Can I Deduct My Property Taxes

One of the most common questions homeowners ask is whether they can deduct property taxes from their federal income tax returns. The answer is yes, but it's a bit more complex than a straightforward "yes" or "no." Let's delve into the details of property tax deductions, exploring the ins and outs of this financial strategy to help you maximize your savings.

Understanding Property Tax Deductions

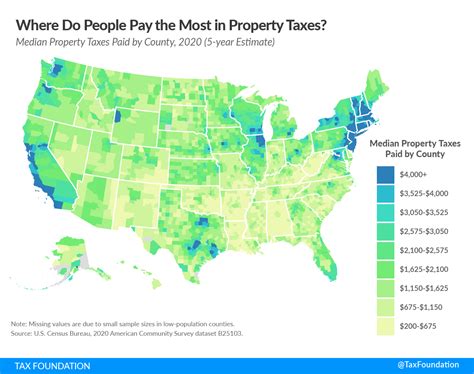

Property taxes are a significant expense for homeowners, and being able to deduct them can provide a substantial tax benefit. In the United States, property taxes are typically levied by local governments and are based on the assessed value of your property. These taxes fund essential services such as public schools, infrastructure, and local government operations.

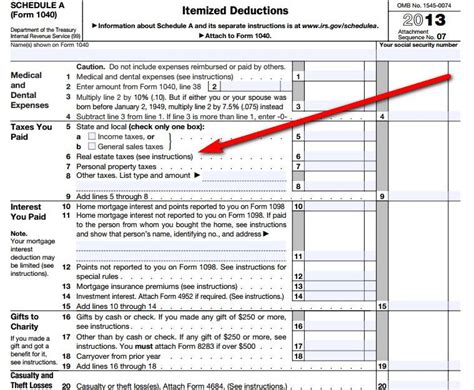

When it comes to federal income tax returns, individuals have the opportunity to itemize their deductions, which allows them to claim specific expenses, including property taxes, to reduce their taxable income. This is in contrast to taking the standard deduction, which is a fixed amount set by the IRS and applicable to all taxpayers who don't itemize.

The Benefits of Itemizing Deductions

Itemizing deductions offers a more personalized approach to tax planning. By taking the time to calculate and claim all eligible deductions, including property taxes, you can potentially lower your taxable income significantly. This is especially beneficial for individuals with high property tax liabilities and other substantial deductible expenses.

For instance, consider a homeowner with an annual property tax bill of $5,000. If this individual itemizes their deductions and has no other significant expenses, they could potentially reduce their taxable income by $5,000, resulting in a substantial tax savings.

| Property Tax Liability | Potential Tax Savings |

|---|---|

| $5,000 | $1,500 - $2,000 (depending on tax bracket) |

| $10,000 | $3,000 - $4,000 (depending on tax bracket) |

| $15,000 | $4,500 - $6,000 (depending on tax bracket) |

The table above provides a rough estimate of the potential tax savings based on different property tax liabilities. It's important to note that the actual savings will depend on the taxpayer's income, tax bracket, and other factors.

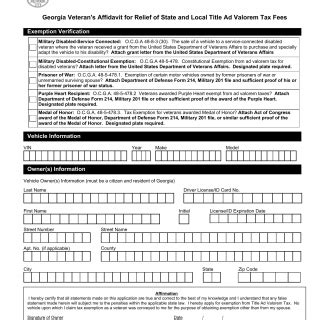

Who Qualifies for Property Tax Deductions?

In general, anyone who owns real estate and pays property taxes can deduct these taxes on their federal income tax return. This includes homeowners, commercial property owners, and even those who own vacation homes or rental properties. However, there are a few key requirements to keep in mind:

- Ownership: You must own the property to claim the deduction. If you rent or lease a property, you cannot deduct the property taxes paid by the owner.

- Tax Liability: You must actually owe property taxes. If your property is exempt from taxation or if you receive a tax credit that offsets your liability, you cannot deduct the taxes.

- Payment: You must have paid the property taxes during the tax year for which you are filing. This includes taxes paid directly to the local government or through an escrow account with your mortgage lender.

Maximizing Your Property Tax Deduction

To fully maximize the benefits of the property tax deduction, it’s essential to understand the different components of property taxes and how they can be strategically managed.

Components of Property Taxes

Property taxes typically consist of several components, each serving a specific purpose and contributing to the overall tax bill. These components can include:

- Real Estate Taxes: This is the primary portion of your property tax bill and is based on the assessed value of your property. It funds local government services and may also support public schools.

- Special Assessments: These are additional taxes levied to fund specific projects or improvements in your area. They could be for infrastructure upgrades, new community centers, or other local initiatives.

- Mello-Roos Taxes: Named after the California legislation that created them, Mello-Roos taxes are special taxes used to fund community services and infrastructure in new developments or areas undergoing significant improvements.

- School District Taxes: In some areas, school district taxes are included in the property tax bill to support local schools. These taxes ensure a stable funding source for education.

Strategic Property Tax Management

To maximize your property tax deduction, consider the following strategies:

- Understand Your Assessment: Property taxes are based on the assessed value of your home. If you believe your assessment is too high, you may be able to appeal it. This could result in a lower tax bill and a more significant deduction.

- Review Special Assessments: Carefully review any special assessments included in your property tax bill. If you disagree with the assessment or feel it is not benefiting your community, you may be able to challenge it.

- Consider Escrow Accounts: If you have a mortgage, your lender may require you to pay property taxes into an escrow account. This ensures that your taxes are paid on time and can provide some flexibility in managing your finances.

- Monitor School District Taxes: Keep an eye on school district taxes, especially if you don't have children in the local school system. These taxes can be a significant portion of your property tax bill, and you may be able to explore alternatives if you're not directly benefiting from them.

The Future of Property Tax Deductions

The future of property tax deductions is an ongoing topic of discussion in the world of tax policy. While the deduction has been a longstanding feature of the U.S. tax code, there have been recent proposals to limit or eliminate it.

Proposed Changes

In recent years, there have been proposals to either cap or eliminate the deduction for state and local taxes, including property taxes. These proposals aim to simplify the tax code and reduce the incentive for high-tax states to impose excessive tax burdens on their residents. However, such changes would significantly impact homeowners, especially those in high-tax states like California, New York, and New Jersey.

For instance, under the Tax Cuts and Jobs Act of 2017, the deduction for state and local taxes was capped at $10,000. This means that taxpayers can only deduct up to $10,000 of their combined state and local income, sales, and property taxes.

Potential Impact

The potential elimination or capping of property tax deductions could have a significant impact on homeowners, particularly those in high-tax areas. It would reduce the incentive to own a home and could lead to a shift in housing preferences, with more individuals opting for rental properties or moving to lower-tax states.

Additionally, it could affect local governments' ability to fund essential services, as property taxes are a primary source of revenue for many municipalities. This could lead to cuts in services or an increase in other taxes to make up for the lost revenue.

Conclusion

Property tax deductions offer a valuable opportunity for homeowners to reduce their taxable income and save on their federal income taxes. By understanding the intricacies of property taxes and strategically managing your payments, you can maximize the benefits of this deduction. However, the future of this deduction is uncertain, and it’s essential to stay informed about potential changes to tax policy that could impact your financial planning.

Frequently Asked Questions

Can I deduct property taxes if I rent out my property?

+

Yes, if you own a rental property and pay property taxes on it, you can deduct those taxes as a business expense. This is separate from your personal deductions and is claimed on your business tax return.

What if my property taxes are paid through my mortgage escrow account? Can I still deduct them?

+

Absolutely! Property taxes paid through an escrow account are still deductible as long as you actually owe and pay the taxes. Keep in mind that the deduction is taken on your personal tax return, not your mortgage interest statement.

Are there any limitations on the amount of property taxes I can deduct?

+

Yes, there are limitations. As of 2023, the deduction for state and local taxes, including property taxes, is capped at $10,000 for individuals and married couples filing jointly. Any amount over this limit cannot be deducted.

Can I deduct property taxes if I receive a tax credit or exemption?

+

No, if you receive a tax credit or exemption that reduces your property tax liability, you cannot deduct the taxes. The deduction is only applicable to taxes you actually owe and pay.

How do I claim the property tax deduction on my tax return?

+

To claim the property tax deduction, you’ll need to itemize your deductions on Schedule A of Form 1040. You’ll need to provide details about your property, including its location and assessed value, as well as proof of payment.