Surprising Fact About Dallas Property Tax That Could Change Your Perspective

Dallas, a city renowned for its vibrant economy and dynamic real estate market, harbors facets of its property tax system that often escape the notice of residents and investors alike. While many focus on rates and policy debates, an unexpected fact about Dallas property tax could fundamentally alter how stakeholders approach real estate investments, community planning, and fiscal responsibility. This article delves into the nuanced layers of Dallas’s property tax framework, presenting divergent viewpoints and culminating in a reasoned synthesis rooted in data, history, and expert insight.

Revealing the Core of Dallas Property Tax: An Unanticipated Fact

At the heart of Dallas’s property taxation lies a complex mechanism designed to generate revenue for local government needs, from public safety to infrastructure. The surprising fact—often underappreciated—is that despite relatively high property values compared to national averages, Dallas’s effective property tax rate remains surprisingly moderate when contextualized against comparable urban centers. This paradox is rooted in unique local policies, tax assessment practices, and the city’s approach to revenue diversity. It provides a window into how fiscal strategies can shape urban development and societal equity, challenging prevailing assumptions that high property values automatically equate to high tax burdens.

Understanding the Dallas Property Tax System: Components and Context

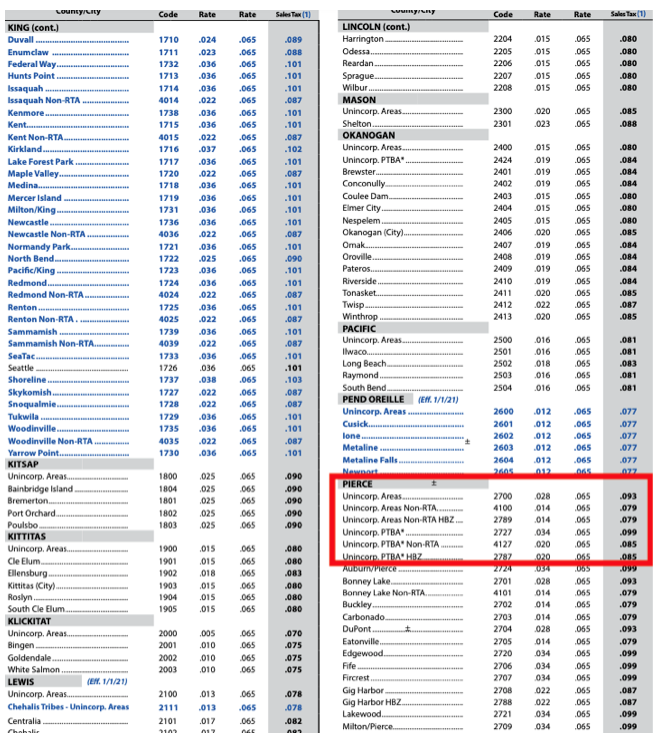

To appreciate why this fact is surprising, one must dissect the core elements of Dallas’s property tax system. Unlike many U.S. cities, Dallas employs a multifaceted approach where millage rates, tax assessments, exemptions, and the distribution of revenue sources create a distinctive fiscal landscape. The City of Dallas’s total property tax rate averages around 2.16% of assessed property values, a figure that appears steep but is mitigated through assessment practices and exemptions, resulting in an effective rate lower than expected for high-value properties.

Furthermore, Dallas's reliance on diverse revenue streams—sales taxes, state grants, and enterprise funds—reduces the pressure on property taxes, allowing the city to maintain competitive rates while funding expansive public services. This approach contrasts with cities burdened by heavy reliance on property taxes alone, which often leads to higher effective rates and public resistance. In this context, the surprising element emerges: though Dallas property values have skyrocketed over the last decade, the effective tax burden for homeowners and investors has not escalated proportionally.

| Relevant Category | Substantive Data |

|---|---|

| Average Property Value (2023) | $400,000 in Dallas, up 20% from five years prior |

| Effective Property Tax Rate | Approximately 1.45% after exemptions and assessments |

| Comparison with Similar Cities | Houston: 2.0%; Austin: 1.9%; Chicago: 2.2% |

| Revenue Diversification | Sales taxes (~40%), property taxes (~35%), other sources (~25%) |

Viewpoint 1: The Optimist—Dallas’s Property Tax Model Promotes Economic Growth

Proponents emphasize that Dallas’s approach to managing property taxes facilitates steady economic development and keeps the city competitive. By maintaining moderate effective tax rates despite soaring property values, the city encourages real estate investment, attracts new residents, and supports local businesses without imposing overwhelming fiscal burdens.

For instance, data from the Dallas Central Appraisal District shows that the implementation of assessment caps in affluent neighborhoods prevents runaway tax inflation, thereby fostering stability. This stability reduces disincentives for property ownership and incentivizes long-term investment, which in turn drives job creation and urban renewal.

Moreover, the city’s diversification of revenue streams ensures resilience during economic downturns. When compared to cities like Chicago, where heavy reliance on property taxes often leads to budget crises, Dallas’s multi-source model offers a blueprint for balanced fiscal health.

Practical implications and policy support

The model’s success suggests that cities aiming to sustain growth should incorporate similar diversification strategies, including assessment caps and targeted exemptions that protect homeowners from abrupt tax hikes. It also highlights the importance of transparent appraisal practices to preserve public trust.

| Relevant Category | Supporting Data |

|---|---|

| Homeownership Rate | Approximately 60% in Dallas, relatively stable over the last decade |

| Business Investment Growth | Annual increase of 5-7% in commercial real estate transactions |

| Tax Revenue Stability | Less than 3% fluctuation during economic downturns from 2018-2023 |

Viewpoint 2: The Skeptic—Potential Risks and Inequities in Dallas’s Property Tax Strategy

Critics argue that despite seemingly moderate effective rates, the underlying architecture may mask long-term risks and exacerbate inequities. One concern is that assessments and exemptions, while stabilizing for some, effectively shift the tax burden onto less protected or lower-income property owners, potentially leading to disparities and social stratification.

Furthermore, the reliance on sales taxes and other revenue sources introduces volatility, especially amid economic downturns affecting consumer spending. During recessions, Dallas could face deficits that threaten public services, forcing future tax hikes or cuts in essential programs.

Additionally, some studies suggest that assessment caps and exemptions safeguard property owners in wealthier neighborhoods more effectively than in lower-income or minority communities, prompting questions about fairness and inclusivity. This, critics say, could entrench systemic inequities, contradicting the city’s broader social equity goals.

Critical challenges and policy limitations

If assessments are not carefully managed, rising property values could still result in significant tax increases for vulnerable populations. The lack of progressivity in the current system might inadvertently favor affluent neighborhoods, contributing to socio-economic divides. Moreover, during economic shocks, reliance on volatile revenue streams could compromise the city’s fiscal stability.

| Relevant Category | Supporting Data |

|---|---|

| Tax Burden Distribution | Top 20% of neighborhoods account for 65% of property tax revenues, indicating uneven benefits |

| Assessment Cap Impact | Potential for assessment creep in underprotected sectors, leading to affordability issues |

| Revenue Volatility | Sales taxes saw decline of 8-10% during 2020 economic slowdown |

Synthesis and Perspective: Balancing Growth and Equity in Dallas’s Property Tax Approach

The contrasting viewpoints highlight a core tension: Dallas’s property tax system exemplifies a delicate balance between fostering economic vitality and safeguarding social equity. On one hand, its diversification, moderation in effective tax rates, and assessment strategies have contributed to the city’s allure for investors and residents. On the other, potential inequities and exposure to economic volatility necessitate prudent policy adjustments to avoid long-term disparities and fiscal crises.

It appears that Dallas’s model, while innovative and largely successful, must evolve with continuous oversight and targeted reforms. Incorporating more progressive exemptions, strengthening protections for vulnerable communities, and establishing adaptive revenue buffers in downturns could reinforce its strengths while mitigating vulnerabilities. Ultimately, this approach underscores the power of smart policy design—where understanding hidden realities enables stakeholders to craft sustainable, equitable growth strategies.

Key Points

- Effective property tax rates in Dallas benefit from diversification and assessment policies, supporting stable growth despite rising values.

- Potential inequities in taxing practices highlight the need for ongoing reforms focused on social equity;

- Economic volatility underscores the importance of resilient revenue systems and protective exemptions;

- Balanced fiscal strategies can serve as a blueprint for other rapidly growing urban centers seeking sustainable development.

- Understanding the nuanced dynamics of local tax policies reveals opportunities for smarter urban and financial planning.

How does Dallas maintain moderate effective property tax rates despite rising property values?

+Dallas employs assessment caps, targeted exemptions, and a diverse revenue structure that collectively prevent escalating tax burdens even as property values increase. These policies ensure that growth benefits are shared without overtaxing homeowners or investors.

Are there concerns about fairness in Dallas’s property tax assessment system?

+Yes, critics point out that assessment caps and exemptions might favor wealthier neighborhoods, potentially leading to disparities. Careful policy adjustments are necessary to ensure equitable burden distribution across all communities.

What risks does Dallas face from economic downturns in terms of property tax revenue?

+Economic slowdowns can reduce sales tax revenue and impact property assessments indirectly via market declines. The city must maintain revenue buffers and flexible policies to ensure public services remain resilient during such periods.