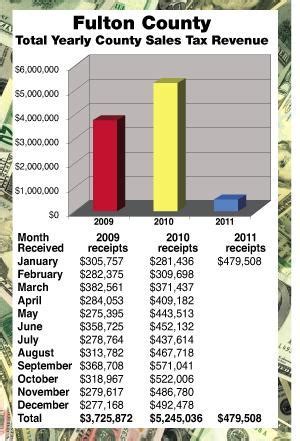

Atlanta Fulton County Sales Tax

Welcome to the comprehensive guide on the Atlanta Fulton County Sales Tax, an essential aspect of understanding the local economy and its impact on businesses and residents alike. This article aims to delve deep into the intricacies of this tax, offering a thorough analysis and insights for those seeking to navigate the financial landscape of this vibrant city.

Understanding the Atlanta Fulton County Sales Tax

The sales tax levied in Atlanta, Fulton County, is a vital revenue source for the local government, funding various public services and infrastructure projects. It is a consumption tax, applied to the sale of goods and certain services within the county. This tax is an essential part of the city’s fiscal policy, contributing significantly to the overall economic stability and growth.

In Atlanta, the sales tax is composed of both state and local taxes, each serving distinct purposes. The state sales tax is a uniform rate applied across Georgia, while the local sales tax varies by county and city, allowing for local governments to address specific community needs and initiatives.

State Sales Tax

As of the last verified data, the state sales tax in Georgia stands at 4%, which is applicable to most retail sales, with some exceptions for essential items like groceries and medications. This rate is set by the Georgia Department of Revenue and is a crucial component of the state’s revenue stream.

Local Sales Tax

The local sales tax in Fulton County, where Atlanta is located, is currently set at 3%, bringing the total sales tax rate to 7% when combined with the state tax. This local tax is vital for funding local projects and initiatives, such as road improvements, public transportation, and community development.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 4% |

| Fulton County Local Sales Tax | 3% |

| Total Sales Tax in Atlanta, Fulton County | 7% |

Impact on Businesses and Consumers

The Atlanta Fulton County Sales Tax has a direct impact on both businesses and consumers. For businesses, particularly retailers, the tax influences pricing strategies and can affect competitiveness in the market. It is a factor that must be carefully considered in financial planning and can influence a business’s success or failure.

For consumers, the sales tax is a significant cost added to their purchases. While it may seem like a small percentage, over time and with multiple purchases, it can add up to a substantial amount. Understanding and accounting for this tax is crucial for personal financial planning and budgeting.

Strategies for Businesses

Businesses operating in Atlanta Fulton County can employ various strategies to navigate the sales tax landscape effectively. Some key considerations include:

- Pricing Strategy: Setting prices that include the sales tax and clearly communicating this to customers can help manage expectations and avoid surprises at the point of sale.

- Tax Exemptions: Researching and understanding tax exemptions for specific goods or services can provide opportunities to reduce tax liabilities and offer competitive pricing.

- Online Sales: With the growth of e-commerce, businesses should be aware of the sales tax implications for online transactions and ensure compliance with the relevant laws.

- Tax Planning: Engaging with tax professionals to develop effective tax planning strategies can help businesses optimize their financial position and ensure compliance with local tax regulations.

Consumer Awareness and Budgeting

For consumers, being aware of the sales tax rate and its impact on their purchases is crucial for effective budgeting and financial planning. Some tips for consumers include:

- Understanding the Tax: Knowing the total sales tax rate (state and local) in Atlanta Fulton County is essential. This awareness helps in budgeting and making informed purchasing decisions.

- Comparative Shopping: Comparing prices across retailers, both online and in-store, can help consumers find the best deals and manage their spending effectively.

- Tax-Free Events: Keeping an eye out for tax-free shopping events, often organized by the state or local government, can provide opportunities to save on purchases.

- Budgeting Tools: Utilizing budgeting apps or spreadsheets to track spending and account for sales tax can help consumers stay on top of their finances and avoid overspending.

Future Implications and Trends

The Atlanta Fulton County Sales Tax is subject to ongoing discussions and potential changes, influenced by economic trends, political decisions, and community needs. Here are some key considerations for the future:

- Economic Growth and Development: As Atlanta continues to grow and develop, the sales tax revenue plays a critical role in funding infrastructure projects and economic initiatives. The tax rate and its distribution may be adjusted to support these efforts.

- Political Landscape: Changes in local or state government leadership can lead to discussions around tax reform, potentially impacting the sales tax rates and structures.

- Community Needs: The local sales tax is often a key funding source for community projects and services. As community needs evolve, the tax revenue may be redirected to address these changing priorities.

- E-Commerce and Online Sales: With the increasing shift towards online shopping, the sales tax landscape for e-commerce businesses is evolving. Keeping up with these changes is crucial for both businesses and consumers.

Conclusion

The Atlanta Fulton County Sales Tax is a dynamic and essential component of the local economy, impacting businesses, consumers, and the community as a whole. Understanding its intricacies, staying informed about potential changes, and employing effective financial strategies can help both businesses and individuals navigate this tax landscape successfully.

How often are sales tax rates reviewed and adjusted in Atlanta Fulton County?

+

Sales tax rates are typically reviewed and adjusted on an annual basis, or as needed, by the local government and state authorities. These adjustments are made to ensure the tax remains fair and sufficient to meet the financial needs of the community.

Are there any plans to reduce or increase the sales tax rate in the near future?

+

While there are ongoing discussions about tax reform and economic development, there are no confirmed plans to significantly alter the sales tax rate in the immediate future. However, it’s important to stay informed about local government announcements and proposals.

What are the penalties for non-compliance with sales tax regulations in Atlanta Fulton County?

+

Non-compliance with sales tax regulations can result in significant penalties, including fines and legal repercussions. It is crucial for businesses to ensure they are accurately collecting and remitting sales tax to avoid these penalties.