Texas Auto Sales Tax

The Texas auto sales tax is a critical component of the state's revenue system, contributing significantly to its financial stability. Understanding this tax is essential for both consumers and businesses operating within the state. In this comprehensive guide, we delve into the intricacies of the Texas auto sales tax, its calculation, and its impact on the automotive industry and consumers.

Understanding the Texas Auto Sales Tax

The Texas auto sales tax is a consumption tax levied on the purchase of vehicles, including cars, trucks, motorcycles, and other motorized vehicles. It is a crucial source of revenue for the state, aiding in the funding of essential public services and infrastructure projects. The tax rate and collection process are governed by state laws and regulations, ensuring a fair and consistent approach across the state.

The Texas Comptroller of Public Accounts is the primary authority responsible for overseeing and administering the auto sales tax. They provide guidance and resources to both taxpayers and businesses, ensuring compliance with the tax laws. The Comptroller's office also plays a crucial role in resolving any disputes or issues related to the tax.

Tax Rate and Calculation

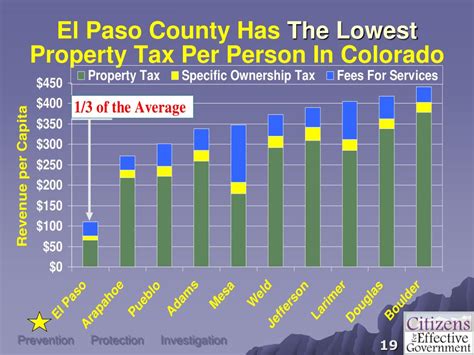

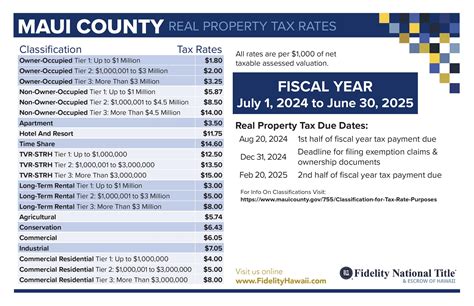

The tax rate for the Texas auto sales tax is 6.25% as of [current date]. However, it’s important to note that this is the base rate, and local municipalities and counties can impose additional taxes, known as local option sales taxes (LOST), on top of the state rate. These LOST rates can vary, resulting in a higher overall tax burden for vehicle purchases in certain areas.

The calculation of the auto sales tax is straightforward. The tax is applied to the total purchase price of the vehicle, including any additional fees, such as documentation fees, title fees, or dealer preparation charges. This means that the tax is calculated as a percentage of the final cost of the vehicle, providing a clear and transparent process for both buyers and sellers.

| Base Tax Rate | 6.25% |

|---|---|

| Local Option Sales Tax (LOST) | Varies by location |

| Tax Calculation | Applied to total purchase price, including fees |

Exemptions and Special Cases

While the auto sales tax is generally applicable to most vehicle purchases, there are certain exemptions and special cases to be aware of. These include:

- Leased Vehicles: Vehicles that are leased are subject to a lease acquisition tax, which is calculated differently from the sales tax. The lease acquisition tax is based on the total lease price and may include additional fees.

- Trade-Ins: When trading in a vehicle as part of a new purchase, the trade-in value is deducted from the purchase price, potentially reducing the tax liability. However, the tax is still calculated based on the final purchase price after the trade-in.

- Military Personnel: Active-duty military personnel stationed in Texas may be eligible for certain tax exemptions or reduced rates. It's important for military members to understand their specific tax obligations and benefits.

Impact on Consumers and Businesses

The Texas auto sales tax has a significant impact on both consumers and businesses operating in the state’s automotive industry.

Consumer Perspective

For consumers, the auto sales tax is a crucial consideration when purchasing a vehicle. It directly affects the overall cost of the vehicle, influencing their financial planning and decision-making. Understanding the tax rate and calculation can help consumers budget effectively and negotiate better deals with dealerships.

Additionally, consumers should be aware of the potential variations in tax rates across different counties and municipalities. This knowledge can be valuable when comparing prices and considering vehicle purchases in different parts of the state.

Business Perspective

For businesses, particularly dealerships and automotive retailers, the auto sales tax is a critical component of their operations. They are responsible for collecting and remitting the tax to the state, ensuring compliance with tax laws and regulations.

Dealers play a vital role in educating consumers about the tax, providing transparent pricing information, and assisting with any tax-related queries. They must also stay updated on any changes to tax laws and regulations to ensure accurate tax collection and reporting.

Compliance and Reporting

Compliance with the Texas auto sales tax is essential for both consumers and businesses. The state has strict regulations and penalties for non-compliance, ensuring a fair and efficient tax system.

Consumer Compliance

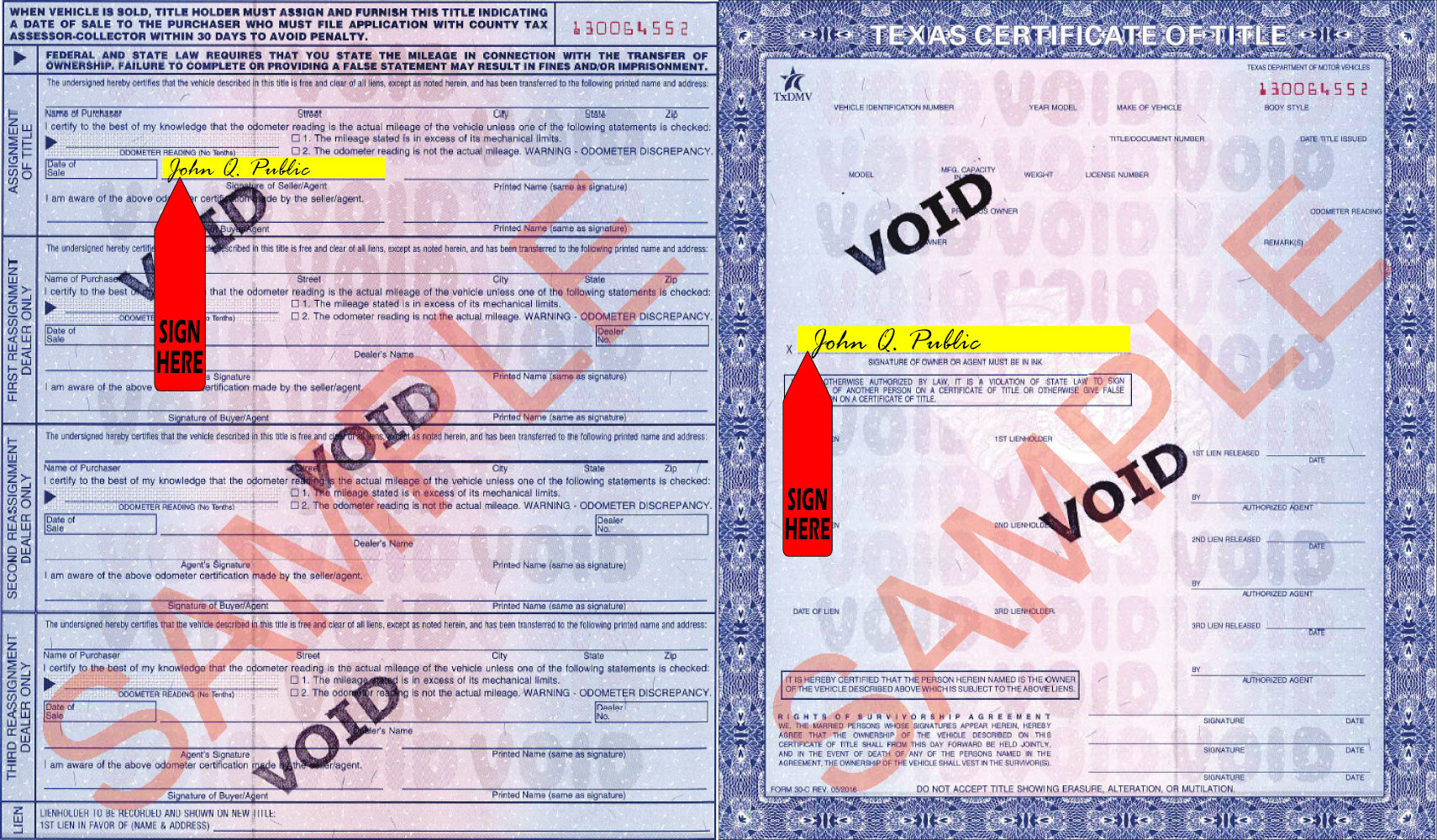

Consumers are responsible for paying the auto sales tax at the time of purchase. It’s important for buyers to understand their tax obligations and ensure that the tax is accurately calculated and included in the final transaction.

In the event of a dispute or error in tax calculation, consumers should contact the dealership or the Texas Comptroller's office for assistance. They can provide guidance and help resolve any issues related to the tax.

Business Compliance

Businesses, particularly dealerships, are required to register with the Texas Comptroller’s office and obtain a sales and use tax permit. This permit authorizes them to collect and remit the auto sales tax on behalf of the state.

Dealers must maintain accurate records of all vehicle sales, including the tax collected, and remit the tax to the state on a regular basis. Failure to comply with these requirements can result in penalties and legal consequences.

Future Outlook and Potential Changes

As with any tax system, the Texas auto sales tax is subject to potential changes and reforms. The state government periodically reviews and assesses the tax structure to ensure its effectiveness and fairness.

Proposed Reforms

In recent years, there have been discussions and proposals for reforms to the auto sales tax. These include suggestions to simplify the tax calculation, reduce the tax rate, or introduce new incentives for certain types of vehicle purchases, such as electric or hybrid vehicles.

While these proposals are still in the early stages, they highlight the ongoing efforts to modernize and improve the tax system. It's important for consumers and businesses to stay informed about any potential changes and their potential impact.

Potential Impact of Electric Vehicles

The rise of electric vehicles (EVs) has led to discussions about the future of the auto sales tax in Texas. As EV sales increase, there is a need to consider the tax implications and potential revenue losses for the state. Some states have implemented specific tax incentives or exemptions for EV purchases to encourage their adoption.

Texas may explore similar strategies to promote the transition to electric vehicles and maintain a sustainable tax revenue stream. This could include tax credits, rebates, or reduced tax rates for EV purchases, which would have a significant impact on the automotive industry and consumer behavior.

Conclusion

The Texas auto sales tax is a vital component of the state’s revenue system, impacting both consumers and businesses in the automotive industry. Understanding the tax rate, calculation, and compliance requirements is essential for all parties involved. With potential reforms and the rise of electric vehicles, the auto sales tax landscape in Texas is likely to evolve, shaping the future of vehicle purchases and the automotive market.

How often are auto sales tax rates reviewed and updated in Texas?

+

The auto sales tax rates in Texas are typically reviewed and updated on an annual basis. However, in certain circumstances, such as budget changes or legislative actions, the rates may be adjusted more frequently.

Are there any online tools or calculators available to estimate the auto sales tax for a specific vehicle purchase in Texas?

+

Yes, there are several online resources and calculators provided by the Texas Comptroller’s office and third-party websites. These tools allow consumers to estimate the auto sales tax based on the vehicle’s purchase price and local tax rates.

What happens if a consumer discovers an error in the auto sales tax calculation after purchasing a vehicle in Texas?

+

If a consumer suspects an error in the auto sales tax calculation, they should contact the dealership where the vehicle was purchased. The dealership can review the transaction and make any necessary corrections. If the error cannot be resolved at the dealership level, the consumer can seek assistance from the Texas Comptroller’s office.

Are there any resources or guides available for businesses to ensure compliance with the Texas auto sales tax laws?

+

Absolutely! The Texas Comptroller’s office provides comprehensive guides, resources, and training materials specifically designed for businesses. These resources cover registration requirements, tax calculation, record-keeping, and reporting obligations. Businesses can access these materials on the Comptroller’s website or by contacting their local tax office.

How can consumers stay informed about any changes or updates to the Texas auto sales tax?

+

Consumers can stay informed by regularly checking the Texas Comptroller’s website, which provides the latest updates and announcements regarding tax rates and regulations. Additionally, consumers can subscribe to email alerts or follow the Comptroller’s social media channels for timely notifications.