Sonoma County Real Estate Taxes

Understanding the intricacies of real estate taxes is crucial when navigating the Sonoma County property market. These taxes play a significant role in the overall cost of owning property and are a key consideration for both buyers and investors. This comprehensive guide aims to delve into the specifics of Sonoma County real estate taxes, providing an in-depth analysis of tax rates, assessment processes, and the various factors that influence property tax obligations.

Unraveling the Complexity of Sonoma County Real Estate Taxes

Sonoma County, known for its vibrant communities and picturesque landscapes, imposes a property tax system that, like many other counties, is primarily based on the assessed value of real estate properties. This system is governed by a set of regulations and assessment procedures that can vary across different regions within the county.

The assessment process in Sonoma County is an intricate affair. It begins with an evaluation of the property's market value, taking into account factors such as location, size, improvements, and recent sales data. This initial assessment is then used to calculate the property's taxable value, which serves as the basis for determining the annual tax liability.

One unique aspect of Sonoma County's real estate tax landscape is the split-roll property tax system. Under this system, commercial and industrial properties are assessed and taxed differently from residential properties. This distinction is designed to provide a more equitable tax burden, ensuring that homeowners are not disproportionately affected by rising property values in the commercial sector.

Understanding Tax Rates and Assessment Practices

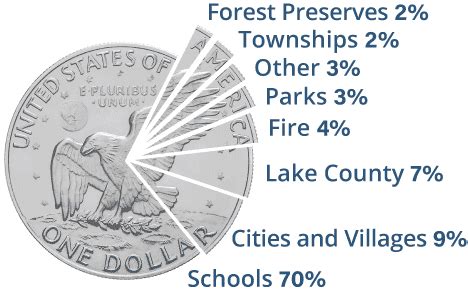

The tax rate in Sonoma County is determined by a combination of factors, including the general tax rate, voter-approved special taxes, and local bond measures. These rates can vary significantly depending on the specific location within the county and the type of property being assessed.

To illustrate, consider the following table showcasing the general tax rates for different regions in Sonoma County:

| Region | General Tax Rate (%) |

|---|---|

| Santa Rosa | 1.10 |

| Sonoma Valley | 1.15 |

| Petaluma | 1.20 |

| Healdsburg | 1.12 |

| Southeast Sonoma County | 1.18 |

These general tax rates are subject to change annually, influenced by factors such as budget requirements, voter-approved initiatives, and the overall economic climate.

In addition to the general tax rate, Sonoma County property owners may also be subject to special taxes and assessments. These are typically levied to fund specific community services or infrastructure projects. Examples include parcel taxes for school districts or assessments for local improvement districts.

Factors Influencing Property Tax Obligations

The complexity of Sonoma County's real estate tax landscape is further compounded by various factors that can influence an individual property's tax obligations. These factors include:

- Property Type: As mentioned earlier, the split-roll system differentiates between residential and commercial properties, leading to different tax rates and assessment methods.

- Assessed Value: The taxable value of a property is based on its assessed value, which can change annually due to market fluctuations, improvements, or reassessments.

- Ownership Changes: Whenever there is a change in property ownership, a new assessment is typically triggered, potentially resulting in a different tax liability.

- Proposition 13: California's Proposition 13, passed in 1978, limits annual property tax increases to no more than 2% unless there is a change in ownership or new construction.

- Exemptions and Deductibles: Certain properties may qualify for exemptions or deductions, such as the homeowner's exemption, which can reduce the taxable value of a property.

Navigating the Future: Tax Trends and Potential Challenges

Looking ahead, several trends and challenges are likely to shape the future of Sonoma County's real estate tax landscape.

One notable trend is the increasing focus on sustainable development and green initiatives. As the county continues to prioritize environmental sustainability, tax incentives and assessments may be introduced to encourage eco-friendly practices among property owners. This could include rebates or tax breaks for energy-efficient upgrades or solar installations.

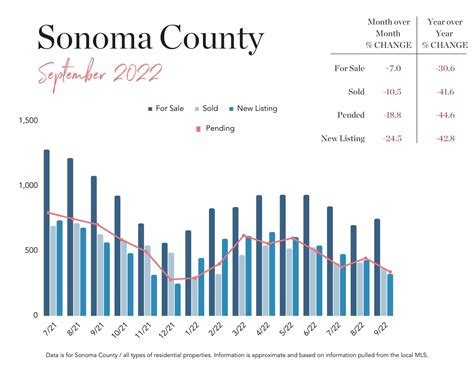

Additionally, the ongoing housing market dynamics in Sonoma County, characterized by a limited supply and high demand, could lead to further increases in property values. While this benefits homeowners through increased equity, it also results in higher tax assessments and obligations. This trend may prompt the county to explore alternative tax structures or assess the feasibility of a reassessment program to ensure tax fairness.

In the realm of tax challenges, the potential impact of climate-related events, such as wildfires or extreme weather conditions, cannot be overlooked. These events can significantly affect property values and tax assessments, especially in vulnerable areas. The county will need to carefully consider these risks and develop strategies to mitigate their financial impact on property owners.

Furthermore, the continued evolution of technology and data analytics presents both opportunities and challenges. On one hand, advanced data systems can improve the accuracy and efficiency of property assessments. On the other hand, it may raise concerns about privacy and data security, which the county will need to address effectively.

Conclusion: A Complex but Navigable Landscape

Sonoma County's real estate tax system is intricate, encompassing a range of rates, assessments, and influencing factors. While it can be challenging to navigate, especially for those new to the area, understanding these complexities is essential for making informed decisions about property ownership.

As the county continues to evolve and adapt to changing circumstances, property owners and prospective buyers can stay ahead by staying informed about tax trends, initiatives, and potential challenges. This proactive approach ensures that they are well-prepared to manage their tax obligations effectively and leverage any available incentives or exemptions.

For those seeking more detailed information or personalized guidance, it is recommended to consult with local tax advisors or real estate professionals who can provide expert insights tailored to individual circumstances.

What is the average real estate tax rate in Sonoma County?

+The average real estate tax rate in Sonoma County varies depending on the specific location and property type. As of our latest data, the average rate ranges from approximately 1.10% to 1.20% of the assessed value. However, it’s important to note that this can change annually due to various factors.

How often are properties reassessed for tax purposes in Sonoma County?

+In Sonoma County, properties are generally reassessed whenever there is a change in ownership or new construction. Additionally, the county may conduct periodic reassessments to ensure that property values are accurately reflected. However, Proposition 13 limits annual tax increases to no more than 2% unless these specific changes occur.

Are there any tax incentives or exemptions available for homeowners in Sonoma County?

+Yes, Sonoma County offers various tax incentives and exemptions for homeowners. These include the homeowner’s exemption, which reduces the taxable value of a primary residence by $7,000, and the Veteran’s Exemption, which provides a property tax reduction for eligible veterans. Additionally, there may be other incentives for energy-efficient upgrades or solar installations.