Tax In Miami Dade

When it comes to tax matters, understanding the unique landscape of Miami-Dade County is crucial for both individuals and businesses. The tax system in this vibrant region is shaped by a combination of federal, state, and local regulations, offering a diverse range of considerations. From property taxes to sales taxes, Miami-Dade County presents a dynamic tax environment that influences financial planning and decision-making.

Unraveling the Miami-Dade Tax Landscape

The tax structure in Miami-Dade County is intricate, reflecting the region’s economic diversity and growth. Let’s delve into the key aspects that define the tax environment here.

Property Taxes: A Pillar of Miami-Dade’s Revenue

Property taxes are a significant component of the county’s revenue stream. Miami-Dade County assesses property taxes based on the value of real estate, which includes land, buildings, and improvements. The tax rate is determined by a combination of factors, including the property’s location, usage, and any applicable exemptions.

For homeowners, understanding the property tax landscape is crucial. The county offers various exemptions, such as the Homestead Exemption, which provides a discount on the assessed value of a primary residence. Additionally, the Save Our Homes amendment limits the annual increase in assessed value for qualifying properties, offering stability to long-term residents.

| Property Tax Key Facts | Details |

|---|---|

| Assessment Method | Market Value Assessment |

| Tax Rate | Varies by Location and Property Type |

| Exemptions | Homestead, Senior, Disability, and more |

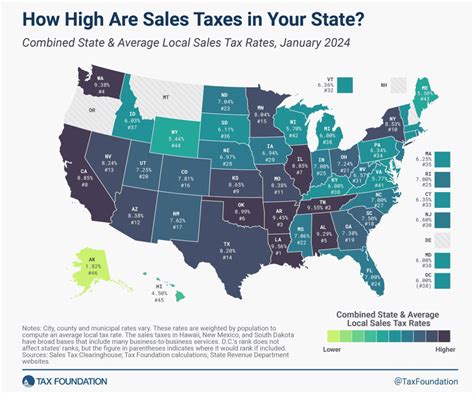

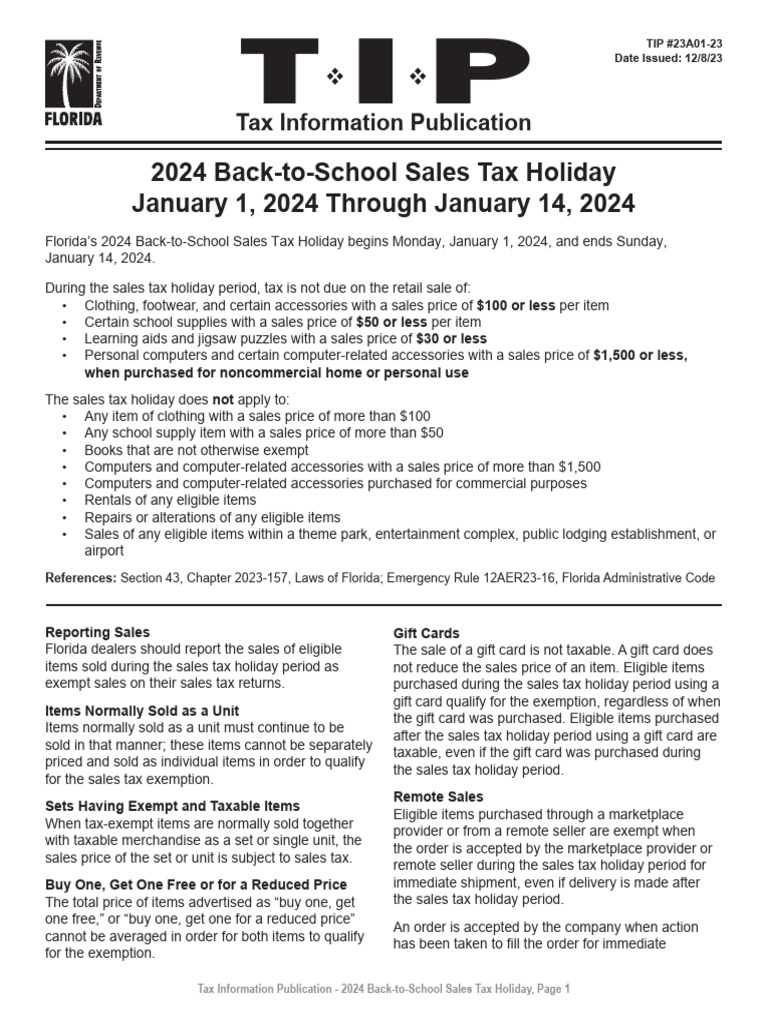

Sales and Use Taxes: A Dynamic Revenue Stream

Sales and use taxes are another vital source of revenue for Miami-Dade County. The county imposes a sales tax on most tangible personal property and certain services sold within its borders. This tax is collected by businesses and remitted to the county, with rates varying depending on the type of transaction and the location of the sale.

For businesses, understanding the sales tax landscape is crucial for accurate tax compliance. Miami-Dade County's sales tax rate is subject to change, and businesses must stay updated to ensure they are collecting and remitting the correct amount. Additionally, the county offers various tax incentives and programs to encourage economic development and investment.

| Sales Tax Insights | Details |

|---|---|

| Current Rate | 6.5% (as of [Date]) |

| Taxable Items | Most Goods and Some Services |

| Exemptions | Groceries, Prescription Drugs, and More |

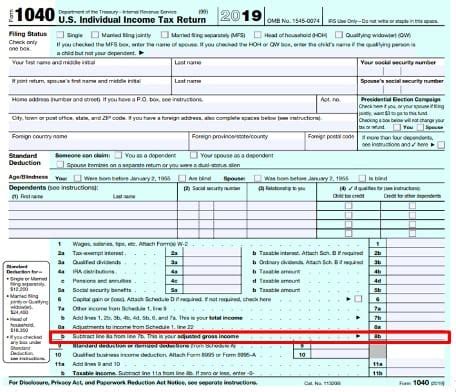

Income Taxes: Navigating Federal and State Requirements

While Miami-Dade County does not impose a local income tax, residents and businesses still navigate the complexities of federal and state income tax regulations. The Internal Revenue Service (IRS) and the Florida Department of Revenue administer income tax laws, which impact individuals and businesses operating within the county.

For individuals, understanding the federal and state tax brackets and deductions is crucial for effective financial planning. Miami-Dade County residents may qualify for various tax credits and deductions, such as the Child Tax Credit or the Mortgage Interest Deduction, which can significantly impact their tax liability.

Businesses, on the other hand, must navigate a range of federal and state tax obligations, including corporate income taxes, payroll taxes, and excise taxes. The complexity of these taxes often requires professional guidance to ensure compliance and optimize tax strategies.

Tax Planning and Strategies for Miami-Dade Residents

Navigating the tax landscape in Miami-Dade County requires a strategic approach. Here are some key considerations for effective tax planning:

-

Utilize Exemptions and Deductions: Miami-Dade County offers a range of exemptions and deductions that can reduce tax liability. From property tax exemptions for homeowners to tax credits for businesses, understanding and utilizing these benefits is essential for optimizing your tax strategy.

-

Stay Informed on Tax Changes: The tax landscape is dynamic, with frequent updates and changes. Staying informed on tax law amendments, new regulations, and emerging incentives is crucial for ensuring compliance and taking advantage of any tax-saving opportunities.

-

Seek Professional Guidance: The complexity of tax regulations often warrants professional assistance. Engaging the services of a qualified tax professional, such as a Certified Public Accountant (CPA) or a tax attorney, can provide tailored advice and ensure compliance with federal, state, and local tax laws.

Conclusion: Embracing Tax Opportunities in Miami-Dade

The tax environment in Miami-Dade County is a multifaceted landscape that offers both challenges and opportunities. By understanding the intricacies of property taxes, sales taxes, and income taxes, individuals and businesses can navigate this terrain with confidence. Embracing the tax incentives, exemptions, and strategic planning opportunities available in Miami-Dade County can lead to more effective financial management and a stronger economic future.

What is the current property tax rate in Miami-Dade County?

+The property tax rate in Miami-Dade County varies depending on the location and type of property. On average, the rate is approximately [Rate]% of the assessed value. However, it’s essential to consult the Miami-Dade Property Appraiser’s Office for the most accurate and up-to-date information.

Are there any tax incentives for businesses in Miami-Dade County?

+Yes, Miami-Dade County offers various tax incentives to attract and support businesses. These incentives include tax credits, enterprise zones, and exemptions for specific industries or activities. The Miami-Dade Beacon Council provides detailed information on these incentives, tailored to different business sectors.

How often do sales tax rates change in Miami-Dade County?

+Sales tax rates in Miami-Dade County can change periodically. The county commission has the authority to adjust the rate, often to support specific projects or initiatives. It’s recommended to check with the Miami-Dade County Tax Collector’s Office for the most current sales tax rate.