Sales Tax For Cars In Nc

When purchasing a car in North Carolina, understanding the sales tax regulations is crucial to ensure a smooth transaction and avoid any unexpected costs. North Carolina's sales tax system is designed to generate revenue for the state and local governments while adhering to specific guidelines and exemptions. This comprehensive guide will delve into the intricacies of sales tax for cars in NC, covering everything from the basic tax rate to potential exemptions and special considerations.

Understanding the Basic Sales Tax Rate

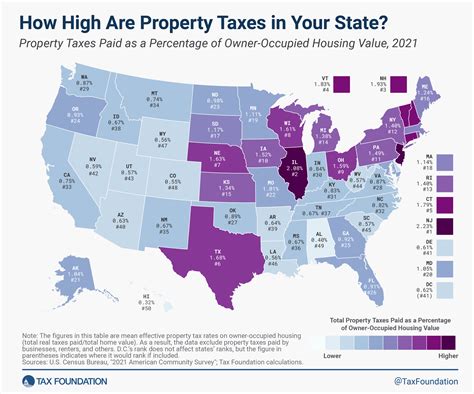

The state of North Carolina imposes a standard sales and use tax rate of 4.75% on the sale of vehicles. This tax is applicable to the purchase price of the car, including any additional costs such as dealer preparation fees, delivery fees, and optional equipment. The standard sales tax rate is a fundamental component of the state’s revenue stream and is consistent across most counties.

However, it's essential to note that local governments within North Carolina have the authority to levy additional sales taxes. These local taxes, often referred to as local option taxes, can increase the overall sales tax rate for vehicle purchases. As of the most recent information, the highest additional local option tax rate is 3%, bringing the total sales tax rate to 7.75% in certain areas.

Calculating Sales Tax for Your Car Purchase

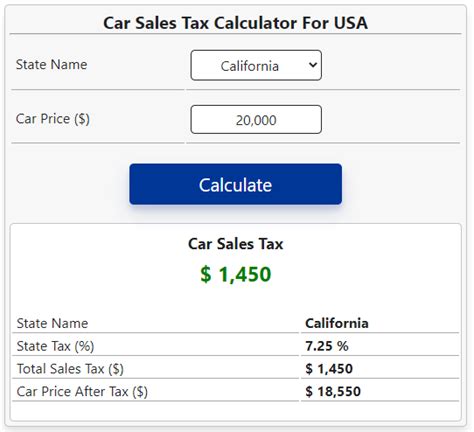

To estimate the sales tax you may incur when buying a car in North Carolina, you can use the following formula:

| Total Sales Tax | = | Standard Sales Tax Rate (4.75%) | + | Local Option Tax Rate (varies) |

|---|---|---|---|---|

| Sales Tax on Purchase Price | = | Purchase Price x (Standard Rate + Local Rate) |

For example, if you're purchasing a car in a county with a 3% local option tax, the total sales tax rate would be 7.75% (4.75% + 3%). To calculate the sales tax on a $25,000 car purchase, you would use the following calculation:

| $25,000 | x | 0.0775 | = | $1,937.50 |

This means that the sales tax on a $25,000 car purchase in this county would amount to $1,937.50.

Exemptions and Special Considerations

While the standard sales tax rate applies to most vehicle purchases in North Carolina, certain situations may qualify for exemptions or special considerations. It’s crucial to understand these scenarios to ensure you are aware of your potential tax liabilities.

Military Personnel and Vehicles

Active-duty military personnel stationed in North Carolina may be eligible for a sales tax exemption on the purchase of a vehicle. This exemption applies to both new and used vehicles and is available to service members who are residents of North Carolina or have been stationed in the state for at least 60 days. To claim this exemption, military personnel must provide valid military identification and complete the appropriate tax forms at the time of purchase.

Vehicle Trade-Ins

When trading in a vehicle as part of a new purchase, the sales tax in North Carolina is calculated based on the difference in value between the new and old vehicles. This is known as the trade-in allowance and can significantly impact the overall sales tax liability. For instance, if you trade in a vehicle with a value of 10,000 towards the purchase of a new car priced at 25,000, the sales tax would only be applied to the difference of $15,000.

Leased Vehicles

For individuals leasing a vehicle in North Carolina, the sales tax is typically calculated as a percentage of the monthly lease payment. The exact tax rate may vary depending on the county where the lease agreement is executed. It’s important to carefully review the lease agreement and understand the sales tax implications before signing.

Electric and Alternative Fuel Vehicles

North Carolina offers incentives for the purchase of electric and alternative fuel vehicles. These incentives can take the form of tax credits or rebates, which may offset some of the sales tax liability. It’s recommended to research and understand the specific incentives available for these environmentally friendly vehicles to maximize potential savings.

The Registration Process and Sales Tax

After purchasing a vehicle in North Carolina, you must register it with the North Carolina Division of Motor Vehicles (NCDMV). During the registration process, you will be required to pay various fees, including the sales tax on the vehicle. The NCDMV will guide you through the registration process and ensure that all applicable taxes and fees are properly accounted for.

It's essential to keep records of your vehicle purchase, including the sales contract, odometer disclosure statement, and any other relevant documentation. These records can be vital in case of an audit or if you need to prove the value of your vehicle for insurance or other purposes.

Additional Fees and Considerations

In addition to sales tax, there are other fees and considerations to be aware of when purchasing a vehicle in North Carolina. These may include:

- Title Fees: A fee is charged for the issuance of a vehicle title, which provides proof of ownership.

- Registration Fees: These fees vary depending on the type of vehicle and its weight class.

- License Plate Fees: North Carolina requires the purchase of license plates, and the fee depends on the type of vehicle.

- Personal Property Tax: This tax is levied annually on vehicles registered in North Carolina. The rate is determined by the county of residence and the vehicle's value.

It's advisable to thoroughly research and understand these additional fees to budget appropriately for your vehicle purchase.

Future Implications and Potential Changes

While the sales tax structure for cars in North Carolina is relatively stable, it’s essential to stay informed about potential changes. The state’s legislature and local governments may propose amendments to the tax code, which could impact vehicle purchases. Additionally, economic factors, such as inflation and market conditions, can influence the overall tax burden.

It's recommended to regularly check the official websites of the North Carolina Department of Revenue and the North Carolina Division of Motor Vehicles for updates and any announced changes to tax rates or regulations. Staying informed can help you make more informed financial decisions when purchasing a vehicle in North Carolina.

Expert Insight: Tax Strategies for Car Buyers

Frequently Asked Questions

How often are sales tax rates updated in North Carolina?

+

Sales tax rates in North Carolina are generally updated annually, typically in July. However, local governments may adjust their local option tax rates more frequently, so it’s important to check with your county for the most up-to-date information.

Are there any counties in North Carolina with no additional local option tax on vehicle purchases?

+

Yes, there are several counties in North Carolina that do not levy an additional local option tax on vehicle purchases. These counties apply only the standard state sales tax rate of 4.75% to vehicle sales. Check with your local government or tax authority to confirm the specific tax rate in your county.

Can I deduct sales tax on my North Carolina vehicle purchase from my federal taxes?

+

No, the sales tax on your vehicle purchase in North Carolina is not deductible from your federal taxes. However, you may be able to deduct certain vehicle-related expenses, such as mileage for business use, as part of your federal tax return. Consult with a tax professional for specific advice based on your circumstances.

What happens if I fail to pay the sales tax on my vehicle purchase in North Carolina?

+

Failing to pay the sales tax on your vehicle purchase can result in penalties and interest charges. It’s important to ensure that you accurately calculate and remit the sales tax to the appropriate tax authority. If you have questions or concerns about your tax liability, it’s recommended to seek guidance from a tax professional or contact the North Carolina Department of Revenue for assistance.