Gwinnett Tax Commissioner

The Gwinnett County Tax Commissioner's Office plays a crucial role in the financial landscape of this vibrant Georgia county. With a commitment to efficiency and transparency, the office ensures the smooth collection of various taxes, providing vital revenue for the county's operations and development. In this comprehensive guide, we will delve into the workings of the Gwinnett Tax Commissioner's Office, exploring its functions, services, and the impact it has on the community.

Understanding the Role of the Gwinnett Tax Commissioner

The Tax Commissioner of Gwinnett County is an elected official, entrusted with the responsibility of overseeing the collection of ad valorem taxes, motor vehicle taxes, and other related fees. This role is integral to the county’s financial stability, as the revenue generated funds essential services such as education, public safety, and infrastructure development.

One of the key responsibilities of the Tax Commissioner is the annual tax digest, which involves assessing the value of all taxable property within the county. This process ensures that property owners are taxed fairly and accurately, based on the current market value of their properties. The office also handles the billing and collection of these taxes, providing a range of payment options to accommodate different financial situations.

Services Offered by the Gwinnett Tax Commissioner’s Office

The Gwinnett Tax Commissioner’s Office offers a comprehensive suite of services to residents and businesses alike. These services are designed to streamline the tax payment process, provide accurate information, and assist with various motor vehicle-related tasks.

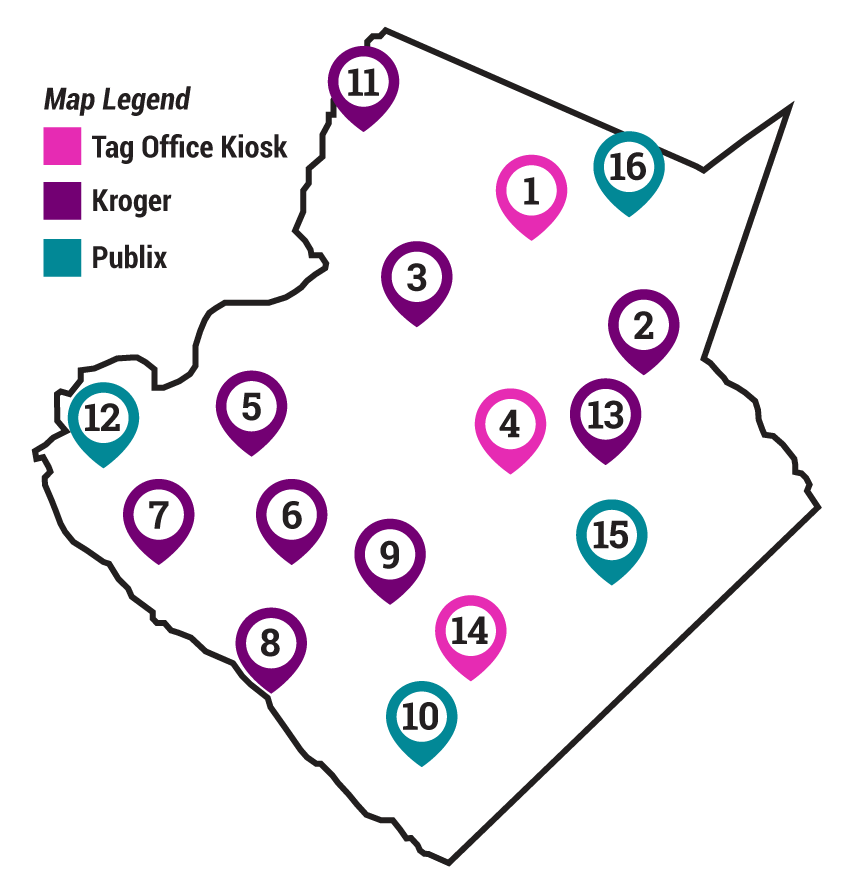

- Tax Payment Options: The office provides convenient payment methods, including online payments, eCheck payments, and in-person payments at their office locations. They also offer a convenient drop box service for after-hours payments.

- Property Tax Assessments: Property owners can access their tax assessments and account information online, making it easier to understand their tax obligations and ensure accuracy.

- Motor Vehicle Services: The Tax Commissioner's Office handles a range of motor vehicle services, including title transfers, registration renewals, and the issuance of specialized license plates. They also provide assistance with title and lien issues, ensuring a smooth process for vehicle owners.

- Taxpayer Assistance: The office prioritizes taxpayer assistance, offering a dedicated team to answer queries, provide guidance, and resolve issues related to tax payments and property assessments. They also host taxpayer workshops and provide educational resources to ensure a well-informed community.

Additionally, the Gwinnett Tax Commissioner's Office actively engages with the community through various outreach programs and initiatives. They participate in local events, providing information booths and educational sessions to raise awareness about tax obligations and services. This proactive approach ensures that residents are well-informed and can navigate the tax system with ease.

| Service | Description |

|---|---|

| Online Tax Payment | Secure and convenient way to pay property taxes and vehicle taxes. |

| eCheck Payment | Electronic check payment option for tax payments. |

| In-Person Payment | Pay taxes at designated office locations during business hours. |

| Drop Box Payment | After-hours payment option for convenience. |

| Property Tax Assessments | Access your tax assessments and account details online. |

| Motor Vehicle Services | Title transfers, registration renewals, and specialized license plates. |

| Taxpayer Workshops | Educational sessions to inform residents about tax obligations. |

Performance and Community Impact

The Gwinnett Tax Commissioner’s Office has consistently achieved high performance metrics, reflecting its dedication to efficient tax collection and exceptional service. According to recent reports, the office has maintained an impressive tax collection rate, ensuring a steady revenue stream for the county’s operations.

Beyond its financial responsibilities, the office has actively contributed to community development and engagement. Through various initiatives, they have fostered a sense of transparency and trust, ensuring that taxpayers understand the importance of their contributions and the impact it has on the community. This has led to increased participation in local events and a greater sense of civic duty among residents.

Furthermore, the office's commitment to taxpayer assistance has resulted in a significant reduction in taxpayer queries and complaints. By providing accessible information and personalized guidance, they have empowered residents to navigate the tax system with confidence, leading to a more positive experience for all.

Community Engagement Initiatives

The Gwinnett Tax Commissioner’s Office believes in giving back to the community and actively participates in various initiatives to support local causes. Here are some notable community engagement efforts:

- Taxpayer Appreciation Events: The office hosts annual events to show appreciation for taxpayers and provide an opportunity for residents to connect with the team. These events often include educational workshops, entertainment, and community resource booths.

- Partnership with Local Charities: They collaborate with local charities and non-profit organizations to support their initiatives. This includes donating a portion of their proceeds to these organizations and promoting their causes to the community.

- Educational Outreach Programs: Recognizing the importance of financial literacy, the office conducts outreach programs in schools and community centers. These programs aim to educate students and residents about tax responsibilities, budgeting, and financial planning.

Through these initiatives, the Gwinnett Tax Commissioner's Office not only fulfills its financial duties but also actively contributes to the well-being and growth of the community it serves.

Future Prospects and Innovations

Looking ahead, the Gwinnett Tax Commissioner’s Office is focused on continuous improvement and innovation to enhance its services. With technological advancements, they aim to further streamline the tax payment process, making it even more efficient and user-friendly. This includes exploring mobile payment options and implementing advanced online platforms for a seamless taxpayer experience.

Additionally, the office is committed to staying ahead of the curve in tax assessment methodologies. They plan to invest in advanced valuation techniques and data analytics to ensure accurate and fair assessments, maintaining the county's reputation for transparency and fairness in taxation.

The Gwinnett Tax Commissioner's Office also recognizes the importance of environmental sustainability. They are exploring initiatives to reduce their environmental footprint, such as implementing paperless processes and encouraging digital communication. By embracing sustainability, they aim to contribute to a greener and more environmentally conscious community.

Upcoming Initiatives

Here are some exciting initiatives that the Gwinnett Tax Commissioner’s Office has planned for the near future:

- Enhanced Online Portal: A redesigned online portal with improved navigation and features, making it easier for taxpayers to access their accounts, make payments, and retrieve important documents.

- Mobile App Development: The office is working on a mobile application that will allow taxpayers to manage their tax obligations on the go. This app will include features like push notifications for due dates and the ability to make payments directly from a mobile device.

- Community Tax Clinics: In collaboration with local community centers, they plan to host tax clinics to assist residents with their tax returns and provide financial counseling. These clinics will be held regularly, ensuring that all residents have access to professional tax advice and support.

With these initiatives and a commitment to innovation, the Gwinnett Tax Commissioner's Office is poised to continue its legacy of excellence, ensuring a bright future for the county and its residents.

What are the office hours for the Gwinnett Tax Commissioner’s Office?

+

The office hours for the Gwinnett Tax Commissioner’s Office are typically Monday to Friday, 8:30 AM to 5:00 PM. However, it is recommended to check their official website for any holiday closures or special operating hours.

How can I pay my property taxes in Gwinnett County?

+

You can pay your property taxes through various methods, including online payments, eCheck payments, and in-person payments at the Tax Commissioner’s Office. The office also provides a convenient drop box for after-hours payments.

What is the role of the Tax Commissioner in Gwinnett County?

+

The Tax Commissioner is responsible for assessing and collecting ad valorem taxes, motor vehicle taxes, and other related fees. They ensure the fair and accurate valuation of taxable properties and provide services related to motor vehicles, such as title transfers and registration renewals.

How often are property taxes assessed in Gwinnett County?

+

Property taxes in Gwinnett County are assessed annually. The Tax Commissioner’s Office prepares a tax digest each year, determining the fair market value of taxable properties and calculating the taxes owed.

Can I access my tax assessment information online?

+

Yes, you can access your tax assessment information online through the Gwinnett County Tax Commissioner’s official website. This allows you to view your tax assessments, account details, and payment history conveniently.