Maximize Your Missouri Tax Refund: Tips to Boost Your Return

Jane had always considered herself diligent with her finances, meticulously tracking expenses and filing her taxes every spring. Yet, when she received her Missouri tax refund last year, she realized she left money on the table—an oversight that many taxpayers might unknowingly repeat. As Missouri residents navigate complex tax laws and ever-changing regulations, understanding how to maximize a tax refund isn't merely a matter of luck but a strategic game. For individuals seeking to boost their return, a comprehensive grasp of tax deductions, credits, and planning strategies can make all the difference.

Understanding Missouri Tax Refunds: The Foundation of Optimization

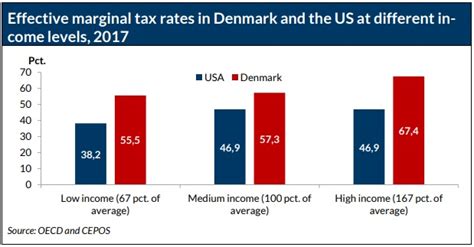

Missouri’s tax landscape, like many state systems in the U.S., blends federal tax principles with state-specific nuances. The state’s income tax system operates on a progressive scale, with rates varying based on income brackets, and includes unique credits and deductions tailored to residents’ circumstances. To maximize a refund, taxpayers must first comprehend their eligibility for these credits, the impact of deductions, and how to plan effectively throughout the year. With over 6 million residents, Missouri offers a varied array of tax relief mechanisms, but many often overlook opportunities due to lack of awareness or misinterpretation of policy.

Missouri Tax Credits: Unlocking Hidden Value

Among the most potent tools for boosting your tax refund are state-specific tax credits, which reduce actual tax liability dollar-for-dollar. Notable Missouri credits include the Missouri Sector Enhancement Program (MSEP) Credit, the Missouri Foster Care & Adoption Credit, and the Low-Income Housing Tax Credit. Each offers targeted relief, often underutilized due to limited awareness. For instance, the Missouri Earned Income Tax Credit (EITC), aligned with federal EITC, can significantly reduce taxes for low- to moderate-income earners, effectively increasing net refunds.

| Relevant Category | Substantive Data |

|---|---|

| Missouri EITC Qualification | Filing status: single/married, income below $58,000 (2023) |

| Maximum Credit | $600 (federal EITC correlated value varies) |

| Participation Rate | Approximately 37.8% of eligible filers claim the Missouri EITC (2022 data) |

Strategic Deductions and Planning: The Art of Reducing Tax Liability

While credits directly diminish tax owed, deductions serve as a means to reduce taxable income, ultimately lowering the base upon which tax calculations are made. For Missourians, several deductions and credits are worth strategic consideration, especially if planned carefully over the tax year. These include deductions for mortgage interest, property taxes, educational expenses, and charitable contributions—each a potential avenue to enhance your refund.

Maximizing Itemized Deductions in Missouri

Taxpayers should evaluate whether itemizing deductions provides a better benefit than the standard deduction. Missouri aligns most of its itemized deductions with the federal system, but with some limitations. For example, property taxes paid on primary or secondary residences are fully deductible on Missouri returns. Moreover, recent policy changes have expanded the scope of deductions for contributions to Missouri-based charitable organizations, especially during pandemic recovery phases, offering double benefits—supporting local causes while decreasing taxable income.

| Relevant Category | Substantive Data |

|---|---|

| Standard Deduction (Missouri) | $13,350 for single filers, $26,700 for married filing jointly (2023) |

| Mortgage Interest Deduction | Up to $750,000 home loan limits |

| Charitable Contribution Deduction | Deductible if itemized, qualifying registered charities in Missouri |

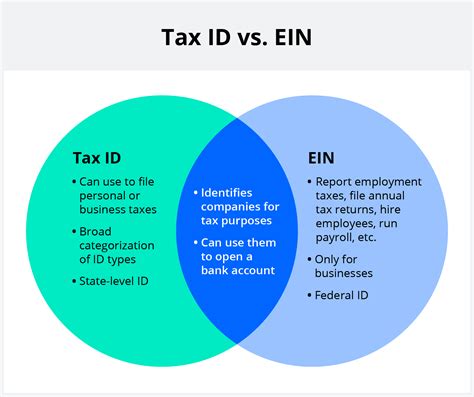

Leveraging Non-Refundable and Refundable Credits

Beyond deductions and traditional credits, understanding the distinction between non-refundable and refundable credits can be crucial. Non-refundable credits, such as the Missouri Child Tax Credit, reduce the tax owed but do not generate refunds beyond what is paid. Conversely, refundable credits like the Missouri EITC or the federal Additional Child Tax Credit can result in actual cash refunds, even if tax liability is already zero.

Real-World Application: Credit Harvesting

Taxpayers can increase their refund by ‘harvesting’ credits — arranging their income and qualifying expenses to maximize receipt of refundable credits. For example, making charitable donations before year-end or claiming childcare expenses aligned with qualifying hours and costs ensures they are eligible for these benefits. Strategic timing of income and expenses isn’t just academic: it can tip the scales toward a larger refund.

| Relevant Category | Substantive Data |

|---|---|

| Maximum Missouri Child Tax Credit | $1,000 per qualifying child (for income below thresholds) |

| Refundable Portion of Federal CTC | Up to $2,000 per child, with refunds up to $1,500 (2023) |

| Childcare Expense Eligibility | Up to $3,000 for one child, $6,000 for two or more children (2023 limits) |

Seasonal and Year-Round Tips to Push Your Missouri Tax Refund Higher

Preparation is the cornerstone of maximizing your refund, and this doesn’t stop at tax season. Engaging in year-round financial health habits can significantly impact your refund outcome. For instance, adjusting withholding allowances with your employer, contributing to Missouri-specific retirement plans, or timing charitable contributions strategically ensures benefits are accrued over time.

Adjusting Withholding for Better Refunds

Most Missouri residents receive a W-4 form from their employers specifying how much tax is withheld from wages. Periodic review and adjustment of these allowances based on current income, deductions, and credits can prevent over-withholding—resulting in a larger refund—or under-withholding, avoiding penalties. Professional tax advice or high-quality tax software can provide personalized recommendations, ensuring each paycheck balances the equation effectively.

| Relevant Category | Substantive Data |

|---|---|

| Recommended W-4 allowances in Missouri | 1 allowance per estimated dependent or deduction item |

| Mid-year adjustments | Review every 6 months or after significant income changes |

Understanding Limitations and Avoiding Pitfalls

While these strategies can substantially boost your Missouri tax refund, it’s also vital to be aware of constraints and common pitfalls. Overclaiming credits without legitimate qualifying expenses can lead even the most meticulous taxpayer into audit scrutiny. Similarly, relying solely on deductions without considering broader tax planning may miss more impactful credits. Staying updated with Missouri tax law amendments, attending informational workshops, or consulting qualified professionals ensures your efforts remain compliant and effective.

Common Mistakes to Avoid

- Failing to document deductible expenses thoroughly

- Overestimating credits without supporting documentation

- Neglecting to update withholding allowances regularly

- Ignoring available state-specific programs designed to aid taxpayers

How can I determine if I qualify for Missouri’s Earned Income Tax Credit?

+Eligibility hinges on income level, filing status, and qualifying dependents. Typically, if your federal EITC qualification criteria are met, you can claim the Missouri EITC. For precise thresholds and documentation, consult the Missouri Department of Revenue or a tax professional specializing in Missouri tax law.

Are there specific deadlines for claiming Missouri tax credits?

+Yes. Missouri follows the federal tax filing deadline, usually April 15th, with extensions available. To ensure eligibility for credits, claims must be filed by the statutory deadline and include accurate documentation. Filing early also aids in timely processing and potential refunds.

Can I amend my Missouri state tax return if I realize I missed claiming credits or deductions?

+Absolutely. Missouri allows amended returns using Form MO-1040X within three years from the original filing deadline. Amending can increase your refund if you discover missed credits or deductions, but ensure to provide proper documentation to support revised claims.