Wesley Snipes Tax

The case of Wesley Snipes' tax troubles is a well-known incident in the entertainment industry, serving as a cautionary tale for celebrities and high-net-worth individuals alike. In this comprehensive article, we will delve into the intricacies of the actor's legal battles, the financial implications, and the lasting impact on his career and reputation. Through an in-depth analysis, we aim to shed light on the complexities of tax evasion, the legal consequences, and the lessons learned from this high-profile case.

The Rise and Fall of Wesley Snipes’ Career

Wesley Trent Snipes, a renowned American actor, producer, and martial artist, rose to fame in the late 1980s and early 1990s with his dynamic roles in films like “Major League”, “New Jack City”, and the popular “Blade” franchise. His charismatic presence and action-packed performances established him as a leading figure in the entertainment industry.

However, in the early 2000s, Snipes' career took a dramatic turn as he found himself embroiled in a legal battle with the Internal Revenue Service (IRS) over his tax obligations. This chapter of his life serves as a stark reminder of the potential consequences of tax evasion and the far-reaching impact it can have on an individual's life and professional standing.

A Brief Overview of Wesley Snipes’ Tax Troubles

The tax issues surrounding Wesley Snipes began to surface in the late 1990s. According to court documents, Snipes, along with his financial advisors, allegedly engaged in a series of complex financial maneuvers and tax strategies that led to the non-payment of federal income taxes for several years.

In 2006, Snipes was indicted on three felony counts, including failure to file tax returns, and faced a maximum sentence of 16 years in prison. The case gained significant media attention, not only due to Snipes' celebrity status but also because of the serious nature of the charges and the potential precedent it could set for other high-profile individuals.

The legal battle ensued for several years, with Snipes maintaining his innocence and claiming that he was a victim of a corrupt tax system. However, in 2008, a jury in Florida found Snipes guilty on three misdemeanor counts of willful failure to file tax returns. He was sentenced to three years in prison, along with additional community service and financial penalties.

Financial Implications and Legal Consequences

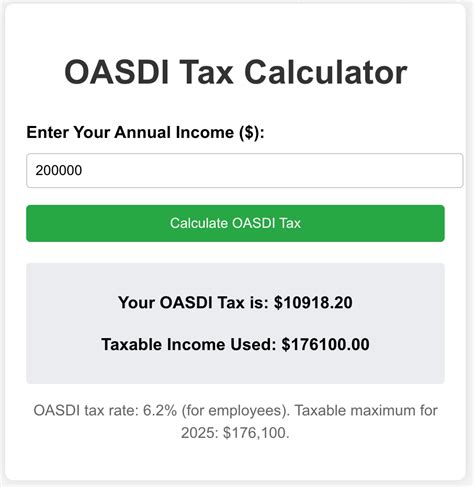

The legal verdict had severe financial implications for Wesley Snipes. In addition to the prison sentence, he was ordered to pay a substantial amount in back taxes, penalties, and interest. The IRS estimated that Snipes owed approximately $20 million in unpaid taxes, penalties, and interest dating back to the late 1990s.

The financial burden was not limited to the IRS; Snipes also faced civil lawsuits from his former financial advisors, who accused him of negligence and breach of contract. These legal battles further drained his financial resources and damaged his reputation in the business world.

Beyond the monetary penalties, Snipes' conviction had a profound impact on his personal and professional life. He spent several years in federal prison, during which his acting career was put on hold. Upon his release, he faced challenges in rebuilding his reputation and re-establishing himself in the entertainment industry.

Impact on the Entertainment Industry

Wesley Snipes’ tax troubles sent shockwaves through the entertainment industry, prompting a closer examination of tax practices and financial management among celebrities. Many industry professionals and financial advisors took note of the case, recognizing the potential risks associated with aggressive tax strategies and the importance of compliance with tax laws.

The case also highlighted the complexities of tax law and the potential for misunderstandings or misinterpretations, especially for high-net-worth individuals with complex financial structures. It served as a reminder that celebrities, despite their fame and fortune, are not exempt from the law and must navigate the tax system with caution and professional guidance.

Lessons Learned and Future Implications

Wesley Snipes’ tax issues offer several valuable lessons for individuals, especially those with substantial wealth and complex financial affairs. One of the key takeaways is the importance of seeking competent and ethical financial advice. Snipes’ reliance on questionable financial advisors led him down a path of legal troubles that could have been avoided with more prudent guidance.

Furthermore, the case underscores the significance of tax compliance and the potential consequences of tax evasion. While tax laws can be complex and sometimes controversial, ignoring one's tax obligations can lead to severe legal and financial repercussions. It is crucial for individuals to stay informed about their tax responsibilities and seek professional assistance when needed.

From a broader perspective, Snipes' legal battle has contributed to a heightened awareness of tax issues among the general public. The media coverage surrounding the case brought attention to the intricacies of tax law and the potential for abuse or misunderstanding. This increased awareness can lead to more informed discussions and potential reforms in the tax system.

| Key Takeaways | Implications |

|---|---|

| Seek Ethical Financial Advice | Choose advisors carefully to avoid legal pitfalls. |

| Understand Tax Obligations | Stay informed to prevent tax-related issues. |

| Promotes Tax Awareness | Encourages public discourse on tax reforms. |

Rehabilitation and Future Opportunities

Despite the setbacks, Wesley Snipes has demonstrated resilience in his post-prison career. He has actively worked to rebuild his reputation and reconnect with his audience. In recent years, he has made appearances in several films and television series, showcasing his acting prowess and reminding the industry of his talent.

Snipes' return to the spotlight has not only provided him with professional opportunities but has also opened a dialogue about second chances and redemption. His story serves as a reminder that even in the face of significant challenges, it is possible to overcome obstacles and rebuild one's life and career.

What were the specific tax issues Wesley Snipes faced?

+Snipes was accused of failing to file federal income tax returns for several years and using questionable tax strategies to avoid paying taxes.

How did Wesley Snipes’ tax issues impact his career and reputation?

+The legal battle and conviction resulted in a hiatus from his acting career and damaged his reputation, making it challenging to re-establish himself in the industry.

What lessons can be learned from Wesley Snipes’ tax troubles?

+The case emphasizes the importance of ethical financial practices, understanding tax obligations, and seeking professional advice to avoid legal and financial pitfalls.