Kansas City Tax

Welcome to our in-depth exploration of the Kansas City Tax, a topic that delves into the intricate world of tax regulations and their impact on businesses and individuals in the vibrant city of Kansas. As we navigate the complexities of the tax landscape, we'll uncover the ins and outs of this tax system, offering a comprehensive guide for those seeking clarity and understanding. Get ready to dive into the details and discover how the Kansas City Tax shapes the financial landscape of this dynamic metropolis.

Unraveling the Kansas City Tax: A Comprehensive Overview

The Kansas City Tax, a vital component of the city’s economic framework, plays a significant role in shaping the financial strategies of both local businesses and residents. With a unique set of regulations and rates, this tax system presents a challenge and an opportunity for those operating within its jurisdiction. Let’s delve into the specifics to gain a clearer understanding of its workings and implications.

Tax Rates and Structure

At the core of the Kansas City Tax lies a structured system of tax rates, designed to generate revenue for the city’s infrastructure and services. These rates are meticulously calculated and vary depending on the nature of the taxpayer and the type of transaction. For instance, the city imposes a 3% tax on all retail sales, a 2% tax on services, and a 1% tax on wholesale transactions. These rates are subject to change based on legislative decisions and economic factors, highlighting the dynamic nature of the tax system.

Additionally, the city levies a 2% earnings tax on individuals and businesses, a measure that significantly contributes to the city's revenue. This tax is applicable to residents and businesses operating within the city limits, making it a crucial aspect of the tax landscape. The earnings tax is calculated based on the taxpayer's income, with specific brackets and exemptions in place to ensure fairness and compliance.

| Tax Type | Rate |

|---|---|

| Retail Sales Tax | 3% |

| Services Tax | 2% |

| Wholesale Tax | 1% |

| Earnings Tax | 2% |

Compliance and Reporting

Ensuring compliance with the Kansas City Tax regulations is a critical aspect for businesses and individuals alike. The city has implemented a robust reporting system, requiring taxpayers to file returns and make payments within specified deadlines. Late filings and non-compliance can result in penalties and interest charges, underscoring the importance of staying abreast of the latest tax requirements.

The city provides a user-friendly online portal, allowing taxpayers to register, file returns, and make payments digitally. This platform offers a convenient and efficient way to manage tax obligations, ensuring a streamlined process for taxpayers. Additionally, the city's tax office offers support and guidance, providing resources and workshops to educate taxpayers on their rights and responsibilities.

Impact on Businesses

For businesses operating in Kansas City, the tax system presents both challenges and opportunities. While the tax rates can impact profitability, especially for small businesses, the city’s strategic tax policies can also foster growth and development. The earnings tax, for instance, provides an incentive for businesses to expand their operations within the city limits, benefiting from the reduced tax rates and supportive business environment.

Furthermore, the city's tax structure encourages investment and job creation, with specific tax incentives for businesses that meet certain criteria. This approach not only boosts the local economy but also creates a competitive advantage for Kansas City, attracting businesses and talent from across the region. The city's commitment to supporting business growth is evident in its tax policies, making it an attractive destination for entrepreneurs and established companies alike.

Tax Relief and Incentives

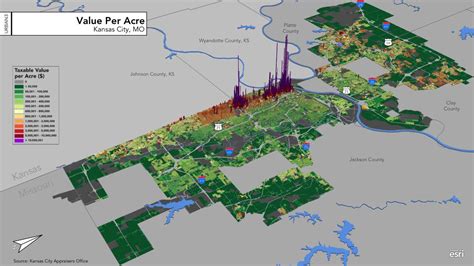

Understanding the tax landscape in Kansas City is not complete without exploring the tax relief and incentives available to taxpayers. The city recognizes the importance of supporting its residents and businesses, and thus, offers a range of tax breaks and benefits.

For homeowners, the city provides a homestead tax relief program, which offers a reduction in property taxes for primary residences. This incentive aims to encourage homeownership and provide financial relief to residents, making it a key component of the city's tax strategy. Additionally, the city offers tax credits for energy-efficient upgrades and renovations, promoting sustainability and reducing the carbon footprint of its residents.

Businesses, too, benefit from a range of tax incentives. The city provides tax abatements for companies investing in new construction or renovation projects, especially in designated economic development zones. This strategy not only encourages investment but also fosters urban regeneration, transforming underutilized areas into vibrant business hubs.

Conclusion: Navigating the Kansas City Tax Landscape

The Kansas City Tax is a multifaceted system, offering a unique set of challenges and opportunities for taxpayers. From its structured tax rates to the supportive incentives and relief programs, the city’s tax policies are designed to foster growth and compliance. By understanding the intricacies of this tax system, businesses and individuals can navigate the financial landscape of Kansas City with confidence and clarity.

As we conclude our exploration, we hope this guide has provided valuable insights into the Kansas City Tax, offering a comprehensive understanding of its impact and potential. Remember, staying informed and proactive is key to successfully managing your tax obligations, ensuring a positive financial future in this dynamic city.

How often do tax rates change in Kansas City?

+Tax rates in Kansas City are subject to change based on legislative decisions and economic factors. Typically, the city reviews and adjusts tax rates annually, ensuring they remain competitive and aligned with the city’s financial goals.

Are there any tax breaks for start-up businesses in Kansas City?

+Yes, Kansas City offers a range of tax incentives for start-up businesses, including tax abatements and reduced tax rates for businesses operating in designated economic development zones. These incentives aim to foster entrepreneurship and support small businesses.

What support does the city provide for taxpayers struggling with compliance?

+The city’s tax office provides extensive support and resources for taxpayers, including online tools, workshops, and one-on-one assistance. They offer guidance on tax obligations, filing requirements, and payment options, ensuring taxpayers have the support they need to comply with the city’s tax regulations.