Is Vehicle Sales Tax

In the world of automotive transactions, the question of sales tax is a crucial consideration for both buyers and sellers. The amount of sales tax due on a vehicle purchase can significantly impact the overall cost and financial planning associated with acquiring a new or used car. This comprehensive guide delves into the intricacies of vehicle sales tax, shedding light on the factors that influence it and the processes involved in calculating and paying this essential tax.

Understanding Vehicle Sales Tax: A Comprehensive Overview

Vehicle sales tax is a type of excise tax levied on the purchase of motor vehicles, typically at the state or local level. This tax is an essential revenue stream for governments, contributing to the funding of various public services and infrastructure projects. For buyers, understanding the sales tax on vehicles is vital, as it directly affects the total cost of ownership.

The rate of vehicle sales tax varies across jurisdictions, often ranging from 5% to 10% of the purchase price. Some states impose a flat rate, while others have a progressive scale based on the vehicle's value. Additionally, certain areas may exempt specific types of vehicles, such as electric or hybrid cars, from sales tax to encourage environmentally friendly choices.

Factors Influencing Sales Tax Rates

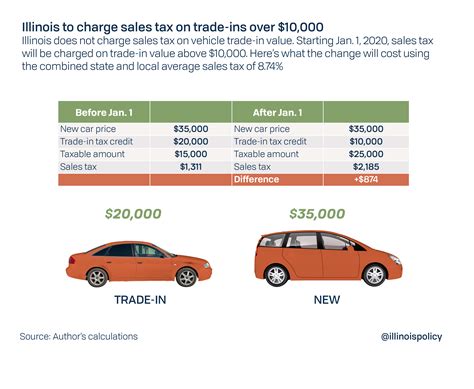

Several factors come into play when determining the sales tax on a vehicle purchase. These include the state or region where the purchase is made, the type of vehicle (new or used), and any applicable discounts or incentives. For instance, buying a car from a dealership in one state and registering it in another can result in different tax rates and requirements.

The table below illustrates the varying sales tax rates across a selection of U.S. states, showcasing the diversity in tax structures and the potential financial impact on vehicle buyers.

| State | Sales Tax Rate |

|---|---|

| Alabama | 4% |

| California | 7.25% |

| Florida | 6% |

| New York | 8% |

| Texas | 6.25% |

Calculating and Paying Vehicle Sales Tax

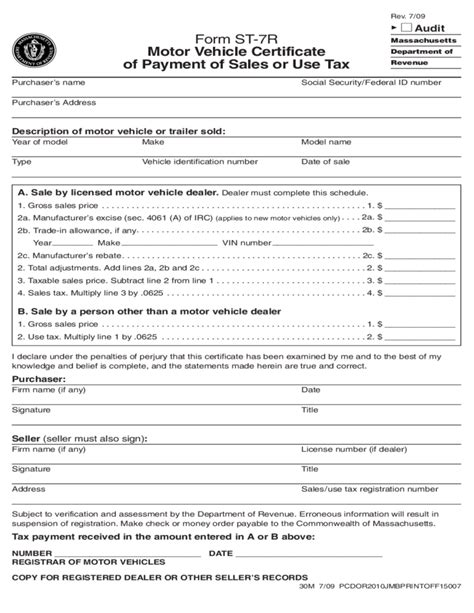

The process of calculating and paying vehicle sales tax involves several steps. Typically, the buyer provides the seller with information about their residency and the vehicle’s purchase price. The seller then calculates the sales tax based on the applicable rate and includes it in the total cost.

When purchasing a vehicle from a dealership, the sales tax is often included in the final invoice, making the transaction more straightforward. However, for private sales or purchases from independent sellers, buyers may need to calculate the sales tax themselves and remit it directly to the relevant tax authority.

Special Considerations for Online Purchases

With the rise of online vehicle marketplaces, the process of calculating and paying sales tax has become more complex. In many cases, buyers must pay the sales tax to the state where the vehicle is registered, even if they reside in a different state. This can lead to additional paperwork and potential tax discrepancies, highlighting the importance of staying informed about the latest regulations.

Some online marketplaces and dealerships offer tools to help buyers estimate the sales tax based on their location and the vehicle's purchase price. These tools provide a more accurate picture of the total cost, including tax, and can assist buyers in making more informed decisions.

Future Implications and Industry Trends

The landscape of vehicle sales tax is constantly evolving, with new trends and regulations shaping the industry. As governments seek to optimize revenue streams and adapt to changing consumer behaviors, we can expect to see ongoing adjustments to sales tax rates and collection processes.

One notable trend is the increasing focus on electric and hybrid vehicles, with many states offering incentives and tax breaks to encourage their adoption. This shift towards sustainable transportation options has the potential to reshape the sales tax landscape, creating new challenges and opportunities for both buyers and sellers.

Additionally, the growth of ride-sharing and car-subscription services is prompting governments to reevaluate their sales tax structures. These emerging business models often involve complex ownership and leasing arrangements, necessitating new tax regulations to ensure fair revenue collection.

As the automotive industry continues to innovate, it is essential for buyers, sellers, and tax authorities to stay abreast of these changes. Staying informed ensures compliance with the latest regulations and helps stakeholders navigate the evolving landscape of vehicle sales tax effectively.

Are there any ways to reduce or avoid sales tax on vehicle purchases?

+In certain circumstances, buyers may be eligible for sales tax exemptions or discounts. For example, individuals with disabilities or veterans may qualify for reduced tax rates. Additionally, some states offer incentives for purchasing environmentally friendly vehicles, such as electric or hybrid cars. However, it’s important to note that these exemptions and incentives are subject to specific criteria and may vary by state.

What happens if I fail to pay the correct sales tax on my vehicle purchase?

+Failing to pay the correct sales tax can result in significant penalties and legal consequences. Tax authorities have mechanisms in place to identify and pursue individuals who underreport or avoid paying sales tax. It’s crucial to accurately calculate and remit the appropriate sales tax to avoid potential legal issues and financial penalties.

How often do sales tax rates change, and how can I stay updated on these changes?

+Sales tax rates can change periodically, often in response to legislative decisions or economic factors. To stay informed, it’s advisable to regularly check the official websites of your state’s tax authority or department of revenue. These websites typically provide up-to-date information on tax rates and any relevant changes or updates.