Tax

My Tax Form.com

<section>

<h2>Introduction: A Taxpayer's Journey</h2>

<p>Welcome to the world of tax forms, a complex yet essential aspect of our financial lives. As we embark on this journey, understanding the intricacies of tax season becomes crucial. My Tax Form.com is here to guide you through the maze of forms, deductions, and strategies, ensuring you navigate this process with clarity and confidence.</p>

<p>Tax season is a critical period for individuals and businesses alike. It's a time when we reflect on our financial activities, assess our earnings and expenses, and fulfill our legal obligations. With the right knowledge and tools, this annual ritual can become a well-managed process, offering opportunities for optimization and strategic planning.</p>

<p>In this comprehensive guide, we will delve into the world of tax forms, exploring the different types, their purposes, and the key considerations for an efficient and successful tax filing journey. Whether you're a seasoned taxpayer or a first-time filer, this article aims to provide valuable insights and practical tips to make your tax season a breeze.</p>

</section>

<section>

<h2>The Importance of Understanding Tax Forms</h2>

<p>Tax forms are the cornerstone of any tax filing process. They are the official documents that allow individuals and entities to report their income, claim deductions, and calculate their tax liabilities. Understanding these forms is essential for several reasons:</p>

<ul>

<li><strong>Compliance with Tax Laws:</strong> Filling out tax forms accurately is a legal requirement. Failure to do so can lead to penalties, fines, or even legal repercussions. By understanding the forms, you ensure compliance and avoid unnecessary issues with tax authorities.</li>

<li><strong>Maximizing Deductions and Credits:</strong> Tax forms provide an opportunity to claim deductions and credits that can reduce your tax burden. These can include expenses related to business, education, healthcare, and more. By thoroughly understanding the forms, you can identify and claim all eligible deductions, optimizing your tax position.</li>

<li><strong>Efficient Financial Planning:</strong> Tax forms are a reflection of your financial activities throughout the year. By analyzing these forms, you can gain valuable insights into your income sources, expenses, and overall financial health. This knowledge empowers you to make informed decisions and plan your finances more effectively in the future.</li>

</ul>

<p>Let's explore some of the key tax forms and their significance in the context of tax season.</p>

</section>

<section>

<h2>Key Tax Forms: A Comprehensive Overview</h2>

<p>There are various tax forms used for different purposes during tax season. While the specific forms may vary depending on your country or region, here's an overview of some common tax forms and their functions:</p>

<h3>Income Tax Return Forms</h3>

<p>These forms are the foundation of your tax filing. They are used to report your income, including wages, salaries, investments, business profits, and other sources of earnings. Common income tax return forms include:</p>

<ul>

<li><strong>Form 1040 (USA):</strong> The primary federal income tax return form for individuals in the United States. It comes with various schedules for reporting specific income types and deductions.</li>

<li><strong>Self-Assessment Tax Return (UK):</strong> A comprehensive form used by individuals and businesses in the UK to report income and calculate tax liabilities.</li>

<li><strong>Income Tax Return (India):</strong> This form is used by individuals and businesses in India to declare their income and calculate taxes owed to the government.</li>

</ul>

<h3>Deduction and Credit Forms</h3>

<p>These forms are essential for claiming deductions and credits that can reduce your taxable income. Some key forms include:</p>

<ul>

<li><strong>Schedule A (USA):</strong> Used to itemize deductions for medical expenses, state and local taxes, charitable contributions, and certain other expenses.</li>

<li><strong>Form 8962 (USA):</strong> The Premium Tax Credit form, which allows taxpayers to claim credits for health insurance premiums paid through the Affordable Care Act.</li>

<li><strong>Form T2202A (Canada):</strong> Used by students to claim education tax credits for tuition and education-related expenses.</li>

</ul>

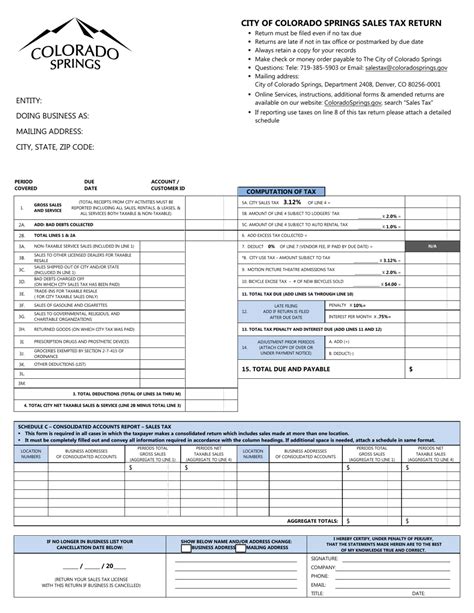

<h3>Business and Self-Employment Forms</h3>

<p>If you operate a business or are self-employed, you'll need to use specific forms to report your business income and expenses. Some notable forms include:</p>

<ul>

<li><strong>Schedule C (USA):</strong> Used to report profits or losses from a business operated as a sole proprietorship.</li>

<li><strong>Form 1065 (USA):</strong> The U.S. Return of Partnership Income form, used by partnerships to report their income, deductions, and credits.</li>

<li><strong>VAT Returns (EU):</strong> Used by businesses registered for Value Added Tax (VAT) in the European Union to report and pay their VAT liabilities.</li>

</ul>

</section>

<section>

<h2>Strategies for an Efficient Tax Season</h2>

<p>Navigating tax season efficiently requires careful planning and a strategic approach. Here are some tips to make the process smoother and more successful:</p>

<h3>Gather and Organize Your Documents</h3>

<p>Before you begin, gather all relevant documents, such as pay stubs, investment statements, receipts for deductions, and any other financial records. Organize them systematically to make the filing process more manageable.</p>

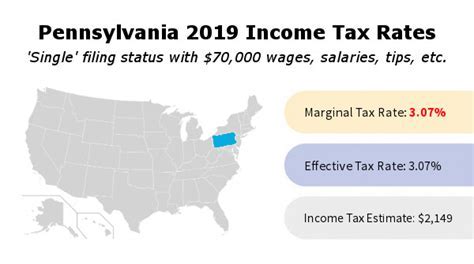

<h3>Understand Your Tax Bracket and Deductions</h3>

<p>Familiarize yourself with your tax bracket and the deductions you're eligible for. This knowledge will help you optimize your tax position and ensure you're claiming all applicable deductions.</p>

<h3>Consider Tax Software or Professional Help</h3>

<p>Tax software can simplify the filing process and help you identify deductions and credits. Alternatively, if you have complex financial situations or prefer professional guidance, consider hiring a tax accountant or advisor.</p>

<h3>Stay Informed about Tax Changes</h3>

<p>Tax laws and regulations can change annually. Stay updated on any modifications to tax forms, deductions, or credits that may impact your filing. This ensures you're compliant with the latest requirements.</p>

</section>

<section>

<h2>Real-World Examples and Case Studies</h2>

<p>To illustrate the practical application of tax forms and strategies, let's explore some real-world examples and case studies:</p>

<h3>Case Study: Maximizing Deductions for Small Businesses</h3>

<p>Sarah, a small business owner, carefully analyzed her business expenses using Schedule C (Form 1040). By identifying and documenting eligible deductions, such as office rent, utilities, and advertising costs, she was able to significantly reduce her taxable income. This strategic approach not only lowered her tax liability but also provided valuable insights for future financial planning.</p>

<h3>Example: Utilizing Tax Credits for Education</h3>

<p>John, a recent college graduate, discovered he was eligible for tax credits related to his education expenses. By filing Form T2202A in Canada, he claimed the Tuition and Education Amounts tax credit, reducing his taxable income and receiving a refund. This example highlights the importance of understanding and utilizing specific tax forms to maximize financial benefits.</p>

</section>

<section>

<h2>Future Implications and Tax Planning</h2>

<p>As we look ahead, tax planning becomes an essential component of financial strategy. By understanding the current tax landscape and potential future changes, individuals and businesses can make informed decisions to optimize their tax positions.</p>

<p>Staying informed about tax reforms, economic policies, and emerging trends is crucial. This knowledge enables proactive tax planning, allowing taxpayers to adapt their strategies and ensure compliance with evolving regulations.</p>

<p>Additionally, exploring tax-efficient investment options and retirement planning strategies can provide long-term financial benefits. Consulting with tax professionals and financial advisors can offer personalized guidance tailored to individual circumstances, ensuring a well-rounded approach to tax optimization.</p>

</section>

<section>

<h2>Conclusion: Empowering Taxpayers with Knowledge</h2>

<p>Tax forms and the tax season journey can be daunting, but with the right knowledge and resources, they become manageable and even strategic opportunities. My Tax Form.com aims to empower taxpayers by providing comprehensive guides, real-world examples, and practical tips to navigate this complex process.</p>

<p>By understanding the different tax forms, their purposes, and the strategies to optimize your financial position, you can approach tax season with confidence and clarity. Remember, tax planning is an ongoing process, and staying informed is key to maximizing benefits and ensuring compliance.</p>

<p>We hope this guide has been informative and valuable in your tax journey. Stay tuned for more insights and updates as we continue to explore the world of taxes and financial strategies.</p>

</section>

<div class="faq-section">

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>What are the common mistakes to avoid when filing tax forms?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Common mistakes include failing to report all income sources, claiming ineligible deductions, and not double-checking calculations. Always ensure accuracy and completeness when filling out tax forms to avoid penalties and audits.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I stay updated on tax law changes?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Stay informed by regularly checking official government websites, subscribing to tax newsletters or blogs, and consulting with tax professionals or financial advisors. They can provide valuable insights into the latest tax law changes and their potential impact on your financial situation.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax-saving strategies for individuals with complex financial situations?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! Complex financial situations often present unique opportunities for tax optimization. Consider strategies like tax-loss harvesting, contributing to tax-advantaged retirement accounts, or utilizing specific tax credits and deductions. Consulting a tax professional can help tailor these strategies to your specific circumstances.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I ensure I'm claiming all eligible deductions and credits?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Thoroughly review the tax forms and their instructions, as well as any applicable schedules or worksheets. Additionally, consider using tax software or seeking professional advice to ensure you're not missing out on any deductions or credits you're entitled to.</p>

</div>

</div>

</div>

</div>

<footer>

<p>© 2024 My Tax Form.com. All rights reserved.</p>

<p>Disclaimer: The information provided on this website is for educational and informational purposes only. It is not intended as financial or tax advice. Please consult a qualified professional for personalized guidance based on your specific circumstances.</p>

</footer>