Broward County Taxes Com

Welcome to the ultimate guide on understanding and navigating the intricacies of Broward County Taxes. This comprehensive article will delve into the various aspects of tax processes, offering valuable insights for both residents and businesses in this vibrant county. From tax assessments to payment options and relief programs, we'll explore it all, ensuring you're equipped with the knowledge to manage your tax obligations efficiently.

The Broward County Tax Ecosystem: An Overview

Broward County, located in the heart of Florida, is a dynamic hub of economic activity, home to a diverse range of businesses and residents. The tax system in Broward County is designed to support the county’s growth while ensuring a fair and efficient tax collection process. Understanding this system is crucial for individuals and businesses to stay compliant and make informed financial decisions.

Key Tax Authorities and Their Roles

The tax landscape in Broward County is overseen by several key authorities, each with distinct responsibilities:

- Broward County Property Appraiser’s Office: Responsible for the annual assessment of property values, a critical step in determining property tax liabilities.

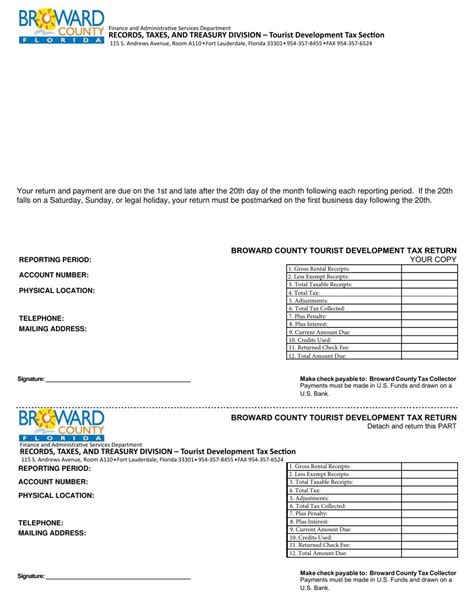

- Broward County Tax Collector’s Office: Handles the collection and distribution of various taxes, including property taxes, vehicle registration fees, and more.

- Broward County Board of County Commissioners: Sets the tax rates and allocates funds to essential services like education, public safety, and infrastructure.

- Florida Department of Revenue: Oversees state-level taxes and provides guidance to local authorities, ensuring compliance with state tax laws.

Tax Assessment and Property Valuation

One of the most crucial aspects of the Broward County tax system is property valuation. The Property Appraiser’s Office assesses the value of real estate properties annually. This valuation process considers factors like market trends, property improvements, and location, to ensure an accurate assessment. Property owners receive a Notice of Proposed Property Taxes, detailing the assessed value and the estimated tax amount.

Property owners have the right to appeal their assessments if they believe the valuation is incorrect. The process involves submitting evidence to support a lower valuation, such as recent sales data or appraisals. The Property Appraiser's Office reviews these appeals and makes final determinations.

Tax Payment Options and Deadlines

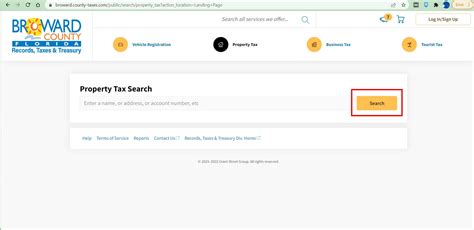

Broward County offers several convenient payment options for taxpayers. Property taxes can be paid online through the Tax Collector’s website, via phone, or by mail. Additionally, taxpayers can opt for automatic payments, ensuring timely payments without the risk of late fees.

| Payment Method | Description |

|---|---|

| Online Payment | Secure and instant payment through the Tax Collector's website. |

| Phone Payment | Pay over the phone using a credit or debit card. |

| Mail-in Payment | Send a check or money order to the Tax Collector's Office. |

| Automatic Payment | Set up recurring payments to avoid late fees. |

Tax payment deadlines are typically set for two installments: November 1st and March 31st. Failure to pay by these deadlines can result in late fees and potential penalties. It's crucial for taxpayers to stay informed about these deadlines to avoid unnecessary financial burdens.

Tax Relief Programs: A Safety Net for Residents

Broward County understands the financial challenges that taxpayers may face. To provide relief, the county offers several tax relief programs designed to assist eligible residents.

- Homestead Exemption: Property owners who permanently reside in their homes can apply for a Homestead Exemption, which reduces the taxable value of their property, resulting in lower property taxes.

- Senior Exemption: Broward County provides an additional exemption for senior citizens aged 65 and above. This exemption further reduces the taxable value of their property, offering significant savings.

- Low-Income Tax Relief: For low-income residents, the county offers programs like the Low-Income Tax Relief program, which provides refunds to eligible individuals who have paid more in taxes than their income should dictate.

These relief programs demonstrate Broward County's commitment to supporting its residents and ensuring that tax obligations remain manageable.

Navigating the Tax Process: A Step-by-Step Guide

Understanding the tax process is crucial for efficient financial management. Here’s a comprehensive guide to help you navigate the various stages:

Step 1: Understanding Your Tax Liability

The first step in managing your taxes is to understand your tax liability. This involves receiving and reviewing your Notice of Proposed Property Taxes. Take time to carefully examine the assessed value and the calculated tax amount. If you have any questions or concerns, reach out to the Property Appraiser’s Office for clarification.

Step 2: Appealing Your Assessment (if necessary)

If you believe your property has been overvalued, you have the right to appeal. The process typically involves submitting an appeal application, along with supporting evidence, to the Property Appraiser’s Office. It’s essential to act promptly, as there are deadlines for appealing assessments.

Step 3: Choosing a Payment Method

With your tax liability determined, it’s time to choose a payment method that suits your preferences and financial situation. Whether you opt for online payments, phone payments, or traditional mail-in methods, ensure you meet the payment deadlines to avoid late fees.

Step 4: Taking Advantage of Tax Relief Programs

Don’t forget to explore the various tax relief programs offered by Broward County. If you meet the eligibility criteria for programs like the Homestead Exemption or Senior Exemption, be sure to apply. These programs can significantly reduce your tax burden and provide much-needed financial relief.

The Future of Broward County Taxes: Technological Advancements and Digital Transformation

As technology continues to advance, the Broward County tax system is undergoing a digital transformation. This shift aims to enhance efficiency, improve accessibility, and provide taxpayers with a seamless experience.

Digital Tools and Online Services

Broward County is investing in digital tools and online services to make tax-related tasks more convenient. Taxpayers can now access their account information, view tax documents, and make payments online, anytime, from the comfort of their homes. This digital shift reduces the need for physical visits to government offices, saving time and effort.

Data Security and Privacy Measures

With the increasing reliance on digital platforms, data security and privacy have become top priorities. Broward County has implemented robust security measures to protect taxpayer information. Encryption protocols, secure servers, and regular security audits ensure that personal and financial data remains safe and confidential.

Artificial Intelligence and Automation

Artificial Intelligence (AI) and automation are being leveraged to streamline various tax processes. AI-powered systems can analyze vast amounts of data, detect patterns, and identify potential errors or inconsistencies. This technology assists in ensuring accurate assessments and efficient tax collection, while also reducing the workload for tax authorities.

Conclusion: Empowering Taxpayers in Broward County

Understanding and navigating the Broward County tax system is a crucial aspect of financial management for residents and businesses alike. This comprehensive guide has provided an in-depth look at the tax process, from assessment to payment, and highlighted the support systems and relief programs in place. By staying informed and leveraging the resources available, taxpayers can ensure they meet their obligations while taking advantage of the benefits offered by Broward County.

Frequently Asked Questions

How often are property values assessed in Broward County?

+Property values in Broward County are assessed annually by the Property Appraiser’s Office. This annual assessment ensures that property taxes are based on current market values.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline can result in late fees and potential penalties. It’s important to stay informed about payment deadlines to avoid additional financial burdens.

How can I appeal my property assessment if I believe it’s inaccurate?

+To appeal your property assessment, you need to submit an appeal application to the Property Appraiser’s Office along with supporting evidence. It’s crucial to act promptly, as there are specific deadlines for appeals.

Are there any tax relief programs available for low-income residents?

+Yes, Broward County offers the Low-Income Tax Relief program, which provides refunds to eligible low-income individuals who have paid more in taxes than their income should dictate.