Houston Sales Tax Rate

The city of Houston, located in the state of Texas, has a complex sales tax system that is essential for businesses and consumers to understand. This article aims to provide a comprehensive guide to the Houston sales tax rate, its composition, and its impact on the local economy. By delving into the intricacies of this tax structure, we can gain valuable insights into the financial landscape of one of the largest cities in the United States.

Understanding the Houston Sales Tax Rate

Houston, known for its vibrant culture and thriving business environment, operates under a unique sales tax system that consists of several layers. This system is designed to generate revenue for various governmental bodies, including the state, county, and city, as well as other special-purpose districts.

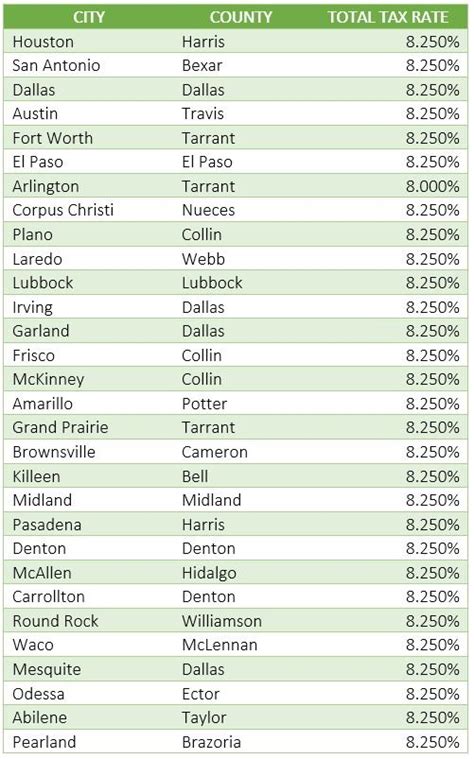

As of [Current Year], the total sales tax rate in Houston is 8.25%, which is the combined rate of all applicable taxes. This rate, however, can vary depending on the specific location within the city and the type of goods or services being purchased.

State Sales Tax

The state of Texas imposes a base sales tax rate of 6.25%, which applies to most retail sales of tangible personal property and certain services. This state tax rate is consistent across the entire state, including Houston.

| Taxing Authority | Sales Tax Rate |

|---|---|

| Texas State | 6.25% |

County and City Sales Tax

In addition to the state sales tax, Houston is subject to a county sales tax and a city sales tax. These additional taxes contribute to the overall sales tax rate in the city.

The Harris County sales tax rate is 0.5%, which is applicable to all taxable sales within the county. This rate is specifically allocated to fund county-wide initiatives and services.

The City of Houston imposes its own sales tax of 1.5%. This tax is used to support various city projects, infrastructure development, and public services.

| Taxing Authority | Sales Tax Rate |

|---|---|

| Harris County | 0.5% |

| City of Houston | 1.5% |

Special-Purpose District Taxes

Houston is home to several special-purpose districts, each with its own sales tax rate to fund specific initiatives. These districts include transportation authorities, hospital districts, and cultural districts, among others.

For example, the Metropolitan Transit Authority of Harris County (METRO) imposes a sales tax rate of 0.5% to support public transportation services. This tax is applicable to all taxable sales within the METRO service area.

Similarly, the Harris County Hospital District (HCHD) levies a sales tax rate of 0.125% to finance healthcare services and facilities in the county. This tax applies to most retail sales within the district's boundaries.

| Special-Purpose District | Sales Tax Rate |

|---|---|

| METRO | 0.5% |

| HCHD | 0.125% |

Impact on Local Economy and Businesses

The Houston sales tax rate plays a significant role in shaping the local economy and influencing consumer behavior. Let’s explore some key aspects of its impact:

Revenue Generation

The sales tax revenue generated in Houston is a crucial source of funding for various governmental entities and special-purpose districts. It supports essential services, infrastructure development, and public projects.

For instance, the city's sales tax revenue is allocated to fund initiatives such as road improvements, public safety enhancements, and cultural programs, contributing to the overall well-being and growth of the community.

Competitive Pricing

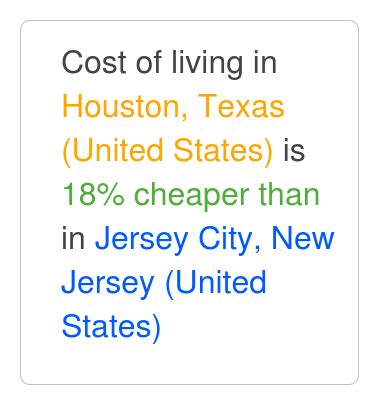

Businesses operating in Houston need to carefully consider the sales tax rate when setting their pricing strategies. While the tax rate can be seen as an additional cost, it is essential to maintain competitive pricing to attract customers.

Businesses often include the sales tax in their pricing calculations, ensuring that the final price is transparent to consumers. This approach allows customers to make informed purchasing decisions and compare prices accurately.

Consumer Behavior and Spending Patterns

The sales tax rate can influence consumer spending habits and preferences. Some consumers may choose to shop in areas with lower sales tax rates, especially for big-ticket items or frequent purchases.

Businesses may also need to adapt their marketing and promotional strategies to account for the sales tax. Offering discounts or incentives that effectively offset the tax can encourage customer loyalty and drive sales.

Compliance and Record-Keeping

For businesses, understanding and complying with the Houston sales tax regulations is crucial. Accurate record-keeping and proper tax filing are essential to avoid penalties and ensure compliance with state and local laws.

Businesses must maintain detailed sales records, categorize transactions accurately, and remit the appropriate sales tax amounts to the respective taxing authorities. This process requires careful attention to detail and may involve the use of specialized software or accounting systems.

Future Implications and Potential Changes

The Houston sales tax rate is subject to change over time, influenced by various factors such as economic conditions, political decisions, and community needs.

Economic Factors

Economic downturns or recessions can prompt discussions about adjusting the sales tax rate to generate additional revenue or provide relief to consumers and businesses.

Conversely, periods of economic growth may lead to considerations of lowering the sales tax rate to stimulate consumer spending and attract more businesses to the area.

Political and Legislative Changes

Changes in local or state government leadership can bring about new tax policies and initiatives. Elected officials may propose amendments to the sales tax structure, including rate adjustments or the introduction of new taxes to fund specific projects or address emerging needs.

Community Needs and Initiatives

The sales tax rate can also be a tool to address specific community concerns or support special initiatives. For example, a higher sales tax rate could be implemented to fund education, healthcare, or environmental projects, with the proceeds directly benefiting the local community.

Additionally, special-purpose districts may propose changes to their sales tax rates to adapt to changing circumstances or to align with the community's evolving needs.

Are there any sales tax exemptions in Houston?

+Yes, Houston, like many other cities in Texas, offers sales tax exemptions for certain goods and services. These exemptions can vary depending on the type of item and the purpose for which it is purchased. Common exemptions include purchases for resale, some agricultural equipment, and certain types of manufacturing machinery.

How often are sales tax rates reviewed and updated in Houston?

+Sales tax rates in Houston are typically reviewed and updated on an annual basis, or as needed, to ensure they align with the city's fiscal requirements and community needs. The city's governing bodies, such as the Houston City Council and the Harris County Commissioners Court, have the authority to propose and approve changes to the sales tax rates.

What happens if a business fails to collect and remit the correct sales tax in Houston?

+Businesses that fail to collect and remit the correct sales tax in Houston may face penalties and interest charges. The Texas Comptroller's office has the authority to enforce sales tax regulations and may impose fines or take legal action against non-compliant businesses. It is crucial for businesses to understand their sales tax obligations and maintain accurate records to avoid such consequences.

The Houston sales tax rate is a dynamic component of the city’s financial landscape, influencing economic decisions and shaping the local community. By understanding the composition of this tax rate and its impact on businesses and consumers, we can gain valuable insights into the economic fabric of this vibrant metropolis.