Florida Tax Free Week

Florida's Tax Free Week is an annual event eagerly anticipated by residents and businesses alike. It's a unique opportunity for Floridians to save on essential items and for retailers to boost sales. In this article, we will delve into the intricacies of this week-long shopping extravaganza, exploring its history, the items covered by the tax exemption, and how businesses and consumers can make the most of it.

A Brief History of Florida’s Tax Free Week

The concept of a tax-free week is not unique to Florida. Several states across the US have implemented similar initiatives to provide relief to consumers and stimulate the local economy. In Florida, the tradition began in 2004 as a way to assist families in preparing for the upcoming school year. The initial focus was on back-to-school essentials, and the event was held in late July or early August to coincide with the start of the academic year.

Over the years, the scope of Florida's Tax Free Week has expanded, offering tax savings on a broader range of items. This evolution reflects the changing needs of Floridians and the state's commitment to supporting its residents and businesses.

The Items Covered During Florida’s Tax Free Week

During this annual event, a wide array of items are eligible for a temporary sales tax exemption. The specific categories vary slightly from year to year, but typically include:

- Clothing and footwear: Items under a certain price limit, usually around $60-100, are exempt from sales tax. This category covers a wide range of apparel, from school uniforms to casual wear and even certain types of sports gear.

- School supplies: Essential items like notebooks, pens, pencils, backpacks, and calculators are often included. This category is especially beneficial for students and their parents as they prepare for the new school year.

- Books: Both printed and digital books are usually tax-free during this period. This includes textbooks, novels, and other educational resources.

- Computers and computer-related accessories: Laptops, desktops, tablets, printers, and certain software are often included. This category is a great opportunity for students, professionals, and anyone looking to upgrade their technology.

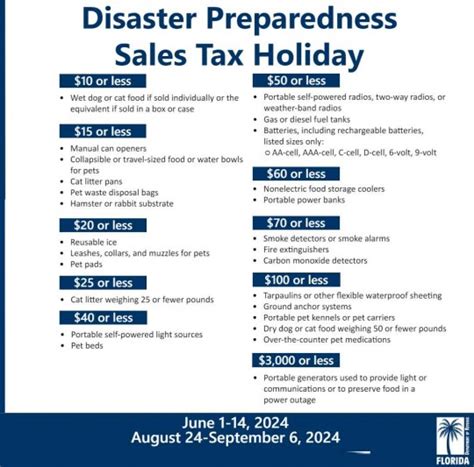

- Hurricane preparedness items: In recognition of Florida's hurricane season, certain emergency supplies like batteries, flashlights, and generators are sometimes included in the tax exemption.

It's important to note that there are often limits and specific conditions attached to these exemptions. For instance, clothing items above a certain price threshold may still be subject to sales tax, and certain types of books or supplies might be excluded. It's always advisable to check the official guidelines published by the Florida Department of Revenue for the most accurate and up-to-date information.

Maximizing Benefits for Consumers

For consumers, Florida’s Tax Free Week presents a great opportunity to save on essential items. Here are some strategies to make the most of this event:

Plan Your Purchases

Start by making a list of the items you need. Check the official guidelines to ensure the items on your list are covered by the tax exemption. Consider the quantity and quality you require, especially for school supplies and clothing. This ensures you don’t overspend and can take advantage of the best deals.

Shop Around

Different retailers may offer varying deals and discounts during this week. Compare prices and promotions to ensure you’re getting the best value. Online shopping can be especially beneficial, as it allows you to easily compare prices and read reviews from other consumers.

Consider Bundling and Bulk Purchases

If you’re buying items with a quantity limit, such as school supplies, consider buying in bulk to maximize your savings. Some retailers may also offer bundle deals, where you can purchase multiple items together at a discounted price.

Take Advantage of Online Deals

Many retailers offer online-only deals during Florida’s Tax Free Week. These deals can be exclusive and provide additional savings. Keep an eye on your favorite retailer’s websites and social media pages for exclusive online promotions.

Strategies for Businesses

Florida’s Tax Free Week is not just a boon for consumers; it’s also a great opportunity for businesses to drive sales and build customer loyalty. Here are some strategies for businesses to make the most of this event:

Promote the Event

Make sure your customers are aware of Florida’s Tax Free Week and the items that are covered by the tax exemption. Use social media, email campaigns, and in-store signage to promote the event and the savings you’re offering.

Offer Exclusive Deals

Consider offering special promotions and discounts during this week. This could include bundle deals, discounts on select items, or even loyalty program bonuses. Exclusive deals can encourage customers to choose your business over competitors.

Stock Up on Popular Items

Anticipate the items that are most likely to sell during this week and ensure you have ample stock. This includes popular clothing styles, school supplies, and technology items. Being well-stocked can prevent disappointed customers and lost sales.

Engage with Customers

Use this week as an opportunity to engage with your customers. Offer in-store events, product demonstrations, or even educational workshops related to the items on sale. This can create a positive shopping experience and build customer loyalty.

The Economic Impact of Florida’s Tax Free Week

Beyond the savings for consumers and the sales boost for businesses, Florida’s Tax Free Week has a significant economic impact on the state. According to a study by the Florida Retail Federation, the event generates millions of dollars in additional sales and creates hundreds of jobs. It also encourages consumers to spend more on essential items, which can have a positive ripple effect on the local economy.

The event's focus on back-to-school essentials also aligns with the state's educational goals, providing a practical support system for families and students. By easing the financial burden of preparing for the school year, Florida's Tax Free Week contributes to a more equitable and accessible educational environment.

Conclusion: A Win-Win for Floridians

Florida’s Tax Free Week is a testament to the state’s commitment to supporting its residents and businesses. By offering a temporary sales tax exemption on essential items, the event provides a much-needed boost to consumers’ budgets and a welcome sales opportunity for retailers. Its economic impact is significant, and its focus on back-to-school essentials aligns with the state’s educational priorities.

Whether you're a consumer looking to save or a business aiming to thrive, Florida's Tax Free Week is an event not to be missed. With careful planning and a strategic approach, both consumers and businesses can make the most of this week-long shopping extravaganza.

When is Florida’s Tax Free Week held each year?

+

Florida’s Tax Free Week is typically held in late July or early August to coincide with the start of the school year. The exact dates vary slightly from year to year, so it’s best to check the official guidelines published by the Florida Department of Revenue.

Are there any limits to the tax exemption during this week?

+

Yes, there are often limits and specific conditions attached to the tax exemptions. For instance, clothing items above a certain price threshold may still be subject to sales tax. It’s important to review the official guidelines for the most accurate and up-to-date information.

How can businesses promote their offerings during this week?

+

Businesses can promote their offerings during Florida’s Tax Free Week through various channels. This includes social media campaigns, email marketing, in-store signage, and even special events or product demonstrations. Offering exclusive deals and engaging with customers can also enhance the shopping experience and boost sales.

What’s the economic impact of Florida’s Tax Free Week?

+

Florida’s Tax Free Week has a significant economic impact. It generates millions of dollars in additional sales and creates hundreds of jobs. By encouraging consumers to spend on essential items, it also stimulates the local economy and aligns with the state’s educational goals.