Sales Tax For Cars In Ohio

Sales tax is an essential aspect of car ownership and purchasing, as it can significantly impact the overall cost of a vehicle. In the state of Ohio, the sales tax system is designed to generate revenue for the state and local governments while ensuring a fair and transparent process for taxpayers. This article aims to provide an in-depth analysis of the sales tax for cars in Ohio, covering its structure, rates, exemptions, and the impact it has on car buyers.

Understanding the Ohio Sales Tax Structure

Ohio’s sales tax system operates on a combined state and local tax basis, meaning the tax rate varies depending on the location where the vehicle is purchased. The state of Ohio imposes a uniform sales tax rate, while local jurisdictions, including counties and municipalities, have the authority to levy additional taxes. This combined tax structure ensures that revenue is distributed across various levels of government, benefiting both the state and local communities.

The Ohio Department of Taxation oversees the administration and collection of sales tax, providing guidelines and resources for taxpayers and businesses. The department's website offers a comprehensive guide to sales tax, including specific information for car purchases. This ensures transparency and ease of access to relevant information for car buyers and dealers.

State Sales Tax Rate

The state of Ohio imposes a sales tax rate of 5.75% on the purchase of motor vehicles. This rate applies uniformly across the state, ensuring a consistent base tax for all car buyers. The state sales tax is calculated based on the purchase price of the vehicle, including any additional fees or charges associated with the transaction.

Local Sales Tax Rates

In addition to the state sales tax, Ohio allows local jurisdictions to impose their own sales taxes. These local taxes are often referred to as county or municipal taxes and can vary significantly across different regions within the state. The purpose of these local taxes is to fund specific projects or initiatives within the community, such as infrastructure development or public services.

Local sales tax rates in Ohio can range from 0% to 2.5%, with the majority of counties having a rate of 1.5% or lower. However, it is important to note that these rates are subject to change, and it is advisable to check the latest tax rates for the specific county where the vehicle is being purchased. Local sales tax rates are typically determined by the county auditor's office or the local government website.

| County | Local Sales Tax Rate |

|---|---|

| Franklin County | 1.5% |

| Cuyahoga County | 1.25% |

| Hamilton County | 1.5% |

| Summit County | 1.0% |

| Lucas County | 1.5% |

The table above provides an example of local sales tax rates in select counties in Ohio. It is important to consult the relevant county's tax information to obtain the most accurate and up-to-date rates.

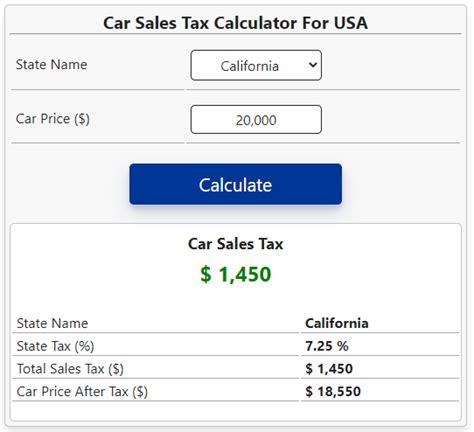

Calculating Sales Tax for Cars in Ohio

When purchasing a car in Ohio, the sales tax is calculated based on the total purchase price, including any additional fees and charges. This ensures that the tax is applied to the entire transaction, providing a comprehensive tax calculation. Here’s a step-by-step guide to calculating the sales tax for a car purchase in Ohio:

- Determine the purchase price of the vehicle, including any applicable fees such as documentation fees, title transfer fees, or dealer preparation charges.

- Calculate the state sales tax by multiplying the purchase price by the state sales tax rate of 5.75%.

- Check the local sales tax rate for the specific county where the purchase is taking place. This information can be obtained from the county auditor's office or the local government website.

- Calculate the local sales tax by multiplying the purchase price by the local sales tax rate.

- Add the state sales tax and local sales tax together to obtain the total sales tax amount.

- Include the total sales tax amount in the overall cost of the vehicle. This ensures that the buyer is aware of the complete financial obligation associated with the purchase.

For example, let's consider a car purchase with a total price of $30,000 in a county with a local sales tax rate of 1.5%. The calculation would be as follows:

- State sales tax: $30,000 x 0.0575 = $1,725

- Local sales tax: $30,000 x 0.015 = $450

- Total sales tax: $1,725 + $450 = $2,175

In this case, the total sales tax amount for the car purchase would be $2,175, which is added to the purchase price to determine the final cost of the vehicle.

Exemptions and Special Considerations

Ohio’s sales tax system for cars includes certain exemptions and special considerations that can impact the overall tax liability. Understanding these exemptions is essential for car buyers to ensure they are not overcharged or incorrectly taxed.

Vehicle Trade-Ins

When trading in a vehicle as part of a new car purchase, the sales tax in Ohio is calculated based on the net purchase price, which is the difference between the new vehicle’s price and the trade-in allowance. This means that the trade-in value of the old vehicle reduces the taxable amount, resulting in a lower sales tax liability. It is important to note that the trade-in allowance is subject to certain conditions and must be accurately assessed by the dealer to ensure compliance with tax regulations.

Military Exemptions

Ohio offers specific sales tax exemptions for active-duty military personnel and their spouses. These exemptions apply to the purchase of a motor vehicle and can significantly reduce the overall tax burden. To qualify for these exemptions, military members must provide valid documentation, such as a military ID or a certificate of eligibility, to the dealer at the time of purchase. It is essential for military buyers to understand the requirements and eligibility criteria to take full advantage of these tax benefits.

Special Considerations for Out-of-State Purchases

Ohio residents who purchase a vehicle out of state are still required to pay sales tax on the vehicle when registering it in Ohio. The tax liability is calculated based on the purchase price, including any applicable fees and charges. It is crucial for out-of-state buyers to understand the tax obligations and comply with Ohio’s tax laws to avoid any penalties or legal issues.

Impact on Car Buyers

The sales tax for cars in Ohio has a significant impact on the overall cost of vehicle ownership. While the state and local sales tax rates may seem relatively low, they can add up quickly, especially for high-value vehicles. Car buyers need to carefully consider the impact of sales tax on their purchase decision and budget accordingly.

Financial Considerations

The sales tax for cars in Ohio can range from several hundred dollars to several thousand dollars, depending on the vehicle’s price and the applicable tax rates. This additional cost should be factored into the overall financial plan when purchasing a car. It is advisable to compare the sales tax rates in different counties or consider financing options that may help manage the upfront tax liability.

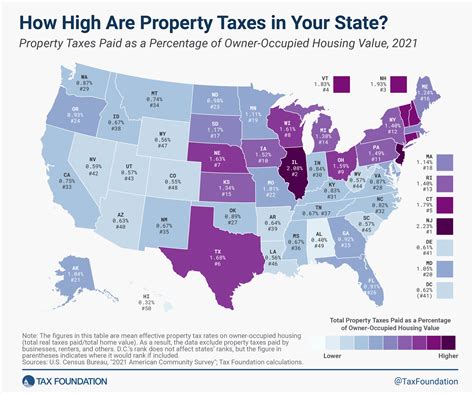

Comparison with Other States

Ohio’s sales tax rates for cars are relatively competitive compared to other states. However, it is important to note that sales tax rates can vary significantly across different states, and car buyers should consider the tax implications when comparing vehicles or considering out-of-state purchases. Some states may have higher or lower tax rates, which can impact the overall cost of ownership.

Tax Planning and Strategies

Car buyers in Ohio can employ certain strategies to optimize their tax obligations. One approach is to research and compare sales tax rates in different counties to identify the most tax-efficient location for their purchase. Additionally, understanding the timing of vehicle purchases can also impact tax liability. For example, purchasing a car towards the end of the year may allow for better tax planning and potential tax savings.

Future Implications and Developments

Ohio’s sales tax system for cars is subject to ongoing evaluation and potential changes. The state government and local authorities regularly review tax policies to ensure fairness, efficiency, and revenue generation. As a result, car buyers should stay informed about any updates or modifications to the sales tax structure, as these changes can impact their purchasing decisions and tax obligations.

Furthermore, advancements in technology and online sales platforms have introduced new challenges and opportunities for sales tax collection. Ohio, like many other states, is exploring ways to adapt to the evolving e-commerce landscape and ensure proper tax compliance for online car purchases. This may involve implementing new tax regulations or utilizing innovative tax collection methods to keep pace with the digital economy.

What is the average sales tax rate for cars in Ohio, including both state and local taxes?

+The average sales tax rate for cars in Ohio varies depending on the location of the purchase. On average, the combined state and local sales tax rate ranges from approximately 7.25% to 7.5%. However, it is important to note that local tax rates can vary significantly, so it is advisable to check the specific tax rate for the county where the purchase is taking place.

Are there any online tools or calculators available to estimate the sales tax for a car purchase in Ohio?

+Yes, there are several online tools and calculators available that can assist in estimating the sales tax for a car purchase in Ohio. These tools often consider the state sales tax rate, local tax rates, and other applicable fees. It is recommended to use multiple sources and cross-reference the results to ensure accuracy.

Can I negotiate the sales tax amount when purchasing a car in Ohio?

+The sales tax amount is determined by law and is not typically negotiable. However, car buyers can negotiate the purchase price of the vehicle, which indirectly affects the sales tax liability. By negotiating a lower purchase price, buyers can reduce the overall sales tax they owe.

Are there any tax incentives or rebates available for car purchases in Ohio?

+Ohio does offer certain tax incentives and rebates for specific types of vehicle purchases. For example, there are incentives for purchasing electric vehicles or hybrid cars. It is advisable to check with the Ohio Department of Taxation or consult a tax professional to explore any available tax benefits.

How often are the sales tax rates reviewed and updated in Ohio?

+The sales tax rates in Ohio are periodically reviewed and updated to align with economic conditions and revenue needs. The state government and local authorities may adjust tax rates to ensure a stable revenue stream. It is recommended to check the official sources or consult a tax professional for the most up-to-date information on sales tax rates.