How To Find Agi On Tax Return

The Adjusted Gross Income (AGI) is a crucial metric on your tax return, as it serves as the foundation for calculating your tax liability and determining your eligibility for various tax credits and deductions. In this comprehensive guide, we will explore the steps to find your AGI on different types of tax returns, offering expert insights and practical examples to ensure you can easily identify and understand this critical income measure.

Understanding Adjusted Gross Income (AGI)

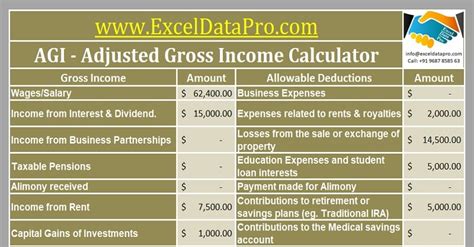

AGI is the total income you earn in a year, adjusted by specific deductions and expenses. It provides a clearer picture of your financial situation and is used as a benchmark for many tax calculations and benefits. Here’s a breakdown of its importance and how it impacts your tax return.

Definition and Calculation

AGI is calculated by starting with your total income, which includes wages, salaries, tips, dividends, interest, and other forms of earnings. From this, you subtract above-the-line deductions, such as contributions to traditional IRAs, student loan interest, and certain business expenses. The result is your AGI.

| Total Income | Above-the-Line Deductions | Adjusted Gross Income |

|---|---|---|

| $60,000 | $5,000 | $55,000 |

In this example, the taxpayer has a total income of $60,000 and qualifies for $5,000 in above-the-line deductions, resulting in an AGI of $55,000.

Impact on Tax Calculations

AGI is a pivotal factor in determining your tax bracket and the amount of tax you owe. The IRS uses AGI to calculate your taxable income, which is then subjected to the appropriate tax rate. A lower AGI can result in a lower tax burden, as it may push you into a lower tax bracket or qualify you for additional tax credits and deductions.

Locating AGI on Different Tax Returns

The location of your AGI on your tax return can vary depending on the type of return you file. Here’s a detailed breakdown for the most common tax forms.

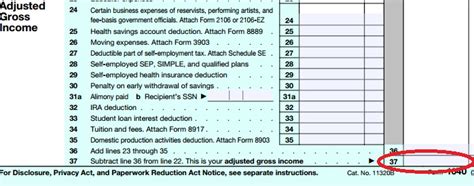

Form 1040 (Individual Income Tax Return)

For most taxpayers, the primary form for filing taxes is the Form 1040. The AGI is prominently displayed on this form, typically found in the Income section. Here’s a step-by-step guide to locating it.

- Start by downloading or obtaining a copy of your Form 1040.

- Locate the Income section, which is usually at the top of the form.

- Look for the line labeled "Adjusted Gross Income (AGI)" or a similar designation. It is often situated near the top of the Income section.

- The AGI will be a numerical value, representing your total adjusted income for the tax year.

For instance, if you're using the Form 1040 for 2022, you'll find the AGI on line 11 of the Income section.

Form 1040-NR (U.S. Nonresident Alien Income Tax Return)

If you are a nonresident alien, you’ll use the Form 1040-NR to file your taxes. The process for finding your AGI is similar to the standard Form 1040.

- Obtain a copy of your Form 1040-NR.

- Navigate to the Income section of the form.

- Locate the line labeled "Adjusted Gross Income (AGI)" or a similar phrase. It is typically positioned near the beginning of the Income section.

- Your AGI will be displayed as a numerical value, representing your adjusted income as a nonresident alien.

On the Form 1040-NR for 2022, the AGI is found on line 28 of the Income section.

Form 1040-X (Amended U.S. Individual Income Tax Return)

In the event that you need to amend your tax return, you’ll use the Form 1040-X. The AGI on this form is used to reconcile your original return with the amended version.

- Obtain a copy of your Form 1040-X and ensure you have the original Form 1040 for comparison.

- Locate the Explanation of Changes section on the Form 1040-X.

- Within this section, you'll find a line labeled "Adjusted Gross Income (AGI) on Original Return" and another for "Adjusted Gross Income (AGI) on Amended Return".

- Compare the AGI values between the original and amended returns to understand the impact of your amendments.

Other Tax Forms

Depending on your income sources and tax situation, you may need to file additional tax forms. Here’s a brief overview of AGI on some common supplemental forms.

- Schedule C (Profit or Loss from Business): AGI is calculated by subtracting business expenses from your business income. It's used to determine your business's net income, which is then added to your other income sources to calculate your total AGI.

- Schedule E (Supplemental Income and Loss): This form is used for rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, or other passive activity income. AGI is calculated by combining the net income from these sources with your other income.

- Schedule F (Profit or Loss from Farming): Similar to Schedule C, AGI is calculated by subtracting farming expenses from your farming income. The net farming income is then added to your other income sources to determine your total AGI.

AGI and Tax Credits

AGI is a critical factor in determining your eligibility for various tax credits. Here are some key tax credits where AGI plays a significant role.

Child Tax Credit

The Child Tax Credit provides a credit of up to $2,000 per qualifying child. AGI is used to determine the amount of the credit you’re eligible for. Generally, the higher your AGI, the lower the credit amount.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit is a refundable credit for low- to moderate-income working individuals and families. AGI is a key factor in determining eligibility and the amount of the credit. The IRS sets AGI limits for different filing statuses and family sizes.

Savings Incentive Match Plan for Employees (SIMPLE) IRA

The SIMPLE IRA is a retirement savings plan for small businesses and their employees. To qualify for the plan, your AGI must be below certain thresholds set by the IRS. The AGI limits vary based on your filing status.

FAQs

What if I can’t find my AGI on my tax return?

+

If you’re unable to locate your AGI on your tax return, it’s essential to review the form thoroughly, ensuring you’re examining the correct section. If you’re still unable to find it, consider seeking assistance from a tax professional or using tax software to calculate your AGI based on your income and deductions.

Can my AGI change after filing my tax return?

+

Yes, your AGI can change after filing if you amend your tax return or if there are adjustments made by the IRS. Amendments are typically made to correct errors or include additional income or deductions. The IRS may also make adjustments based on information they receive from third parties, such as employers or financial institutions.

How does AGI affect my tax refund or amount owed?

+

AGI plays a significant role in determining your tax refund or the amount you owe. A lower AGI can result in a larger refund or a smaller amount owed, as it may reduce your taxable income and increase your eligibility for certain tax credits and deductions. Conversely, a higher AGI can lead to a smaller refund or a larger amount owed.

Are there any disadvantages to having a lower AGI?

+

While a lower AGI can be beneficial for tax purposes, it may have some drawbacks. For instance, a lower AGI can impact your eligibility for certain retirement savings plans, such as the SIMPLE IRA. Additionally, some financial aid programs and government benefits may have income limits based on AGI, so a lower AGI could affect your eligibility for these programs.