Georgia Car Ad Valorem Tax

The state of Georgia, like many other U.S. states, imposes a car ad valorem tax, which is a tax based on the value of a vehicle. This tax is an important revenue source for the state and is applicable to both new and used vehicle purchases. Understanding the intricacies of the Georgia car ad valorem tax is crucial for individuals considering purchasing a vehicle in the state, as it can significantly impact their overall costs.

Understanding the Georgia Car Ad Valorem Tax

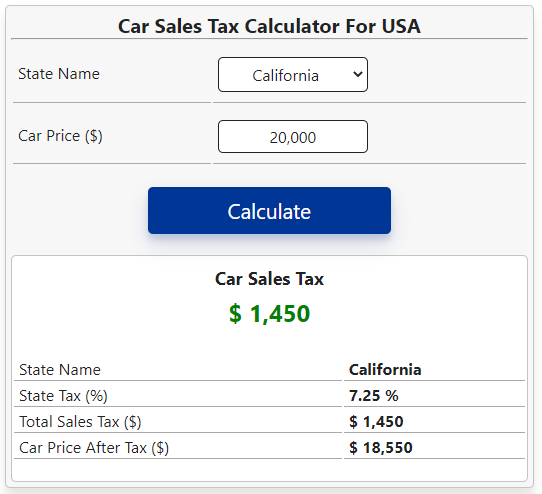

The car ad valorem tax in Georgia is a percentage-based tax calculated on the vehicle’s fair market value or the price paid for the vehicle, whichever is lower. This tax is separate from the sales tax that is also applied to vehicle purchases in the state. The ad valorem tax is unique in that it is assessed annually, meaning vehicle owners must pay this tax each year as long as they own the vehicle.

The tax rate for the ad valorem tax varies depending on the county in which the vehicle is registered. While the state of Georgia sets a minimum tax rate, counties have the authority to increase this rate. As of the latest information, the minimum state tax rate is 1%, but many counties in Georgia have implemented higher rates, with some reaching up to 2% or more.

For instance, let's consider a scenario where an individual purchases a used car for $15,000 in a county with a 1.5% ad valorem tax rate. In this case, the tax calculation would be as follows: $15,000 x 0.015 = $225. Thus, the individual would owe $225 in ad valorem tax for that year.

| County | Ad Valorem Tax Rate |

|---|---|

| Fulton County | 1.5% |

| DeKalb County | 1.6% |

| Cobb County | 1.7% |

| Gwinnett County | 1.5% |

| Chatham County | 1.4% |

It's important to note that the ad valorem tax is assessed based on the vehicle's value on January 1st of each year. This means that if a vehicle is purchased after this date, the tax will still be calculated based on the vehicle's value as of January 1st, not the purchase price or date.

Exemptions and Credits

Georgia provides certain exemptions and tax credits for specific vehicle types and situations. For instance, as mentioned earlier, hybrid and electric vehicles are eligible for a tax credit, reducing the ad valorem tax liability. Additionally, vehicles that are at least 20 years old are considered antiques and are exempt from the ad valorem tax.

Other exemptions include vehicles used for agricultural purposes, military vehicles, and vehicles owned by certain organizations like churches or charitable institutions. It's crucial for vehicle owners to understand these exemptions to ensure they are not overpaying on their ad valorem taxes.

Calculating Tax Credits for Green Vehicles

For green vehicles like hybrids and electric cars, the tax credit is calculated based on the vehicle’s original purchase price. The credit is equal to 50% of the state’s minimum ad valorem tax rate, which is currently 1%. Therefore, the credit amounts to 0.5% of the vehicle’s purchase price.

For example, if an individual purchases a hybrid vehicle for $30,000, the tax credit calculation would be as follows: $30,000 x 0.005 = $150. This means the individual would receive a $150 tax credit, reducing their ad valorem tax liability for that year.

Payment Options and Due Dates

Vehicle owners in Georgia have several options for paying their ad valorem tax. The most common method is to pay online through the Georgia Tax Center website, which offers a secure and convenient payment portal. Alternatively, owners can pay in person at their county tax commissioner’s office or by mail using a remittance voucher.

The due date for the ad valorem tax varies by county. Generally, the tax is due by the first business day in March, but some counties may have slightly different due dates. It's crucial for vehicle owners to stay informed about their specific county's due date to avoid late fees and penalties.

Late Payment Penalties

Failure to pay the ad valorem tax by the due date can result in late fees and interest charges. The late fee is typically 10% of the total tax due, and interest accrues daily at a rate of 1% until the tax is paid in full. These penalties can quickly add up, so it’s best to pay the tax on time to avoid unnecessary costs.

The Future of Georgia’s Car Ad Valorem Tax

The Georgia car ad valorem tax has been a source of revenue for the state for many years, and its future is likely to continue along a similar path. While there have been discussions about potential reforms to the tax system, no significant changes have been implemented recently. The varying tax rates across counties are likely to remain, allowing local governments to have some autonomy in their tax policies.

However, with the increasing popularity of electric and hybrid vehicles, the tax credit for these vehicles may become a more significant factor in the overall tax landscape. This could incentivize more individuals to switch to greener transportation options, benefiting both the environment and their wallets.

Additionally, as the automotive industry continues to evolve, with advancements in autonomous vehicles and ride-sharing services, the ad valorem tax system may need to adapt to accommodate these changes. The future of transportation is likely to bring new challenges and opportunities for tax policy in Georgia and beyond.

How often do I need to pay the ad valorem tax in Georgia?

+The ad valorem tax in Georgia is an annual tax, meaning it is due once a year. The specific due date varies by county but is typically around the first business day in March.

Are there any ways to reduce my ad valorem tax liability in Georgia?

+Yes, there are a few ways to reduce your ad valorem tax liability. One way is to purchase a hybrid or electric vehicle, which is eligible for a tax credit. Additionally, if your vehicle is at least 20 years old and considered an antique, it may be exempt from the tax.

Can I deduct my ad valorem tax payment from my federal taxes?

+No, the ad valorem tax is a state-level tax and cannot be deducted from federal taxes. However, it may be deductible on your state tax return, so it’s worth checking with a tax professional or reviewing the Georgia tax guidelines.

What happens if I sell my vehicle during the tax year?

+If you sell your vehicle during the tax year, you are still responsible for paying the ad valorem tax for that year. However, you may be eligible for a partial refund based on the number of months you owned the vehicle. It’s best to consult with your county tax office for specific refund guidelines.