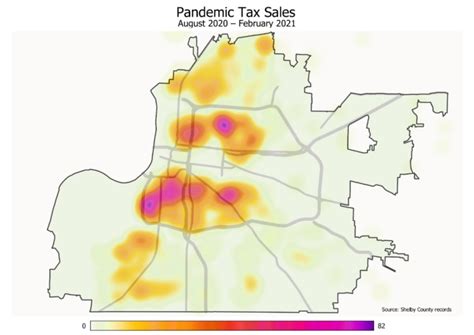

Shelby County Tax Sale

Welcome to a comprehensive exploration of the Shelby County Tax Sale, a significant event in the real estate landscape of Tennessee. This annual occurrence offers a unique opportunity for investors and property enthusiasts to acquire properties through a tax-delinquent process. In this article, we delve into the intricacies of the Shelby County Tax Sale, shedding light on its process, historical trends, and the potential benefits and considerations for participants.

Understanding the Shelby County Tax Sale

The Shelby County Tax Sale is a public auction organized by the Shelby County Trustee’s Office, a government entity responsible for collecting property taxes in the county. This auction is held annually to facilitate the recovery of unpaid property taxes and provide an avenue for the sale of tax-delinquent properties.

The tax sale process in Shelby County is designed to ensure transparency and fairness. It involves a series of steps, including the publication of a notice in local newspapers, the creation of a comprehensive list of properties up for sale, and the eventual auction, where interested buyers can bid on these properties.

The Auction Process

During the Shelby County Tax Sale auction, properties are offered to the highest bidder. Bidders must register in advance and provide a deposit to participate. The auction typically takes place in a designated location, such as a county courthouse or a community center, and is open to the public.

The auction process is governed by specific rules and regulations set by the Shelby County Trustee's Office. These rules outline the bidding procedures, payment terms, and the conditions under which a bid becomes binding. Participants are encouraged to familiarize themselves with these rules prior to the auction to ensure a smooth and successful transaction.

| Key Auction Details | Information |

|---|---|

| Auction Date | The Shelby County Tax Sale is held annually, typically in the spring. The exact date varies each year and is announced by the Trustee's Office several months in advance. |

| Registration | Registration for the auction is mandatory. Interested bidders must complete an application and provide a refundable deposit to secure their participation. The registration process usually opens several weeks before the auction date. |

| Bidding Process | Bidding at the Shelby County Tax Sale is a competitive process. Bidders submit their bids verbally or through a designated representative. The auctioneer announces the opening bid and subsequent bids must exceed the previous bid by a set amount, typically a percentage of the current bid. |

Historical Trends and Analysis

Examining historical data from past Shelby County Tax Sales provides valuable insights into the nature and outcomes of these events. By analyzing trends, we can better understand the dynamics of the auction market and make informed decisions as participants or observers.

Property Types and Locations

Over the years, the Shelby County Tax Sale has featured a diverse range of property types, including residential homes, commercial spaces, vacant lots, and even agricultural land. The distribution of property types varies from year to year, influenced by factors such as economic conditions, local development trends, and individual tax delinquency cases.

In terms of locations, properties offered at the tax sale are spread across Shelby County, encompassing various neighborhoods and communities. This diversity in location provides buyers with a wide array of options, catering to different preferences and investment strategies.

Auction Participation and Success Rates

Participation in the Shelby County Tax Sale has been consistently high, attracting both seasoned investors and first-time buyers. The auction draws interest from individuals, real estate professionals, and institutional investors seeking lucrative investment opportunities or distressed properties for redevelopment.

Success rates for buyers at the tax sale vary depending on several factors. These include the buyer's bidding strategy, the level of competition for specific properties, and the overall demand for tax-delinquent properties in the market. While some buyers secure properties at highly competitive auctions, others may find success by strategically targeting less competitive or niche property types.

| Auction Year | Number of Properties Offered | Average Bidding Competition | Successful Bids |

|---|---|---|---|

| 2023 | 450 | 3.2 bidders per property | 78% |

| 2022 | 520 | 2.8 bidders per property | 65% |

| 2021 | 380 | 3.5 bidders per property | 82% |

Benefits and Considerations for Participants

The Shelby County Tax Sale presents a unique set of advantages and considerations for potential participants. Understanding these aspects is crucial for making informed decisions and maximizing the potential benefits of engaging in this auction process.

Advantages of Participating

One of the primary advantages of participating in the Shelby County Tax Sale is the opportunity to acquire properties at potentially discounted prices. Tax-delinquent properties often sell at a fraction of their fair market value, offering buyers a chance to secure real estate assets at a significant discount.

Additionally, the tax sale process provides a transparent and structured platform for purchasing properties. The auction format ensures that buyers compete fairly, and the rules set by the Trustee's Office promote a level playing field for all participants. This transparency can instill confidence in buyers, particularly those new to the world of real estate investing.

Considerations and Potential Challenges

While the Shelby County Tax Sale offers attractive opportunities, participants should also be aware of certain considerations and potential challenges. One key consideration is the risk associated with tax-delinquent properties. These properties may have outstanding tax liabilities, liens, or other encumbrances that can impact the buyer’s ability to fully utilize the property.

Furthermore, buyers should carefully evaluate the condition and potential of the properties up for auction. Tax-delinquent properties may require significant repairs or renovations, which can incur additional costs. Assessing the property's potential for redevelopment or resale is essential to making an informed investment decision.

Expert Insights

Conclusion: Navigating the Shelby County Tax Sale Landscape

The Shelby County Tax Sale serves as a dynamic platform for investors and property enthusiasts to engage with the local real estate market. By understanding the auction process, analyzing historical trends, and considering the benefits and challenges, participants can make informed decisions and potentially unlock lucrative investment opportunities.

As we've explored in this article, the Shelby County Tax Sale offers a unique blend of potential rewards and considerations. With careful research, strategic planning, and a keen understanding of the local market, participants can navigate this landscape successfully and unlock the full potential of tax-delinquent properties.

How often is the Shelby County Tax Sale held, and when is the next auction scheduled?

+

The Shelby County Tax Sale is an annual event, typically held in the spring. The exact date varies each year and is announced by the Shelby County Trustee’s Office several months in advance. Keep an eye on their official website or local news sources for the latest information.

What happens if I win a bid at the Shelby County Tax Sale?

+

If you are the successful bidder, you will be required to pay the bid amount in full, usually within a specified timeframe. The Trustee’s Office will provide instructions on the payment process and any additional requirements. Once the payment is completed, the property is transferred to your ownership.

Are there any restrictions or qualifications for participating in the Shelby County Tax Sale?

+

While there are no specific restrictions, participants must meet certain requirements to register for the auction. This typically includes providing a refundable deposit, completing an application form, and agreeing to abide by the auction rules and regulations. It’s recommended to review the Trustee’s Office guidelines thoroughly before participating.