Minneapolis Mn Sales Tax

Welcome to Minneapolis, Minnesota, a vibrant city known for its thriving cultural scene, beautiful parks, and, of course, its unique sales tax structure. Understanding the sales tax in Minneapolis is crucial for both residents and visitors, as it impacts everyday transactions and financial planning. This article aims to provide a comprehensive guide to the Minneapolis sales tax, shedding light on its rates, applicable goods and services, and any unique features that set it apart from other cities.

Understanding the Minneapolis Sales Tax Landscape

The sales tax in Minneapolis operates under a multilayered system, consisting of various tax rates imposed by different governing bodies. These include the state of Minnesota, Minneapolis city, and sometimes even special districts within the city. Each layer adds a specific percentage to the overall sales tax, which can vary depending on the type of goods or services being purchased.

As of [current date], the state of Minnesota imposes a sales tax rate of 6.875% on most retail sales. This state tax is a foundational rate, to which other taxes are added based on the specific location within Minnesota.

City of Minneapolis Sales Tax

The City of Minneapolis adds an additional 0.5% sales tax, bringing the total sales tax rate within the city to 7.375%. This city-specific tax is applied uniformly across most goods and services, making it a crucial consideration for anyone doing business or shopping in Minneapolis.

It's important to note that this city tax is not the only additional tax that may be applicable. Certain special districts within Minneapolis, such as the Minneapolis Park and Recreation Board, may impose their own taxes, resulting in even higher sales tax rates in specific areas or for certain activities.

Goods and Services Subject to Sales Tax

The sales tax in Minneapolis is applicable to a wide range of tangible personal property and certain services. This includes everyday items like groceries, clothing, electronics, and vehicles. However, there are some notable exceptions and exemptions, which can vary depending on the type of goods or services involved.

For instance, certain food items, prescription drugs, and medical devices are exempt from sales tax in Minnesota. Additionally, services like healthcare, legal advice, and certain professional services may not be subject to sales tax, depending on the specific circumstances and the applicable laws.

| Taxable Items | Tax Rate |

|---|---|

| Groceries (excluding prepared food) | 6.875% |

| Clothing and Shoes | 6.875% |

| Electronics | 7.375% |

| Vehicles | 7.375% |

| Restaurants and Prepared Food | 7.375% |

Sales Tax Exemptions and Special Considerations

Minnesota and Minneapolis have various sales tax exemptions and special considerations, which can significantly impact the overall tax burden for certain individuals and businesses. These exemptions are designed to encourage specific behaviors or support certain industries.

For example, Minnesota offers a sales tax exemption for qualifying solar energy equipment, promoting the use of renewable energy sources. Additionally, certain charitable organizations may be exempt from sales tax on their purchases, provided they meet specific criteria and obtain the necessary certifications.

It's crucial for businesses operating in Minneapolis to stay updated on these exemptions and consider their eligibility. This can lead to significant savings and a more favorable tax position.

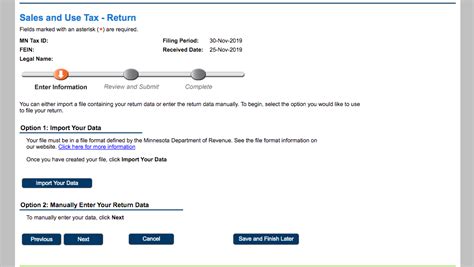

Compliance and Reporting

Compliance with sales tax laws is a critical aspect of doing business in Minneapolis. Businesses are responsible for collecting, remitting, and reporting sales tax accurately to the appropriate authorities. This process involves several steps and can be complex, especially for businesses with multiple locations or those selling taxable and exempt items.

The Minnesota Department of Revenue provides resources and guidelines to help businesses understand their sales tax obligations. This includes information on registering for a sales tax permit, calculating and remitting sales tax, and maintaining proper records for audit purposes.

Businesses should also be aware of their reporting frequency, which can vary based on their sales volume. Most businesses are required to file sales tax returns and remit taxes on a monthly or quarterly basis, but some may be eligible for annual reporting.

Online Sales and Remote Sellers

With the rise of e-commerce, online sales and remote sellers have become a significant consideration for sales tax compliance. In Minnesota, remote sellers are generally required to collect and remit sales tax if they have a certain level of sales or economic presence in the state.

This requirement, known as economic nexus, means that even if a business does not have a physical presence in Minnesota, it may still be obligated to collect and remit sales tax if it meets specific sales thresholds. The Department of Revenue provides guidance on economic nexus and how it applies to remote sellers.

Sales Tax Rates and Their Impact

The sales tax rates in Minneapolis can significantly impact the overall cost of living and doing business in the city. For residents, the sales tax adds a notable percentage to their everyday purchases, which can influence their spending habits and financial planning.

For businesses, the sales tax can affect their pricing strategies, profitability, and competitiveness. A higher sales tax rate may lead to increased prices, which could impact customer demand and the business's market position.

Furthermore, businesses must consider the administrative burden and compliance costs associated with collecting and remitting sales tax. This includes the time and resources required to understand and comply with the tax laws, as well as the potential penalties for non-compliance.

Comparative Analysis with Other Cities

When comparing Minneapolis to other major cities in the United States, it’s evident that the sales tax rate in Minneapolis is relatively higher than the national average. This higher rate can make Minneapolis a less attractive destination for certain businesses and consumers, especially those who are price-sensitive.

However, it's important to consider the overall tax climate and business environment when evaluating the impact of sales tax. Minneapolis offers a range of incentives and support for businesses, which can offset the higher sales tax rate. Additionally, the city's vibrant culture, strong economy, and high quality of life can make it an appealing location despite the sales tax burden.

Future Implications and Potential Changes

The sales tax landscape in Minneapolis is subject to change, influenced by various factors such as economic conditions, political decisions, and societal trends. While it’s difficult to predict specific changes, there are some potential future developments that could impact the sales tax rate and its applicability.

One potential change could be the expansion of sales tax to certain currently exempt services, such as healthcare or legal services. This could generate additional revenue for the city and state but would also impact the cost of living and doing business in Minneapolis.

Additionally, there may be efforts to simplify the sales tax system, making it more uniform and easier to understand and comply with. This could involve consolidating tax rates or reducing the number of special districts with their own tax rates.

Lastly, the ongoing trend of e-commerce and the rise of remote sellers could lead to increased scrutiny and enforcement of sales tax laws for online businesses. This could result in more stringent requirements for remote sellers to collect and remit sales tax, ensuring a level playing field with brick-and-mortar businesses.

Conclusion

The sales tax in Minneapolis is a complex but crucial aspect of the city’s economic landscape. Understanding the rates, applicable goods and services, and compliance requirements is essential for both residents and businesses. While the sales tax rate may be higher than some other cities, Minneapolis offers a vibrant and thriving environment that can offset this burden.

Staying informed about sales tax laws and their potential changes is vital for financial planning and business strategy. As the city and state continue to evolve, the sales tax landscape will likely adapt, impacting the daily lives and operations of those within Minneapolis.

What is the current sales tax rate in Minneapolis, Minnesota?

+As of [current date], the total sales tax rate in Minneapolis, MN is 7.375%. This includes the state sales tax of 6.875% and the city sales tax of 0.5%.

Are there any special sales tax districts in Minneapolis?

+Yes, there are certain special districts within Minneapolis that may impose additional sales taxes. For example, the Minneapolis Park and Recreation Board has its own sales tax. It’s important to check with the specific district or location for accurate tax information.

What are some common sales tax exemptions in Minnesota?

+Minnesota offers various sales tax exemptions, including exemptions for qualifying solar energy equipment, certain food items, prescription drugs, and medical devices. Charitable organizations may also be exempt from sales tax under specific circumstances.

How often do businesses need to file sales tax returns in Minneapolis?

+Most businesses in Minneapolis are required to file sales tax returns and remit taxes on a monthly or quarterly basis. However, some businesses with lower sales volumes may be eligible for annual reporting. The frequency depends on the business’s sales volume and can be determined by consulting the Minnesota Department of Revenue.

Are there any resources available for businesses to understand their sales tax obligations in Minneapolis?

+Yes, the Minnesota Department of Revenue provides comprehensive resources and guidelines for businesses. This includes information on registering for a sales tax permit, calculating and remitting sales tax, and maintaining proper records. Businesses can access these resources on the Department’s website.