Nevada Tax Calculator

The Nevada Tax Calculator is a valuable tool for individuals and businesses operating within the state, offering a comprehensive solution for tax calculations and providing essential insights into the complex world of Nevada's tax system. This calculator serves as a reliable guide, ensuring compliance with the state's tax regulations and offering a simplified approach to what can often be a daunting task. By understanding the intricacies of Nevada's tax structure, users can make informed decisions, manage their tax obligations efficiently, and navigate the state's unique tax landscape with confidence.

Navigating Nevada’s Tax Landscape

Nevada, known for its vibrant economy and diverse industries, presents a unique set of tax considerations. The state’s tax system is designed to support its thriving business environment while also catering to the needs of its residents. With a focus on simplicity and efficiency, the Nevada Tax Calculator aims to demystify the tax process, making it accessible and understandable for all.

Key Features of the Nevada Tax Calculator

This innovative tool offers a range of features tailored to the specific needs of Nevada taxpayers. From calculating income tax to assessing sales tax obligations, the calculator provides a one-stop solution for all tax-related queries. Here’s a breakdown of its key functionalities:

- Income Tax Calculation: Users can input their income details, including wages, dividends, and other sources, to determine their exact tax liability. The calculator considers various deductions and credits, ensuring an accurate assessment of the tax due.

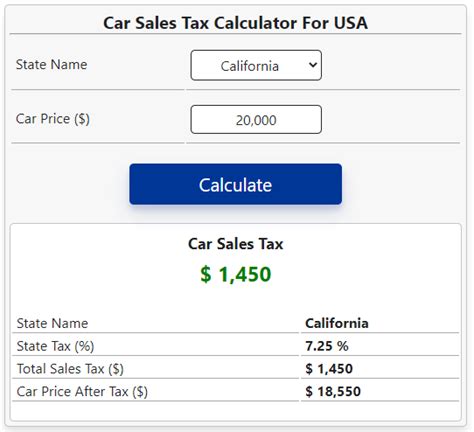

- Sales Tax Estimation: For businesses, the calculator estimates sales tax obligations based on the nature of their operations. It takes into account the specific sales tax rates applicable to different regions within Nevada, providing a precise breakdown of tax collections.

- Property Tax Assessment: The tool also assists in understanding property tax obligations. By inputting property details and location, users can estimate the annual tax liability, helping them budget effectively for this significant expense.

- Tax Planning Strategies: Beyond calculations, the Nevada Tax Calculator offers strategic insights. It provides suggestions on tax-efficient practices, helping users optimize their financial plans and minimize their tax burden.

By leveraging these features, taxpayers can streamline their tax management process, ensuring accuracy and compliance with Nevada's tax laws. The calculator's user-friendly interface and comprehensive coverage of tax categories make it an indispensable tool for both personal finance management and business tax planning.

The Impact of Nevada’s Tax Structure

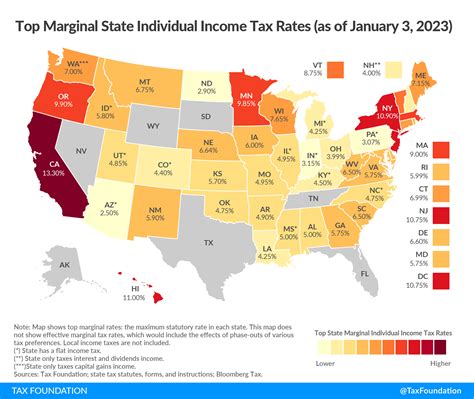

Nevada’s tax system is designed to encourage economic growth and investment. The state boasts a competitive tax environment, with no personal income tax or corporate income tax, making it an attractive destination for businesses and entrepreneurs. However, this also means that other tax streams, such as sales tax and property tax, play a more significant role in funding public services and infrastructure.

| Tax Category | Rate |

|---|---|

| Sales Tax (Statewide) | 6.85% |

| Property Tax (Average Effective Rate) | 0.68% |

| Gasoline Tax | $0.3075 per gallon |

The table above provides a glimpse into Nevada's tax rates. While the state maintains a low overall tax burden, these rates can have a substantial impact on businesses and individuals. The Nevada Tax Calculator helps users understand these implications, offering a transparent view of their tax obligations.

Case Studies: Real-World Applications

To illustrate the practical utility of the Nevada Tax Calculator, let’s explore a couple of scenarios:

Scenario 1: Small Business Owner

Sarah, a small business owner in Las Vegas, relies on the calculator to estimate her sales tax obligations. With a thriving online store, she needs to accurately collect and remit sales tax to the state. The calculator provides her with a breakdown of the applicable rates based on her product categories and shipping locations, ensuring she meets her tax responsibilities without overburdening her customers.

Scenario 2: Retiree Planning

John, a retiree in Reno, uses the calculator to understand his tax position. With a fixed income, he needs to budget effectively. The calculator helps him estimate his property tax liability, ensuring he can plan his expenses accordingly. Additionally, it provides insights into potential tax savings strategies, helping John make the most of his retirement funds.

Expert Insights: Maximizing Tax Efficiency

According to tax experts, the key to optimizing tax efficiency in Nevada lies in understanding the state’s specific tax landscape. While the absence of income tax is a significant advantage, businesses and individuals must navigate other tax categories diligently. Here are some expert tips for maximizing tax efficiency:

- Stay Informed: Keep abreast of any changes in tax rates or regulations. Nevada's tax system, while stable, may undergo periodic adjustments. Staying informed ensures you can adapt your tax strategies accordingly.

- Utilize Deductions: Nevada offers a range of deductions and credits, particularly for businesses. Understanding these incentives and utilizing them effectively can reduce your tax burden significantly.

- Seek Professional Advice: For complex tax situations, consider consulting a tax professional. They can provide tailored advice, ensuring you navigate the tax landscape with precision and confidence.

Conclusion: A Comprehensive Tax Solution

The Nevada Tax Calculator stands as a testament to the state’s commitment to providing accessible and efficient tax management tools. By offering a user-friendly interface and comprehensive coverage of tax categories, it empowers taxpayers to take control of their financial obligations. Whether you’re a business owner, investor, or resident, this calculator ensures you can navigate Nevada’s tax landscape with confidence and precision.

FAQ

How accurate are the calculations provided by the Nevada Tax Calculator?

+The calculator utilizes the most up-to-date tax rates and regulations provided by the state of Nevada. However, it’s important to note that tax laws can be complex, and individual circumstances may vary. While the calculator offers a highly accurate estimation, it’s recommended to consult a tax professional for precise and personalized advice.

Can the calculator handle complex tax scenarios, such as multiple income streams or business deductions?

+Absolutely! The Nevada Tax Calculator is designed to accommodate a wide range of tax situations. It takes into account various income sources, deductions, and credits, ensuring a comprehensive analysis. Whether you’re an individual with multiple jobs or a business owner, the calculator provides an accurate assessment tailored to your specific circumstances.

Are there any additional fees associated with using the Nevada Tax Calculator?

+The Nevada Tax Calculator is a free online tool provided by the state to assist taxpayers. There are no hidden fees or charges associated with its use. However, it’s important to review any potential fees related to filing taxes or seeking professional tax advice, which may vary based on individual needs.

How often are the tax rates and regulations updated within the calculator?

+The Nevada Tax Calculator is regularly updated to reflect any changes in tax laws and rates. The state ensures that the calculator remains current, providing users with the most accurate and reliable information. It’s advisable to check for updates periodically to stay informed about any modifications in tax regulations.