Mt State Income Tax

Understanding the intricacies of state-level taxation is crucial for individuals and businesses alike, as it directly impacts financial planning and compliance. In this comprehensive guide, we delve into the specifics of Montana's income tax system, offering an in-depth analysis of its rates, brackets, deductions, and unique features. By exploring real-world examples and providing expert insights, we aim to equip readers with the knowledge to navigate Montana's tax landscape with confidence.

Montana’s Progressive Income Tax Structure

Montana employs a progressive income tax system, meaning that the tax rate increases as an individual’s income rises. This approach ensures that higher-income earners contribute a larger proportion of their earnings towards the state’s revenue. The state’s income tax structure is designed to promote fairness and support the economic well-being of its residents.

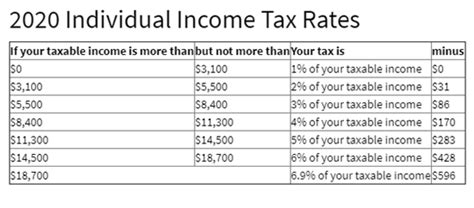

Tax Brackets and Rates

Montana’s income tax brackets are divided into five categories, each with its own tax rate. These brackets are designed to capture different income levels, ensuring a fair and balanced taxation system. The current tax rates for the 2023 tax year are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $2,500 | 0% |

| $2,501 - $7,500 | 1.0% |

| $7,501 - $15,000 | 2.0% |

| $15,001 - $30,000 | 3.0% |

| $30,001 and above | 6.9% |

For instance, if an individual's taxable income falls within the $7,501 - $15,000 bracket, they would be subject to a tax rate of 2.0% on that portion of their income. The progressive nature of this system means that as income increases, the tax rate also increases, ensuring a fair distribution of tax burden.

Deductions and Credits

Montana offers a range of deductions and credits to alleviate the tax burden on its residents. These deductions and credits can significantly reduce the amount of tax owed, providing financial relief to individuals and families.

One notable deduction is the standard deduction, which allows taxpayers to reduce their taxable income by a set amount. For the 2023 tax year, the standard deduction for single filers is $2,300, while joint filers can deduct up to $4,600. This deduction simplifies the tax filing process and ensures a basic level of tax relief for all taxpayers.

Additionally, Montana offers a variety of credits, including the Earned Income Tax Credit (EITC) for low- to moderate-income earners, and the Child and Dependent Care Credit for those with childcare expenses. These credits can provide substantial savings, especially for families with dependent children.

Unique Features of Montana’s Income Tax

Montana’s income tax system incorporates several unique features that set it apart from other states. One notable aspect is the Single Sales Factor Apportionment method for businesses with multi-state operations. This method allows companies to allocate their income to Montana based on the percentage of sales generated within the state, providing a more accurate representation of their economic activity.

Furthermore, Montana offers a Business Equipment Tax Credit, which encourages businesses to invest in new equipment and technology. This credit provides a substantial incentive for companies to expand and modernize their operations, fostering economic growth and development within the state.

Filing and Payment Process

Montana’s Department of Revenue provides a user-friendly online platform for taxpayers to file their income tax returns and make payments. The MT Individual Income Tax Return (Form 2) is the primary form used for filing individual income taxes. The deadline for filing is typically April 15th of each year, following the standard federal tax deadline.

For those who prefer traditional methods, paper forms are also available and can be mailed to the Department of Revenue. However, electronic filing is highly encouraged for its convenience and accuracy.

Payment options include direct bank transfers, credit/debit card payments, and electronic funds transfer. The state also offers a convenient Payment Plan option for taxpayers who cannot pay their tax liability in full. This plan allows taxpayers to make scheduled payments over a specified period, ensuring a manageable approach to settling tax debts.

Future Implications and Expert Insights

Montana’s income tax system is continuously evolving to meet the changing needs of its residents and businesses. As the state’s economy grows and diversifies, the tax structure must adapt to support this growth while maintaining fiscal responsibility.

One area of potential change is the expansion of tax credits to further support low- and middle-income earners. By increasing the availability of credits, the state can provide more substantial financial relief to those who need it most. Additionally, there is a growing discussion around the potential for tax incentives for renewable energy and sustainable practices, which could encourage environmentally conscious behavior and attract businesses in these sectors.

Experts in Montana's tax landscape emphasize the importance of staying informed about tax law changes and utilizing the state's resources effectively. By understanding the nuances of the tax system and taking advantage of available deductions and credits, taxpayers can optimize their financial position and contribute to the state's economic growth.

When is the deadline for filing Montana income taxes?

+The deadline for filing Montana income taxes typically aligns with the federal deadline, which is April 15th of each year. However, it’s important to note that this deadline may be extended in certain circumstances, so it’s advisable to stay updated with the latest guidelines.

Are there any special tax considerations for small businesses in Montana?

+Montana offers several tax incentives and programs to support small businesses. These include tax credits for job creation, research and development, and business investment. Additionally, the state provides resources and guidance to help small businesses navigate the tax landscape effectively.

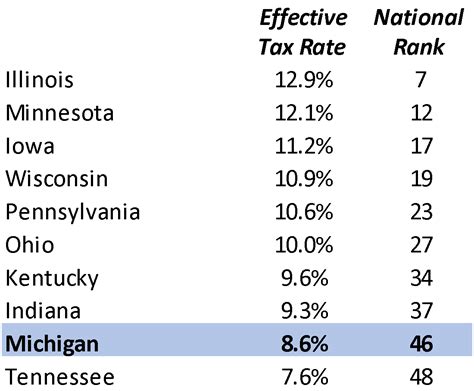

How does Montana’s tax system compare to other states in terms of fairness and competitiveness?

+Montana’s progressive income tax system is generally considered fair and balanced. The state’s tax rates are competitive compared to neighboring states, and the availability of deductions and credits provides relief for a wide range of taxpayers. However, it’s important to analyze specific circumstances and compare tax liabilities on a case-by-case basis.