San Diego County Sales Tax By City

Welcome to an in-depth exploration of the sales tax landscape in San Diego County, California. With a diverse range of cities and communities, each with its own unique characteristics and attractions, understanding the sales tax rates can be crucial for both residents and businesses alike. In this comprehensive guide, we delve into the specifics of sales tax by city, offering a detailed breakdown that goes beyond generic overviews. From the vibrant beaches of San Diego to the charming suburbs of Encinitas, we'll uncover the variations in sales tax rates and their implications.

Unraveling the Sales Tax Landscape in San Diego County

San Diego County boasts a thriving economy, driven by its vibrant tourism industry, thriving tech sector, and diverse local businesses. As such, sales tax plays a significant role in funding public services and infrastructure development. The county’s sales tax structure is a combination of state, county, and city taxes, resulting in varying rates across different localities.

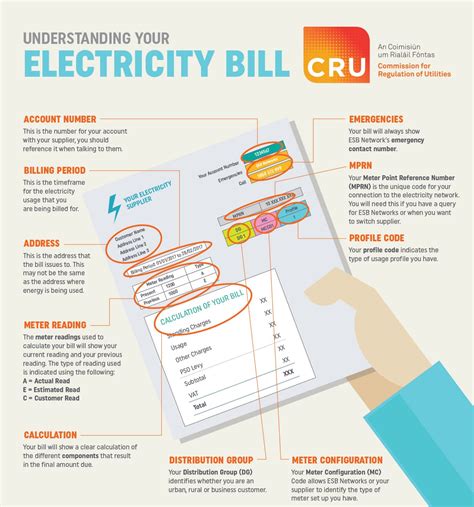

As of our last update, the state sales tax rate in California stands at 7.25%, one of the highest in the nation. However, this is just the starting point, as county and city authorities are authorized to add additional taxes, leading to a unique sales tax environment in each city.

Let's dive into the specifics of sales tax rates by city, exploring the variations, potential implications, and the factors that contribute to these differences.

San Diego: The Heart of the County

As the largest city in the county and the economic hub of the region, San Diego’s sales tax rate reflects its significance. With a diverse economy that encompasses everything from military bases to world-class tourism, the city’s sales tax rate is a key component of its financial ecosystem.

The current sales tax rate in San Diego is 8.75%, which includes the state base rate of 7.25%, a 0.5% county tax, and an additional 1% city tax. This rate is applicable to most goods and services purchased within the city limits, with some exceptions for specific items like groceries and prescription medications.

For residents and businesses, understanding this rate is crucial. It directly impacts the cost of living and doing business, influencing everything from the price of a cup of coffee to the overhead expenses for local enterprises. Additionally, it plays a vital role in the city's budget, funding essential services such as public safety, infrastructure maintenance, and social programs.

When compared to other major cities in California, San Diego's sales tax rate is relatively average. Cities like Los Angeles and San Francisco have similar rates, while some smaller cities may have slightly lower or higher rates depending on their local needs and economic conditions.

Exploring Other Cities in San Diego County

While San Diego may be the largest and most prominent city in the county, it’s not the only one with a unique sales tax rate. Each city in San Diego County has the autonomy to set its own additional tax rate, leading to a varied landscape across the region.

| City | Sales Tax Rate |

|---|---|

| Carlsbad | 8.75% |

| Chula Vista | 8.75% |

| Del Mar | 8.75% |

| Encinitas | 8.75% |

| Escondido | 8.75% |

| La Mesa | 8.75% |

| National City | 8.75% |

| Oceanside | 8.75% |

| Poway | 8.75% |

| Santee | 8.75% |

As seen in the table above, several cities in San Diego County, including Carlsbad, Chula Vista, Del Mar, and Encinitas, share the same sales tax rate of 8.75%. This uniformity is due to a combination of factors, including similar economic structures, shared regional challenges, and a desire for consistency in tax policies.

However, it's important to note that sales tax rates can change over time, especially as cities assess their financial needs and adjust their tax structures accordingly. Therefore, it's essential to stay updated on the latest rates to ensure compliance and accurate financial planning.

The Impact of Sales Tax on Local Economies

Sales tax rates can have a significant impact on the local economies of San Diego County’s cities. For businesses, a higher sales tax rate can increase overhead costs, potentially impacting their profitability and competitiveness. On the other hand, for consumers, a higher sales tax can increase the cost of living, particularly for those on fixed incomes.

However, sales tax also plays a critical role in funding essential services and infrastructure projects. It provides a significant source of revenue for cities to invest in areas such as education, healthcare, public safety, and community development. Therefore, while a higher sales tax rate may present challenges, it also contributes to the overall well-being and sustainability of the community.

For instance, in cities like Carlsbad and Encinitas, known for their vibrant tourism industries, a higher sales tax rate can help fund initiatives to maintain and enhance the visitor experience. This, in turn, can lead to increased tourism revenue, benefiting local businesses and the overall economy.

FAQs: Sales Tax in San Diego County

What is the state sales tax rate in California?

+

As of our last update, the state sales tax rate in California is 7.25%.

Do all cities in San Diego County have the same sales tax rate?

+

No, each city has the autonomy to set its own additional tax rate, leading to varying sales tax rates across the county.

How often do sales tax rates change in San Diego County cities?

+

Sales tax rates can change periodically, usually as cities assess their financial needs and adjust their tax structures accordingly.

What are the implications of a higher sales tax rate for businesses and consumers in San Diego County?

+

For businesses, a higher sales tax rate can increase overhead costs and impact profitability. For consumers, it can increase the cost of living, particularly for those on fixed incomes. However, it also funds essential services and infrastructure projects, benefiting the community as a whole.

Are there any exceptions to the sales tax rate in San Diego County?

+

Yes, certain items like groceries and prescription medications are often exempt from sales tax, resulting in a lower effective tax rate for these essential goods.