Arkansas Taxes

Taxes are an essential component of any state's financial system, and Arkansas is no exception. With a diverse economy and a range of industries, understanding the tax landscape in Arkansas is crucial for individuals, businesses, and investors alike. This comprehensive guide aims to delve into the intricacies of Arkansas taxes, providing an expert analysis of the state's tax policies, rates, and their implications.

Unraveling the Arkansas Tax System

Arkansas, the Natural State, boasts a unique tax structure that shapes its economic landscape. From individual income taxes to corporate levies, sales taxes, and property taxes, each component plays a vital role in funding public services and infrastructure development.

Individual Income Taxes: A Progressive Approach

Arkansas operates on a progressive income tax system, meaning that higher income earners pay a larger proportion of their income in taxes. As of 2023, the state has six tax brackets, ranging from 1.9% to 6.9% for taxable income above $10,000. These rates are subject to change, so it’s crucial to stay updated with the latest tax laws.

| Tax Bracket | Tax Rate | Taxable Income Range |

|---|---|---|

| 1 | 1.9% | Up to $1,500 |

| 2 | 2.9% | $1,501 - $3,500 |

| 3 | 3.9% | $3,501 - $6,000 |

| 4 | 4.9% | $6,001 - $10,000 |

| 5 | 5.9% | $10,001 - $25,000 |

| 6 | 6.9% | Above $25,000 |

For example, let's consider a resident, Jane, with a taxable income of $40,000. Her tax liability would be calculated as follows: $1,500 * 1.9% + ($3,500 - $1,500) * 2.9% + ($6,000 - $3,500) * 3.9% + ($10,000 - $6,000) * 4.9% + ($25,000 - $10,000) * 5.9% + ($40,000 - $25,000) * 6.9%. This results in a total tax liability of $2,755.40.

Corporate Income Taxes: Attracting Businesses

Arkansas aims to create a business-friendly environment, and its corporate tax structure reflects this goal. The state levies a flat tax rate of 6% on corporate income, which is relatively lower compared to many other states. This competitive rate has contributed to the growth of various industries, making Arkansas an attractive destination for businesses.

Additionally, Arkansas offers several tax incentives and credits to encourage economic development and job creation. These incentives often target specific industries, such as technology, manufacturing, and renewable energy, making them a powerful tool for attracting investments.

Sales and Use Taxes: Funding Public Services

Sales and use taxes are a significant source of revenue for Arkansas. The state imposes a 6.5% sales tax on most goods and services, with some exceptions. This rate is applied uniformly across the state, providing a stable revenue stream for funding essential public services like education, healthcare, and infrastructure.

Moreover, Arkansas allows local jurisdictions to impose additional sales taxes, known as local option taxes. These taxes, which vary across cities and counties, are often used to fund specific projects or initiatives, giving local communities more control over their economic development.

Property Taxes: Supporting Local Governments

Property taxes are a vital component of Arkansas’s tax system, primarily funding local governments and public schools. The state’s property tax system is relatively straightforward, with a single assessment rate of 20% applied to the assessed value of real and personal property.

However, it's important to note that the effective property tax rates can vary significantly across counties and municipalities due to differences in local tax rates and the value of property. These variations are a result of the unique needs and priorities of each community.

Tax Incentives and Credits: Boosting the Economy

Arkansas recognizes the importance of tax incentives in attracting investments and stimulating economic growth. The state offers a wide range of tax incentives and credits to businesses, individuals, and specific industries. These incentives are designed to promote job creation, support innovation, and encourage sustainable practices.

Arkansas Economic Development Commission (AEDC)

The AEDC plays a pivotal role in managing and administering various tax incentives. It offers programs like the Arkansas Advantage Package, which provides tax credits and refunds to businesses that create new jobs or invest in research and development.

One notable success story is Company X, a leading technology firm, which expanded its operations in Arkansas after receiving tax incentives from the AEDC. The incentives helped Company X establish a new research facility, creating hundreds of high-skilled jobs and contributing significantly to the state's economy.

Targeted Tax Credits

Arkansas also provides targeted tax credits to support specific industries and initiatives. For instance, the state offers tax credits for film production, renewable energy projects, and historic preservation. These credits not only attract investments but also promote cultural development and environmental sustainability.

The film production tax credit, for example, has been instrumental in fostering the state's growing film industry. It has attracted numerous productions, generating economic activity and creating employment opportunities for local talent.

The Impact of Arkansas Taxes on Residents and Businesses

Arkansas’s tax system has a profound impact on its residents and businesses. While the state’s tax rates are generally competitive, the overall tax burden can vary significantly depending on an individual’s or business’s specific circumstances.

Tax Burden Analysis

For individuals, the progressive income tax system ensures that higher earners contribute a larger share of their income to the state’s revenue. This approach aims to maintain fairness and support social welfare programs. However, it’s essential to consider the overall tax burden, which includes not only income taxes but also sales taxes, property taxes, and other levies.

Businesses, on the other hand, benefit from Arkansas's relatively low corporate tax rate. This, combined with the various tax incentives, makes the state an attractive location for startups and established companies alike. However, businesses should carefully evaluate the total tax burden, including sales taxes, property taxes, and potential local taxes.

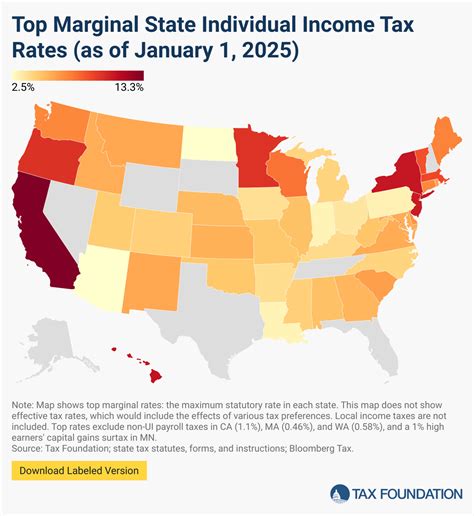

Comparison with Neighboring States

When evaluating Arkansas’s tax system, it’s crucial to consider how it stacks up against neighboring states. For instance, Arkansas’s corporate tax rate of 6% is lower than both Texas (8%) and Oklahoma (6.5%), making it a more attractive destination for businesses. However, its sales tax rate of 6.5% is slightly higher than some neighboring states, which could impact consumer spending.

Conclusion: A Balanced Approach to Taxation

Arkansas’s tax system strikes a balance between generating revenue for essential public services and fostering economic growth. The state’s progressive income tax system, competitive corporate tax rate, and diverse range of tax incentives create a favorable environment for individuals and businesses alike.

As Arkansas continues to evolve, its tax policies will play a crucial role in shaping its economic future. By maintaining a balanced approach to taxation and adapting to the changing needs of its residents and businesses, the state can ensure sustainable growth and prosperity for years to come.

What is the current sales tax rate in Arkansas?

+As of my last update in January 2023, the sales tax rate in Arkansas is 6.5%.

Are there any tax incentives for renewable energy projects in Arkansas?

+Yes, Arkansas offers tax credits for renewable energy projects. These credits aim to encourage the development of sustainable energy sources and reduce the state’s carbon footprint.

How does Arkansas compare to other states in terms of corporate tax rates?

+Arkansas has a competitive corporate tax rate of 6%, which is lower than many neighboring states. This makes it an attractive destination for businesses seeking to minimize their tax burden.