New York Real Estate Property Tax

The Complex World of Property Taxes in New York City: An In-Depth Exploration

Welcome to the intricate landscape of property taxes in New York City, a realm where real estate enthusiasts and homeowners alike navigate a complex web of assessments, rates, and regulations. This article aims to delve deep into the specifics of New York's property tax system, offering an expert guide to help you understand, calculate, and potentially reduce your property tax burden.

Understanding the Fundamentals: What are Property Taxes in New York City?

Property taxes in New York City are a significant financial obligation for property owners, playing a crucial role in funding essential public services and infrastructure. These taxes are calculated based on the assessed value of a property, which is determined by the New York City Department of Finance through a rigorous assessment process.

The assessed value of a property is just one piece of the puzzle. Property taxes are further influenced by tax rates, which can vary significantly depending on the type of property and its location within the city. These rates are set annually by the New York City Council and are an essential factor in determining the overall tax burden.

Key Factors Affecting Property Tax Rates

Several factors come into play when determining property tax rates in New York City:

- Property Type: Different types of properties, such as residential, commercial, or industrial, are subject to varying tax rates.

- Location: Tax rates can differ significantly across the five boroughs, with Manhattan often commanding higher rates compared to other areas.

- City Budget: The city's annual budget plays a crucial role, as tax rates are adjusted to meet funding requirements for public services and projects.

- Market Conditions: Property values and market trends also impact tax rates, with fluctuations in the real estate market often reflected in tax assessments.

The Assessment Process: How is Property Value Determined?

The Department of Finance employs a comprehensive assessment process to determine the value of properties in New York City. This process typically involves the following steps:

- Data Collection: The department gathers information on recent sales, rental income, and other relevant data for each property.

- Market Analysis: This data is then analyzed to determine the fair market value of each property, taking into account factors like location, size, and condition.

- Assessment Notices: Once assessments are finalized, property owners receive notices detailing the assessed value of their properties.

- Grievance Process: Property owners have the right to challenge their assessments if they believe the value is inaccurate. The New York City Tax Commission oversees this process, providing an avenue for appeals.

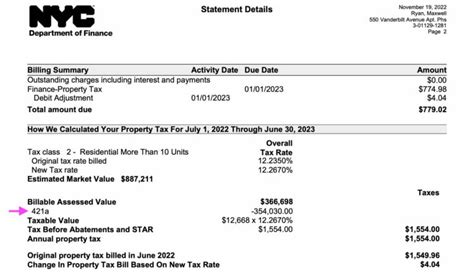

Calculating Your Property Tax Burden: A Step-by-Step Guide

Understanding how to calculate your property taxes is essential for effective financial planning. Here's a step-by-step guide to help you estimate your tax liability:

Step 1: Determine Your Property's Assessed Value

The first step is to obtain the assessed value of your property. This information is available on your annual Notice of Property Value, which is mailed to property owners by the Department of Finance. You can also access this information online through the Property Tax Lookup Tool on the department's website.

Step 2: Identify the Applicable Tax Rate

Once you have your assessed value, you need to determine the applicable tax rate for your property. Tax rates can vary based on factors mentioned earlier, so it's crucial to understand your property's specific rate. The New York City Department of Finance provides an online Tax Rate Lookup Tool to help you find the correct rate.

Step 3: Calculate Your Tax Liability

With your assessed value and tax rate in hand, you can now calculate your property tax liability. The formula is straightforward: Assessed Value x Tax Rate = Tax Liability.

For example, if your property has an assessed value of $500,000 and the applicable tax rate is 1.5%, your tax liability would be:

$500,000 x 0.015 = $7,500

Step 4: Understand Payment Options and Deadlines

New York City offers several payment options for property taxes, including online payments, direct debit, and traditional check payments. It's important to note that taxes are due in two installments, with specific deadlines for each. Late payments may incur penalties and interest.

| Installment | Due Date |

|---|---|

| First Installment | July 1st |

| Second Installment | January 1st |

Strategies to Reduce Your Property Tax Burden: A Comprehensive Guide

While property taxes are a necessary expense, there are strategies you can employ to potentially reduce your tax liability. Here are some expert tips to consider:

1. Challenge Your Property Assessment

If you believe your property's assessed value is inaccurate, you have the right to file a grievance with the New York City Tax Commission. This process allows you to present evidence and argue for a lower assessment, which could result in reduced taxes.

2. Take Advantage of Tax Exemptions and Abatements

New York City offers various tax exemptions and abatements to eligible property owners. These can significantly reduce your tax burden. Some common exemptions include:

- Senior Citizen Abatement: Property tax exemption for seniors based on income and age.

- Veteran Exemption: Tax relief for veterans and their families.

- Star Exemption: A reduction in taxes for owner-occupied primary residences.

3. Consider Property Tax Deductions

If you itemize your federal income taxes, you may be able to deduct a portion of your property taxes. This can provide some relief, especially for higher-income earners.

4. Explore Refinancing Options

Refinancing your mortgage can potentially lower your interest rate, reducing your overall tax liability. This is because mortgage interest is often tax-deductible.

5. Stay Informed About Market Trends

Keeping a close eye on real estate market trends can help you anticipate potential changes in property values and, subsequently, tax assessments. Being proactive in this regard can help you prepare for any necessary adjustments.

The Impact of Property Taxes on the Real Estate Market

Property taxes have a significant influence on the real estate market in New York City. High tax rates can impact investment decisions, with some investors opting for properties in areas with lower tax burdens. For homebuyers, property taxes are a crucial consideration when determining the overall affordability of a property.

Case Study: The Impact of Tax Rates on Real Estate Investments

Let's consider a hypothetical scenario. Investor A purchases a commercial property in Manhattan with an assessed value of $2 million and a tax rate of 3%. Investor B, on the other hand, purchases a similar property in Queens with an assessed value of $1.8 million and a tax rate of 2%. While Investor A's property has a higher assessed value, Investor B's lower tax rate results in a more favorable tax liability.

Over a 5-year period, Investor A pays $60,000 in taxes annually, totaling $300,000. Investor B, with a lower tax rate, pays $36,000 annually, totaling $180,000. This case study illustrates how tax rates can significantly impact the overall profitability of real estate investments.

The Future of Property Taxes in New York City: Predictions and Trends

Looking ahead, several trends and predictions can provide insight into the future of property taxes in New York City:

1. Rising Property Values

The real estate market in New York City is expected to continue its upward trajectory, with rising property values likely to result in higher assessments and, subsequently, increased tax liabilities.

2. Technological Advancements in Assessment Processes

The Department of Finance is investing in technological upgrades to enhance the assessment process. This could lead to more accurate and efficient assessments, potentially reducing disputes and streamlining the grievance process.

3. Potential Tax Reform

There have been discussions about reforming the property tax system in New York City to make it more equitable. While the specifics are yet to be determined, potential reforms could include changes to assessment methods or tax rate structures.

4. Impact of Economic Shifts

Economic shifts, such as changes in the job market or shifts in industry trends, can impact property values and, consequently, tax assessments. Staying informed about these shifts is crucial for both property owners and investors.

How often are property tax assessments conducted in New York City?

+Property tax assessments in New York City are conducted every two years. However, the Department of Finance can also initiate reassessments at any time if significant changes are made to a property, such as additions or renovations.

Can I appeal my property tax assessment if I disagree with it?

+Yes, you have the right to appeal your property tax assessment. The process involves filing a grievance with the New York City Tax Commission, presenting evidence to support your case, and potentially attending a hearing.

What happens if I miss the deadline for paying my property taxes?

+Late payments of property taxes in New York City may result in penalties and interest. It’s important to stay informed about payment deadlines and consider setting up automatic payments to avoid any late fees.

Are there any resources available to help me understand the complex world of property taxes in New York City?

+Absolutely! The New York City Department of Finance provides a wealth of resources, including online tools, guides, and even workshops to help property owners navigate the complexities of property taxes. These resources can be accessed on their official website.