Tax On Overtime Trump

The topic of overtime pay and the associated tax implications has been a subject of discussion and debate, especially during the Trump administration. In this comprehensive article, we will delve into the intricacies of how overtime pay is taxed, the changes implemented during the Trump era, and the potential future ramifications.

Understanding Overtime Pay and Taxation

Overtime pay refers to the additional compensation an employee receives for working beyond their regular working hours. In the United States, the Fair Labor Standards Act (FLSA) mandates that non-exempt employees be paid at least one and a half times their regular rate of pay for hours worked beyond the standard 40-hour workweek. This provision aims to discourage excessive working hours and promote a healthy work-life balance.

The taxation of overtime pay follows a similar structure to regular earnings. Both overtime and regular wages are subject to federal income tax, Social Security tax, and Medicare tax. The exact tax rate depends on various factors, including the employee's income bracket, tax filing status, and any applicable deductions or credits.

Calculating Overtime Tax

To illustrate the process, let’s consider an example. Assume an employee named John earns a regular hourly rate of $20 and works 45 hours in a week. John’s overtime pay for the additional 5 hours would be calculated as follows:

| Regular Hours | Overtime Hours | Regular Pay | Overtime Pay |

|---|---|---|---|

| 40 hours | 5 hours | $20 x 40 = $800 | $20 x 1.5 x 5 = $150 |

John's total earnings for the week would be $800 (regular pay) + $150 (overtime pay) = $950. The tax liability on this income would depend on his tax bracket and other factors. For simplicity, let's assume John falls in the 22% tax bracket. His tax liability for the week would be approximately $209 ($950 x 22%).

Trump Administration’s Impact on Overtime Taxation

During the Trump administration, there were notable changes in the regulations surrounding overtime pay. One of the key actions taken was the revision of the overtime rules by the Department of Labor (DOL) in 2020.

Overtime Rule Changes

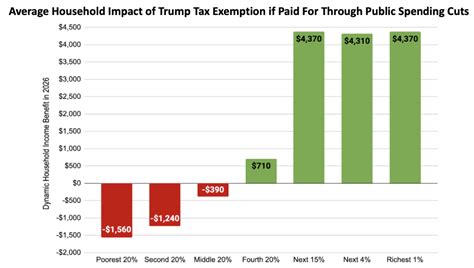

The Trump administration’s DOL implemented a new rule that significantly increased the salary threshold for overtime eligibility. This meant that a higher number of salaried workers became exempt from overtime pay, as their salaries exceeded the threshold.

Prior to the change, the salary threshold was set at $23,660 annually. The Trump administration's DOL raised this threshold to $35,568 annually. Employees earning above this threshold were not entitled to overtime pay, even if they worked beyond the standard 40-hour workweek.

This change had a significant impact on a large number of workers, particularly those in middle-income brackets. Many employees who had previously been eligible for overtime pay found themselves exempt, leading to a reduction in their overall earnings.

Implications for Workers

The revised overtime rules had both positive and negative effects on workers. On one hand, employees who remained eligible for overtime pay benefited from increased earnings when working extra hours. On the other hand, those who became exempt faced a potential decrease in their income, especially if they had previously relied on overtime pay to make ends meet.

Furthermore, the change in overtime rules led to a shift in work culture. Employers had more flexibility in assigning tasks and managing work hours without incurring additional overtime costs. This could result in longer workweeks for some employees, potentially impacting their work-life balance.

Post-Trump Era: Overtime Taxation Today

With the change in administration, the future of overtime pay regulations is uncertain. While the Biden administration has expressed interest in revising the overtime rules, no concrete actions have been taken yet.

Potential Changes Under Biden

President Biden has indicated a desire to restore the overtime rules that were in place prior to the Trump administration’s changes. This would mean reverting the salary threshold back to the previous level, making more workers eligible for overtime pay.

Reinstating the lower salary threshold would benefit a larger number of workers, particularly those in lower-income brackets. It would ensure that more employees receive the overtime pay they are entitled to, promoting fair compensation for their additional efforts.

Impact on Employers and the Economy

A return to the pre-Trump overtime rules could have implications for employers and the economy as a whole. Employers might need to reevaluate their workforce management strategies, potentially leading to increased labor costs. This could result in a shift towards a more balanced distribution of work hours among employees.

However, it is important to note that the impact on the economy is complex and difficult to predict. While increased overtime pay could boost workers' disposable income, it may also affect employers' profitability and investment decisions. The overall effect on economic growth and job creation remains a subject of debate among economists.

Conclusion: The Evolving Landscape of Overtime Taxation

The taxation of overtime pay is a dynamic and politically charged issue. The changes implemented during the Trump administration demonstrated the impact government policies can have on workers’ earnings and work culture.

As the Biden administration considers potential revisions to the overtime rules, workers and employers alike await the outcome. The future of overtime taxation will shape the economic landscape and the balance between work and personal life for millions of Americans.

What is the current federal income tax rate for overtime pay?

+The federal income tax rate for overtime pay, like regular earnings, depends on the employee’s income bracket. It can range from 10% to 37% based on the applicable tax rates for each bracket.

Are there any states that have different overtime pay rules than the federal government?

+Yes, some states have their own overtime pay rules that may differ from federal regulations. For instance, California has a lower overtime threshold, requiring overtime pay for hours worked beyond 8 in a day or 40 in a week.

Can employers avoid paying overtime by reclassifying employees as exempt?

+Reclassifying employees as exempt from overtime pay is a complex process and must adhere to specific criteria. Employers must ensure that exempt employees meet the requirements for executive, professional, or administrative positions, as defined by the FLSA.