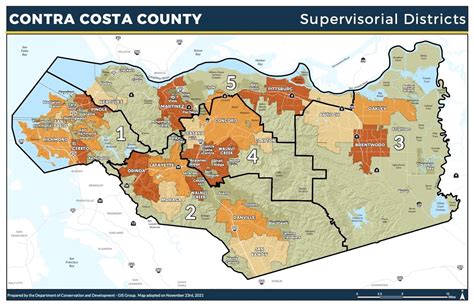

Contra Costa County Property Taxes

Welcome to our comprehensive guide on Contra Costa County property taxes, a topic of utmost importance for homeowners, investors, and anyone interested in the real estate market within this vibrant California county. In this expert-driven article, we will delve into the intricacies of property taxation in Contra Costa County, offering a detailed analysis, insights, and practical information to help you navigate this essential aspect of homeownership.

Understanding Property Taxes in Contra Costa County

Property taxes are a fundamental component of local government revenue in the United States, and Contra Costa County is no exception. These taxes play a crucial role in funding various public services and infrastructure projects, including schools, roads, emergency services, and more. As a homeowner or property investor in Contra Costa County, it is essential to have a thorough understanding of how property taxes work, your rights and responsibilities, and the potential impact on your financial planning.

Contra Costa County, located in the San Francisco Bay Area, is renowned for its diverse landscapes, from the picturesque rolling hills of Lafayette to the vibrant urban centers like Concord and Martinez. With a population of over 1.1 million people, it is the ninth most populous county in California, offering a unique blend of suburban and urban living. As such, property ownership in this county carries a certain allure, but it also comes with its own set of financial considerations, chief among them being property taxes.

The Role of Property Taxes in Contra Costa County

Property taxes are a primary source of revenue for local governments, including Contra Costa County. The funds generated through property taxes are vital for maintaining and improving the infrastructure and services that make the county an attractive place to live and do business. These taxes support essential services such as:

- Public education: From elementary schools to community colleges, property taxes contribute significantly to the funding of the county's education system.

- Public safety: Police, fire protection, and emergency medical services are partially funded through property taxes, ensuring the safety and well-being of residents.

- Infrastructure development: Property taxes play a crucial role in the maintenance and improvement of roads, bridges, public transportation, and other vital infrastructure.

- Environmental initiatives: Contra Costa County is committed to sustainability and environmental stewardship. Property taxes help fund initiatives like waste management, recycling programs, and open space preservation.

- Social services: The county provides a range of social services, including healthcare, senior services, and support for low-income families, all of which are partially funded by property taxes.

By understanding the role that property taxes play in supporting the community, homeowners and investors can appreciate the broader context of their tax contributions and the benefits they bring to the county as a whole.

Tax Assessment Process in Contra Costa County

The process of assessing property taxes in Contra Costa County is governed by the Assessor’s Office, which is responsible for determining the value of each property within the county. This value, known as the assessed value, is a crucial factor in calculating the property taxes owed by the owner.

The Assessor's Office employs a team of professionals who specialize in property valuation. They conduct regular assessments to ensure that the assessed value of each property accurately reflects its market value. This process involves analyzing various factors, including:

- Recent sales data: The Assessor's Office carefully examines recent sales of similar properties in the area to gauge market trends and determine a fair assessed value.

- Physical inspections: In some cases, Assessor's Office staff may conduct physical inspections of properties to assess their condition, improvements, and overall value.

- Income and expense analysis: For commercial properties, the Assessor's Office may consider the income and expenses generated by the property to determine its assessed value.

- Cost approach: This method involves estimating the cost of replacing the property, taking into account factors like depreciation and market conditions.

- Income capitalization: For income-generating properties, the Assessor's Office may use this method to estimate the property's value based on its potential income stream.

Once the assessed value is determined, the tax rate comes into play. The tax rate is established by the county and is applied to the assessed value to calculate the property taxes owed. This rate can vary from year to year and may differ across different areas within the county.

Calculating Property Taxes in Contra Costa County

Calculating property taxes in Contra Costa County involves a straightforward formula: Assessed Value x Tax Rate = Property Taxes Owed. Let’s break this down further to understand how it works in practice.

The assessed value of a property is determined by the Assessor's Office and represents the value of the property for tax purposes. This value is typically based on the property's market value, as determined through various assessment methods. In Contra Costa County, the assessed value of a property is not necessarily the same as its market value, as it may be affected by factors such as Proposition 13, which limits the increase in assessed value to a maximum of 2% per year unless the property undergoes a change in ownership or new construction.

Once the assessed value is established, the tax rate is applied. The tax rate is set by the county and can vary based on the specific location of the property within the county. Tax rates are typically expressed as a percentage and are applied to the assessed value to determine the property taxes owed.

For example, if a property has an assessed value of $500,000 and the tax rate is 1.25%, the property taxes owed would be calculated as follows:

$500,000 x 0.0125 = $6,250

In this case, the property owner would owe $6,250 in property taxes for the year. It's important to note that tax rates can change from year to year, and they may also vary based on the type of property (e.g., residential, commercial, agricultural) and the specific location within the county.

Property owners in Contra Costa County receive an annual tax bill, which details the assessed value of their property, the applicable tax rate, and the total amount of property taxes owed. It is essential for property owners to carefully review these tax bills and ensure that the information is accurate. If there are any discrepancies or concerns, they can contact the Assessor's Office to address any issues.

Property Tax Rates in Contra Costa County

The property tax rate in Contra Costa County is set annually by the county’s Board of Supervisors. This rate is applied uniformly across the county and is a key factor in determining the amount of property taxes owed by each property owner. As of the most recent assessment, the tax rate for the 2023-2024 fiscal year is 1.0854% for residential properties and 1.1344% for commercial properties. This rate includes both the general tax rate and any special assessments or bond measures that may be in effect within specific areas of the county.

| Property Type | Tax Rate |

|---|---|

| Residential | 1.0854% |

| Commercial | 1.1344% |

It's important to note that while the tax rate remains constant for all properties within the county, the assessed value of each property can vary significantly. This variation in assessed value is influenced by factors such as the property's location, size, improvements, and market conditions. As a result, even though the tax rate is the same for all properties, the actual property taxes owed can differ greatly from one property to another.

For instance, consider two residential properties in Contra Costa County: one located in a desirable neighborhood with a high market value, and the other situated in a more affordable area. Even though both properties are subject to the same tax rate of 1.0854%, the property with the higher market value will likely have a higher assessed value and, consequently, a higher property tax bill. This illustrates how the interplay between the tax rate and the assessed value determines the financial obligations of property owners in Contra Costa County.

Special Assessments and Bond Measures

In addition to the general property tax rate, property owners in Contra Costa County may be subject to special assessments and bond measures that can impact their tax obligations. These assessments and measures are typically approved by voters and are used to fund specific projects or services within the county.

Special assessments are charges levied on properties within a defined district or area to fund specific improvements or services that benefit those properties. These assessments can be for a variety of purposes, such as street improvements, sewer or water system upgrades, or the construction of parks and recreational facilities. The amount of the special assessment is typically based on the benefit received by each property, and it is added to the property's regular tax bill.

Bond measures, on the other hand, are approved by voters to raise funds for large-scale projects or infrastructure improvements. These bonds are typically repaid over a set period of time through a dedicated tax, which is added to the regular property tax rate. Bond measures can be used for a wide range of projects, including school construction, transportation improvements, or public safety initiatives. The amount of the bond tax is usually calculated as a fixed rate or a flat fee, which is then added to the property tax bill.

It's important for property owners to be aware of any special assessments or bond measures that may apply to their property. These additional charges can significantly impact the overall property tax bill, so it's essential to stay informed and understand how these assessments and measures are calculated and applied. Property owners can contact the Contra Costa County Assessor's Office or their local government representatives for more information on any special assessments or bond measures that may affect their property taxes.

Property Tax Payments and Due Dates

Understanding when and how to pay property taxes is a crucial aspect of homeownership. In Contra Costa County, property taxes are typically due twice a year, with payment deadlines falling on specific dates. It’s essential for property owners to be aware of these due dates and ensure timely payment to avoid any penalties or interest charges.

Payment Due Dates

Property taxes in Contra Costa County are billed in two installments, with each installment due on a specific date. The first installment is typically due on December 10th of each year, while the second installment is due on April 10th of the following year. These dates are set by the county and are applicable to all property owners within Contra Costa County.

It's important to note that while the due dates are set, property owners have a grace period of several weeks to make their payments without incurring any penalties. The grace period for the first installment extends until December 31st, and for the second installment, it extends until April 30th. After the grace period, any unpaid taxes will be subject to penalties and interest charges, which can accumulate over time.

To ensure timely payment, property owners should mark these due dates on their calendars and plan their finances accordingly. Late payments can result in additional fees and may impact the property owner's credit score, so it's crucial to stay on top of the payment schedule.

Payment Methods

Contra Costa County offers a variety of convenient payment methods for property taxes, allowing property owners to choose the option that best suits their preferences and needs. Here are the primary payment methods accepted by the county:

- Online Payment: Property owners can make secure online payments through the county's official website. This method is quick, convenient, and allows for real-time confirmation of payment. It is a popular choice for those who prefer digital transactions and value the convenience of paying from the comfort of their homes.

- Mail-In Payment: For those who prefer a more traditional approach, mail-in payments are accepted. Property owners can send their payment, along with the remittance stub from their tax bill, to the designated address provided by the county. It's important to ensure that the payment is mailed well in advance of the due date to allow for processing time and avoid any late fees.

- In-Person Payment: Property owners can also choose to make their payments in person at designated locations within the county. These locations typically include the county's Treasurer-Tax Collector's office or authorized payment centers. In-person payments can be made using cash, check, or credit/debit cards (subject to any applicable fees). This option provides an immediate receipt of payment and allows for any immediate clarification of payment-related queries.

- Automatic Payment Plan: To ensure timely payments without the need for manual reminders, property owners can enroll in an automatic payment plan. This plan allows for automatic deductions from a designated bank account on the due dates. It provides peace of mind and ensures that payments are made on time, even if the property owner is traveling or has other commitments on the due date.

Regardless of the payment method chosen, it's crucial to ensure that the payment is made in full and on time to avoid any penalties or interest charges. Property owners should also retain a copy of their payment confirmation or receipt for their records.

Late Payment Penalties and Interest

Failure to pay property taxes on time in Contra Costa County can result in late payment penalties and interest charges. These additional fees are designed to encourage timely payment and ensure that the county receives the necessary revenue to fund its operations and services.

If a property owner misses the due date for either installment, a 10% penalty is applied to the unpaid balance. This penalty is calculated based on the amount of tax due and is added to the total amount owed. Additionally, an 18% interest charge is applied to the unpaid balance for each month (or portion thereof) that the payment remains overdue. This interest charge is cumulative, meaning it can accumulate over time if the payment remains unpaid.

For example, if a property owner owes $1,000 in property taxes and misses the due date for the first installment, a 10% penalty of $100 is added to the total amount due. If the payment remains unpaid for an additional month, an 18% interest charge is applied to the $1,100 (original tax plus penalty), resulting in an additional $198 in interest charges. These penalties and interest charges can quickly add up, so it's essential for property owners to prioritize timely payment to avoid unnecessary financial burdens.

To avoid late payment penalties and interest charges, property owners should plan their finances accordingly and make timely payments. If a property owner is facing financial difficulties or expects to have difficulty making a payment on time, it's advisable to contact the Contra Costa County Treasurer-Tax Collector's Office to discuss potential payment arrangements or options for assistance.

Property Tax Exemptions and Reductions

Property owners in Contra Costa County may be eligible for certain exemptions or reductions in their property taxes, which can provide significant financial relief. These exemptions and reductions are designed to support specific groups of property owners, such as seniors, veterans, and those with disabilities, as well as encourage certain types of development or conservation efforts.

Senior Citizen Exemption

The Senior Citizen Exemption is a valuable benefit available to senior citizens who meet certain age and income requirements. This exemption reduces the assessed value of the property for tax purposes, resulting in lower property taxes. To qualify for the Senior Citizen Exemption, property owners must be at least 62 years of age and have a total household income of $35,500 or less for the previous year. The exemption amount is determined based on the property’s assessed value and can provide significant savings for eligible seniors.

For example, if a senior citizen owns a property with an assessed value of $500,000 and qualifies for the Senior Citizen Exemption, the assessed value for tax purposes may be reduced by up to $70,000. This reduction in assessed value can result in substantial savings on property taxes, providing much-needed financial relief for seniors on fixed incomes.

To apply for the Senior Citizen Exemption, property owners must complete and submit the appropriate application form to the Contra Costa County Assessor's Office. The application process typically requires documentation of age and income, and the exemption is renewable annually. It's important for eligible seniors to take advantage of this exemption to reduce their property tax burden and improve their financial well-being.

Veteran’s Exemption

Contra Costa County recognizes and supports its veteran community by offering the Veteran’s Exemption, which provides a reduction in property taxes for eligible veterans. This exemption is available to veterans who meet certain criteria, including having served on active duty in the U.S. Armed Forces during a period of war or national emergency. The exemption amount is based on the veteran’s length of service and can significantly reduce the property’s assessed value for tax purposes.

To qualify for the