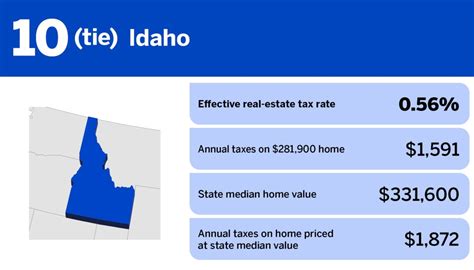

Idaho Real Estate Taxes

Understanding Idaho's real estate taxes is crucial for both homeowners and prospective buyers alike. This article aims to provide an in-depth analysis of the real estate tax system in Idaho, covering its unique features, calculation methods, and potential impacts on property owners. By exploring the state's tax laws and offering practical insights, we can navigate the complexities of real estate taxation in Idaho with confidence.

The Landscape of Idaho Real Estate Taxes

Idaho’s real estate tax system is designed to fund various state and local government services, including education, infrastructure, and public safety. The tax is levied on the assessed value of real property, which encompasses land, buildings, and any permanent fixtures attached to the land. The state’s tax code ensures a fair and equitable approach, aiming to maintain a stable revenue stream while minimizing the burden on property owners.

One of the key aspects of Idaho's real estate tax system is its reliance on assessed value, which is determined through a comprehensive process involving county assessors. These assessors are responsible for appraising properties within their jurisdictions, taking into account factors such as location, size, improvements, and recent sales data. The assessed value serves as the basis for calculating the tax liability, providing a transparent and consistent framework for property owners.

Assessed Value Determination

The process of determining the assessed value involves a meticulous evaluation of each property. County assessors employ various methods, including market analysis, cost approaches, and income capitalization techniques, to arrive at an accurate estimate. They consider recent sales of comparable properties, the cost of replacing or rebuilding the structure, and the potential income-generating capacity of the land. This multi-faceted approach ensures a fair and accurate assessment, reducing the likelihood of disputes and ensuring a stable tax base.

To illustrate, consider the case of a residential property in Ada County. The assessor might analyze recent sales of similar homes in the area, taking into account factors such as square footage, number of bedrooms and bathrooms, and any unique features like a swimming pool or finished basement. By comparing these sales, the assessor can determine a fair market value for the property, which forms the basis for its assessed value.

| Assessment Year | Assessed Value ($) |

|---|---|

| 2022 | 320,000 |

| 2023 | 335,000 |

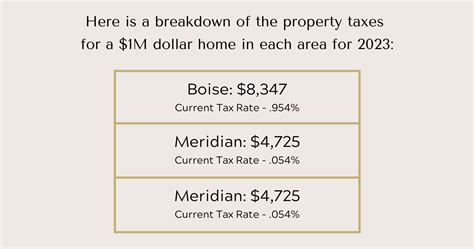

Tax Rate and Calculation

Once the assessed value is determined, the tax liability is calculated using a predefined tax rate, which is set by the local taxing authorities, such as cities, counties, and school districts. These tax rates vary depending on the location and the type of property. For instance, residential properties may have different tax rates compared to commercial or agricultural properties.

The tax rate is typically expressed as a millage rate, which represents the amount of tax owed per $1,000 of assessed value. For example, a millage rate of 5.25 mills would equate to $5.25 in taxes for every $1,000 of assessed value. This rate is then applied to the property's assessed value to calculate the annual tax liability.

To provide a concrete example, let's consider a residential property with an assessed value of $300,000 and a millage rate of 6.0 mills. The tax liability for this property would be calculated as follows:

- Assessed Value: $300,000

- Millage Rate: 6.0 mills

- Tax Liability = Assessed Value x Millage Rate

- Tax Liability = $300,000 x 0.006

- Tax Liability = $1,800

Therefore, the property owner would owe $1,800 in real estate taxes for the year.

Tax Exemptions and Credits

Idaho’s real estate tax system offers a range of exemptions and credits to alleviate the tax burden on certain property owners. These provisions aim to provide relief to homeowners, seniors, and veterans, among others, helping them maintain their properties and stay within their financial means.

Homestead Exemption

One of the most notable exemptions is the Homestead Exemption, which reduces the taxable value of a primary residence. To qualify for this exemption, the property must be the owner’s principal residence, and they must occupy it for at least six months out of the year. The exemption applies to a portion of the property’s assessed value, typically up to a certain limit, which varies by county.

For instance, in Ada County, homeowners can receive a maximum exemption of $100,000 on their primary residence. This means that the first $100,000 of the assessed value is exempt from taxation, reducing the overall tax liability. The exemption provides significant savings for homeowners, especially those with higher-valued properties.

Veterans and Seniors Exemptions

Idaho also offers specific exemptions for veterans and seniors. Veterans who meet certain criteria, such as having a service-connected disability or being a combat veteran, can qualify for a partial or full exemption on their property taxes. Similarly, seniors aged 65 and older may be eligible for a reduced tax rate, providing much-needed relief for those on fixed incomes.

Other Tax Credits and Incentives

In addition to the above exemptions, Idaho provides various tax credits and incentives to encourage specific behaviors or support certain industries. For instance, homeowners who install energy-efficient improvements or make accessibility modifications may be eligible for tax credits. Similarly, agricultural landowners can benefit from programs that promote sustainable farming practices or land conservation.

Impact on Property Owners

The real estate tax system in Idaho has a significant impact on property owners, influencing their financial planning and decision-making. While the tax provides a stable source of revenue for essential public services, it also represents a substantial expense for homeowners and businesses.

Financial Planning and Budgeting

Real estate taxes are a recurring expense that property owners must budget for annually. The tax liability can vary based on changes in the assessed value or tax rates, making it essential for owners to stay informed about these factors. Accurate budgeting ensures that property owners can set aside sufficient funds to cover their tax obligations without straining their finances.

For instance, a homeowner who purchases a new property must factor in the real estate taxes as a recurring cost, in addition to mortgage payments, maintenance, and other expenses. By understanding the tax liability and planning accordingly, homeowners can avoid financial surprises and maintain a healthy financial outlook.

Impact on Property Values

The real estate tax system also influences property values in Idaho. A well-managed tax system, with fair assessments and stable tax rates, can contribute to a healthy real estate market. Conversely, rapid increases in tax rates or inaccurate assessments can lead to market disruptions, making properties less attractive to buyers.

Property owners must consider the tax implications when buying or selling a property. A high tax burden can affect a property's affordability and desirability, impacting its resale value. Therefore, understanding the local tax landscape is crucial for making informed real estate decisions.

Community Impact and Economic Development

Real estate taxes play a vital role in funding local services and infrastructure, which, in turn, impact the overall quality of life in Idaho communities. Well-maintained roads, efficient public transportation, and high-quality education are all supported by real estate tax revenues. As such, the tax system contributes to the economic development and long-term sustainability of Idaho’s cities and towns.

Conclusion

Idaho’s real estate tax system is a complex yet vital component of the state’s economy and community infrastructure. By understanding the intricacies of assessed value determination, tax rates, and available exemptions, property owners can navigate the tax landscape with confidence. This knowledge empowers homeowners and investors to make informed decisions, ensuring their real estate ventures are financially sustainable and contribute to the vibrant communities of Idaho.

How often are property taxes assessed in Idaho?

+Property taxes in Idaho are typically assessed annually. County assessors update the assessed values based on market conditions and other factors each year. This ensures that the tax liability remains aligned with the property’s current value.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The process involves submitting an appeal to the county assessor’s office, providing evidence to support the requested change. It’s important to note that appeals must be made within a specific timeframe, typically 30 days after the assessment notice is received.

How are tax rates determined in Idaho?

+Tax rates in Idaho are set by local taxing authorities, such as cities, counties, and school districts. These entities consider various factors, including budget requirements, population growth, and the need for public services. The tax rate is expressed as a millage rate, which determines the tax liability for each property based on its assessed value.