Dc Income Tax Rate

The District of Columbia, often referred to as Washington, D.C., operates a progressive income tax system with rates varying based on an individual's income level. Understanding the DC income tax rates is crucial for residents and businesses operating within the district, as it directly impacts their financial obligations and planning.

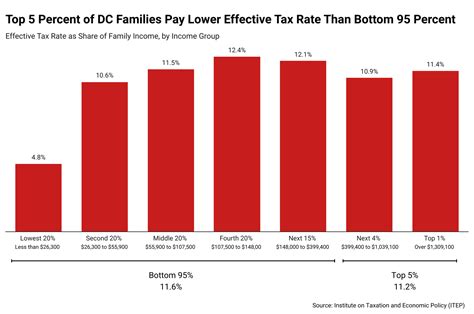

Progressive Income Tax Structure

The District of Columbia’s income tax system is designed to ensure that higher-income earners pay a larger share of their income in taxes, promoting fairness and economic equity. This progressive approach is a common feature of many tax systems worldwide.

The DC tax rates are divided into six brackets, each with its own tax rate. As an individual's taxable income increases, they move into higher tax brackets, resulting in a higher overall tax liability. This system ensures that those with the ability to contribute more do so proportionally.

Tax Brackets and Rates for 2023

Here is a breakdown of the DC income tax brackets and the corresponding tax rates for the current tax year:

| Tax Bracket (Taxable Income) | Tax Rate |

|---|---|

| $0 - $10,000 | 4.00% |

| $10,001 - $40,000 | 6.00% |

| $40,001 - $60,000 | 8.25% |

| $60,001 - $100,000 | 8.50% |

| $100,001 - $400,000 | 8.75% |

| Over $400,000 | 8.75% |

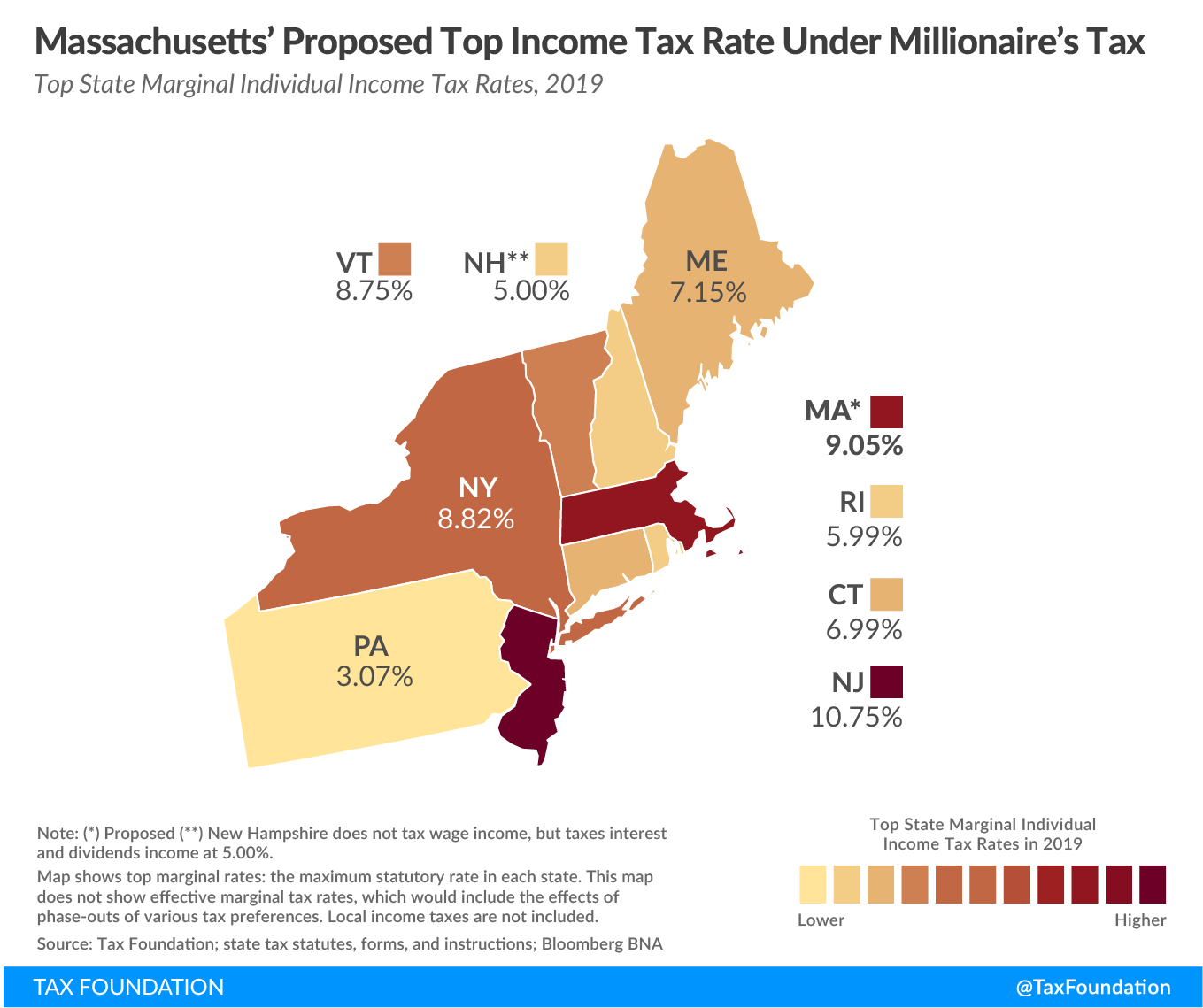

Impact on Individuals and Businesses

The DC income tax rates have a significant impact on both individuals and businesses operating within the district. For individuals, especially those with higher incomes, understanding the progressive nature of the tax system is crucial for effective financial planning and tax optimization.

Businesses, too, must consider the DC income tax rates when making financial decisions, such as determining pricing strategies, evaluating profitability, and planning for future growth. The tax system can influence business operations, investment decisions, and even the competitive landscape within the district.

Strategies for Tax Optimization

Given the progressive nature of the DC income tax system, individuals and businesses can employ various strategies to optimize their tax liabilities. These strategies may include:

- Tax-efficient savings and investment plans: Utilizing tax-advantaged accounts and investment strategies can help individuals and businesses reduce their taxable income and lower their overall tax burden.

- Business structuring: For businesses, carefully considering the legal structure (e.g., sole proprietorship, partnership, corporation) can have tax implications. Some structures may offer more favorable tax treatments, especially for small businesses.

- Expense management: Tracking and managing expenses effectively can help reduce taxable income. This is particularly relevant for businesses, as they can deduct eligible business expenses from their taxable income.

- Retirement planning: Contributions to retirement accounts, such as 401(k)s or IRAs, can provide tax benefits and reduce taxable income for both individuals and business owners.

DC’s Tax Incentives and Programs

In addition to the progressive income tax system, the District of Columbia offers various tax incentives and programs aimed at supporting economic development, job creation, and community growth.

Key Tax Incentives

- Enterprise Zone Tax Credit: This incentive program provides tax credits to businesses that locate or expand in designated Enterprise Zones within the district. The credits are based on the number of jobs created and the investment made in the zone.

- Historic Preservation Tax Credit: Businesses and individuals who invest in the rehabilitation of historic properties within the district may be eligible for tax credits. This program encourages the preservation of historic buildings and contributes to the district’s cultural heritage.

- Research and Development Tax Credit: The DC government offers a tax credit for businesses conducting research and development activities within the district. This credit aims to stimulate innovation and technological advancement.

Community Development Programs

The District of Columbia is committed to community development and has implemented several programs to support low- and moderate-income residents and communities.

- Homestead Deduction: This program provides a tax deduction for homeowners, reducing their taxable property value. It is particularly beneficial for long-term residents and those on fixed incomes.

- Senior Citizens and Disabled Persons Tax Relief: DC offers a property tax relief program for senior citizens and individuals with disabilities. This program reduces the property tax burden for eligible residents, helping them maintain homeownership.

- Low-Income Housing Tax Credit: The district participates in the federal Low-Income Housing Tax Credit program, which provides incentives for the development of affordable housing. This credit supports the creation of housing options for low- and moderate-income families.

Tax Filing and Payment

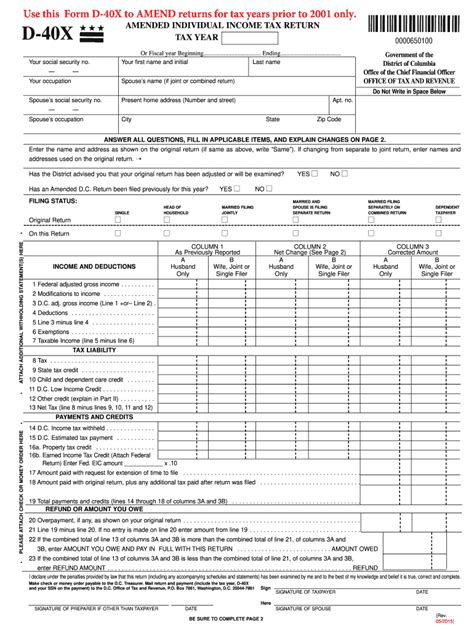

Taxpayers in the District of Columbia have several options for filing their income tax returns and making payments. The DC Office of Tax and Revenue (OTR) provides online services for electronic filing and payment, which is often the most convenient and efficient method.

Electronic Filing and Payment

The OTR’s online portal, MyTax.DC.gov, allows taxpayers to file their returns and make payments securely. This platform offers a user-friendly interface and provides real-time updates on tax balances and payment due dates.

Paper Returns and Payment by Mail

For those who prefer traditional methods, the OTR accepts paper tax returns by mail. Taxpayers can download the necessary forms from the OTR website or request them by phone. Payments can be made by check or money order, and the OTR provides detailed instructions on how to properly submit these payments.

Payment Plans and Tax Relief

The OTR understands that taxpayers may face financial challenges, and it offers payment plans and tax relief programs to assist those who cannot pay their taxes in full. These programs include installment agreements, offers in compromise, and penalty abatement.

Conclusion

Understanding the DC income tax rates and the district’s tax system is essential for residents and businesses to navigate their financial obligations effectively. The progressive tax structure ensures fairness, while the various tax incentives and community development programs demonstrate the district’s commitment to economic growth and community support.

For more information on DC income tax rates, filing requirements, and available tax incentives, taxpayers can visit the official website of the District of Columbia's Office of Tax and Revenue: https://otr.dc.gov.

How often are DC income tax rates updated, and where can I find the latest information?

+DC income tax rates are typically updated annually to reflect changes in the cost of living and economic conditions. The latest tax rates and relevant information can be found on the official website of the District of Columbia’s Office of Tax and Revenue: https://otr.dc.gov. This website provides detailed information on tax rates, due dates, and any amendments to the tax code.

Are there any tax breaks or incentives for first-time homebuyers in DC?

+Yes, the District of Columbia offers a First-Time Homebuyer Credit Program. This program provides a tax credit of up to $5,000 for eligible first-time homebuyers. To qualify, individuals must meet certain income and purchase price requirements. More information on this program can be found on the DC OTR website.

What are the penalties for late tax filing or payment in DC?

+Late tax filing and payment in DC can result in penalties and interest charges. The specific penalties depend on the type of tax and the extent of the delay. For income taxes, a late filing penalty of 5% per month (or part of a month) is imposed, up to a maximum of 25%. Additionally, interest accrues on unpaid taxes at a rate of 6% per year. It’s crucial to stay informed about due dates and to take advantage of the OTR’s payment plans if needed.