Payment Portals

The introduction of secure online payment portals has revolutionized tax payment processes. Taxpayers can now access their tax information, view outstanding balances, and make payments conveniently from their homes or offices. This not only saves time but also reduces the need for in-person visits to the Tax Collector’s office.

Digital Record-Keeping and Data Management

Advanced data management systems have enabled the Pbc Tax Collector to maintain accurate and up-to-date records. This includes digital property records, vehicle registration data, and tax payment histories. Efficient data management not only improves operational efficiency but also enhances transparency and accountability.

Automated Tax Assessment and Collection

With the help of sophisticated software, the Tax Collector’s office can now automate many tax assessment and collection processes. This includes sending out tax notices, calculating tax amounts, and tracking payments. Automation reduces the risk of human error and ensures a more consistent and fair taxation system.

Mobile Apps and Digital Services

To further enhance taxpayer convenience, the Pbc Tax Collector has developed mobile apps and digital services. These tools allow taxpayers to access their accounts, receive notifications, and even pay taxes using their smartphones. This level of accessibility and convenience is especially beneficial for busy professionals and those who prefer digital interactions.

Community Engagement and Taxpayer Assistance

While technology plays a crucial role in modern tax collection, the Pbc Tax Collector also understands the importance of community engagement and taxpayer assistance. Here’s how they ensure a supportive and accessible tax environment:

Public Outreach Programs

The Tax Collector’s office actively participates in community events and organizes outreach programs to educate taxpayers about their rights and responsibilities. These initiatives aim to demystify the tax process, address common concerns, and build trust between the government and taxpayers.

Taxpayer Assistance Centers

Physical taxpayer assistance centers provide a vital service to those who prefer in-person interactions. These centers offer personalized assistance, answer queries, and guide taxpayers through complex tax processes. The Pbc Tax Collector ensures that these centers are easily accessible and well-staffed to cater to the diverse needs of the community.

Online Resources and Guides

Recognizing that not all taxpayers have access to physical assistance centers, the Pbc Tax Collector maintains an extensive online resource library. This includes step-by-step guides, frequently asked questions, and informative articles. These resources empower taxpayers to navigate the tax system independently and make informed decisions.

The Future of Tax Collection: Trends and Predictions

As we look towards the future, several trends and developments are expected to shape the role of the Pbc Tax Collector and the tax collection landscape in general.

Increased Emphasis on Cybersecurity

With the growing sophistication of cyber threats, tax authorities like the Pbc Tax Collector will need to prioritize cybersecurity measures. This includes investing in robust data protection systems, regularly updating security protocols, and educating both staff and taxpayers about potential risks.

Adoption of Blockchain Technology

Blockchain technology, known for its security and transparency, is gaining traction in various industries, including tax collection. The Pbc Tax Collector may explore the use of blockchain to enhance data security, streamline tax processes, and improve transparency in tax transactions.

Integration of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) have the potential to revolutionize tax collection. These technologies can be used for predictive analytics, fraud detection, and personalized taxpayer assistance. The Pbc Tax Collector may leverage AI to improve operational efficiency and enhance taxpayer experiences.

Expansion of Digital Payment Options

To cater to the evolving preferences of taxpayers, the Pbc Tax Collector may expand their digital payment options. This could include integrating with popular digital wallets, allowing for seamless and secure tax payments using cryptocurrencies, or even exploring the use of contactless payment methods.

Conclusion: A Vision for the Future

The role of the Pbc Tax Collector is evolving rapidly, driven by technological advancements and changing taxpayer expectations. By embracing innovations, prioritizing community engagement, and staying ahead of emerging trends, the Tax Collector’s office can continue to serve as a vital pillar of the local government, ensuring a fair, efficient, and transparent tax system.

As we move forward, the Pbc Tax Collector will play an increasingly strategic role in shaping the financial health and development of their community. Their commitment to excellence, innovation, and taxpayer support will be key to their success and the prosperity of the region they serve.

How can I contact the Pbc Tax Collector’s office?

+You can reach out to the Pbc Tax Collector’s office through their official website, where you’ll find contact information and a range of online services. They also have physical locations where you can visit for assistance.

What are the tax due dates in Palm Beach County?

+Property taxes are typically due in November, with a discount period offered until early April. Business taxes have their own due dates, which you can find on the Tax Collector’s website.

Can I pay my taxes online through the Pbc Tax Collector’s website?

+Yes, the Pbc Tax Collector’s website offers a secure online payment portal. You can pay your property taxes, vehicle registration fees, and other taxes and fees conveniently online.

What happens if I miss the tax payment deadline?

+If you miss the tax payment deadline, you may be subject to late fees and interest charges. The Pbc Tax Collector’s office will send out notices and reminders, and in cases of non-payment, they have the authority to take legal action, such as placing a lien on your property.

How can I get assistance if I have complex tax issues or queries?

+The Pbc Tax Collector’s office offers various forms of assistance. You can visit their taxpayer assistance centers, contact them via phone or email, or even schedule an appointment for personalized help. Additionally, their website provides extensive resources and guides to address common tax-related queries.