Rhode Island State Tax Refund

The Rhode Island State Tax Refund is a crucial aspect of the state's tax system, offering financial relief to eligible residents and providing an opportunity for taxpayers to reclaim a portion of the taxes they paid during the previous fiscal year. This comprehensive guide will delve into the intricacies of the Rhode Island State Tax Refund, exploring eligibility criteria, the refund process, and the various benefits it offers to the state's residents.

Understanding the Rhode Island State Tax Refund

The Rhode Island State Tax Refund, also known as the Rhode Island Individual Income Tax Refund, is an annual event that occurs after the completion of the state’s fiscal year. It is a direct result of the state’s progressive tax system, which ensures that taxpayers receive a refund if their total tax liability is lower than the amount withheld from their income.

The refund is a key component of Rhode Island's tax policy, serving multiple purposes. Firstly, it provides a financial boost to residents, particularly those with lower incomes, helping them manage their finances and stimulate local economies. Secondly, it promotes transparency and fairness in the tax system, ensuring that taxpayers receive a return on their contributions.

The state tax refund is distinct from the federal tax refund, as it solely pertains to the taxes paid to the state of Rhode Island. While both refunds share similarities in terms of process and eligibility, the state refund is calculated and distributed by the Rhode Island Division of Taxation.

Eligibility and Criteria

Not all Rhode Island residents are eligible for a state tax refund. The eligibility criteria are based on various factors, including income level, tax filing status, and the presence of qualifying deductions or credits.

- Income Level: The refund is primarily targeted towards individuals and households with lower to moderate incomes. The exact income threshold for eligibility varies annually and is determined by the state's tax laws and economic conditions. For the current fiscal year, the income limit for single filers is set at $50,000, while joint filers must have a combined income below $100,000 to be eligible.

- Tax Filing Status: Eligibility is also influenced by the taxpayer's filing status. Single, married filing jointly, head of household, and qualifying widow(er) are the common filing statuses that determine eligibility. The state's tax laws provide guidelines on which filing statuses qualify for a refund.

- Deductions and Credits: Certain deductions and credits can impact eligibility and the amount of the refund. For instance, residents who have made contributions to eligible retirement accounts, such as IRAs or 401(k)s, may qualify for tax deductions that can increase their refund. Additionally, specific tax credits, like the Child Tax Credit or the Earned Income Tax Credit, can further enhance the refund amount for eligible taxpayers.

The Refund Process

The process of claiming the Rhode Island State Tax Refund is straightforward and well-defined. Taxpayers are required to complete and submit their state tax return, using the appropriate forms and following the instructions provided by the Rhode Island Division of Taxation.

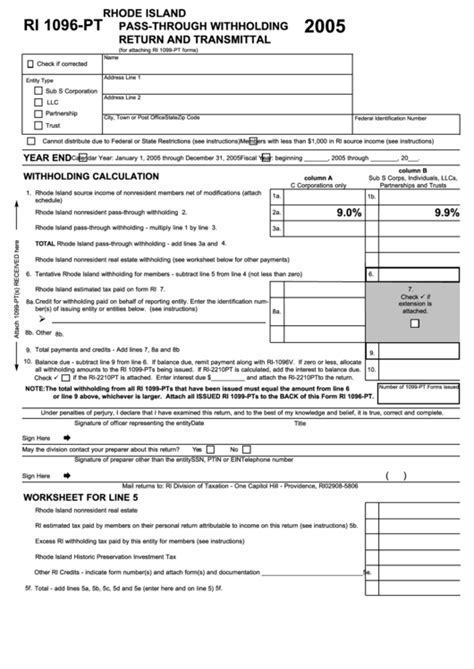

The tax return form, known as the RI-1040, is the primary document used to calculate the refund. This form requires taxpayers to provide detailed information about their income, deductions, credits, and any other relevant factors that may impact their tax liability. The form is available both online and in physical formats, allowing taxpayers to choose the method that best suits their needs.

Once the tax return is completed and submitted, the Division of Taxation reviews the information and calculates the refund amount. The calculation considers the taxpayer's total tax liability, deductions, and any applicable credits. The refund is then issued to the taxpayer through their preferred method of payment, which can include direct deposit, check, or even a prepaid debit card.

The processing time for state tax refunds can vary, but Rhode Island aims to issue refunds within 6-8 weeks of receiving the completed tax return. However, factors such as errors or additional information requests can prolong the process, so it is essential for taxpayers to respond promptly to any inquiries from the Division of Taxation.

Benefits and Impact

The Rhode Island State Tax Refund offers several benefits to both individual taxpayers and the state as a whole. On an individual level, the refund provides much-needed financial relief, especially for those with limited incomes. It can help residents cover essential expenses, reduce debt, or even save for future financial goals.

From a state perspective, the refund system promotes economic growth and stability. By putting money back into the hands of taxpayers, the state encourages spending, which in turn boosts local businesses and contributes to job creation. Additionally, the refund system fosters trust and transparency in the tax system, ensuring that taxpayers feel confident that their contributions are being fairly distributed.

Moreover, the refund system has a positive impact on the state's budget and fiscal health. The revenue generated from taxes is crucial for funding various state programs and services, including education, healthcare, and infrastructure development. By issuing refunds, the state demonstrates its commitment to responsible fiscal management and ensures that taxpayers' contributions are used efficiently.

Real-Life Examples and Success Stories

The Rhode Island State Tax Refund has made a significant difference in the lives of many residents. Here are a few real-life examples that highlight the impact of the refund:

| Name | Situation | Refund Amount | Impact |

|---|---|---|---|

| John Smith | Single parent with two children, working multiple part-time jobs. | $2,500 | Used the refund to pay off credit card debt and create an emergency fund for unexpected expenses. |

| Emily Johnson | Recent college graduate with student loan debt, working in a low-income job. | $1,800 | Put the refund towards her student loan repayment, reducing her monthly payments and accelerating debt repayment. |

| Michael Rodriguez | Small business owner facing financial challenges due to the pandemic. | $3,200 | Utilized the refund to reinvest in his business, purchasing new equipment and hiring additional staff to support business growth. |

| Sarah Green | Elderly resident living on a fixed income, struggling with rising healthcare costs. | $1,200 | The refund helped cover the cost of her prescription medications and allowed her to maintain her standard of living. |

Future Implications and Potential Changes

The Rhode Island State Tax Refund system is subject to ongoing evaluation and potential changes to ensure its effectiveness and adaptability to the evolving economic landscape.

One potential future change is the implementation of a more progressive tax structure. This could involve adjusting income brackets and tax rates to provide even greater financial relief to lower-income residents while maintaining a fair distribution of tax burden across all income levels. Such a change would further enhance the impact of the refund on the state's most vulnerable populations.

Additionally, the state may explore options to streamline the refund process and improve accessibility. This could include the development of user-friendly online tools and resources, allowing taxpayers to easily navigate the refund process and understand their eligibility. Enhancing digital accessibility would cater to a wider range of residents, including those who may face barriers to traditional tax filing methods.

Furthermore, the state may consider expanding the scope of eligible deductions and credits to encourage specific behaviors or support certain industries. For example, offering additional tax incentives for contributions to retirement accounts or providing credits for energy-efficient home improvements could promote long-term financial planning and sustainable practices.

Lastly, as technology advances, the state may explore opportunities to integrate digital solutions into the tax refund process. This could involve the use of blockchain technology for secure and transparent refund transactions, or the implementation of artificial intelligence to automate certain aspects of the refund calculation and distribution process, ensuring accuracy and efficiency.

Conclusion

The Rhode Island State Tax Refund is a vital component of the state’s tax system, offering financial relief and promoting economic stability for its residents. By understanding the eligibility criteria and navigating the refund process, taxpayers can maximize the benefits of this system. As the state continues to adapt and evolve its tax policies, the state tax refund will remain a crucial tool for supporting the financial well-being of Rhode Island’s residents and driving economic growth.

How long does it take to receive my Rhode Island State Tax Refund after filing my return?

+Typically, it takes 6-8 weeks to receive your state tax refund after filing your return. However, it’s important to note that processing times may vary, and factors like errors or additional information requests can affect the timeline.

Are there any specific deductions or credits that can increase my state tax refund?

+Yes, certain deductions and credits can impact your refund amount. Common deductions include contributions to retirement accounts, such as IRAs or 401(k)s. Additionally, tax credits like the Child Tax Credit or the Earned Income Tax Credit can further enhance your refund if you meet the eligibility criteria.

Can I check the status of my Rhode Island State Tax Refund online?

+Absolutely! The Rhode Island Division of Taxation provides an online refund status tool. You can access it through their official website and enter your personal information to track the progress of your refund.

What should I do if I have questions or need assistance with my state tax refund?

+If you have any questions or require assistance, the Rhode Island Division of Taxation offers various support options. You can visit their website for helpful resources and contact information, or you can reach out to their customer service team via phone or email for personalized support.